ETH institutional funds continue to flow in: Fidelity up the ante 250 million dollars, and whales on the chain frequently buy

西格玛学长2024/12/16 03:46

The Ethereum market has recently seen significant inflows of funds, and the active levels of institutions and whales continue to rise. According to Arkham's monitoring, Fidelity purchased $250 million worth of ETH last week, accounting for 16% of its historical inflows, indicating the long-term optimism of traditional financial giants towards ETH.

Meanwhile, according to Spot On Chain data, 9 hours ago, an institution withdrew 4,502 ETH from Binance through two multi-signature wallets, with an average price of about $3,895 and a total value of $17.54 million. These ETH were subsequently pledged to Kelp DAO, and as the ETH price rebounded above $4,000, the position increased by $517,000 (+ 3%) in a short period of time.

In addition, according to Lookonchain monitoring, a whale with $134 million in assets has bought $12.55 million of LINK (429,999) and $6.30 million of ETH (1,600) from the exchange in the past 48 hours. This series of large-scale on-chain operations highlights the core position of Ethereum in institutional and whale asset allocation, and further reflects the market's confidence in the future performance of ETH.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Publicly listed company Parataxis discloses bitcoin holdings exceeding 150 BTC

Chaincatcher•2025/10/15 12:14

Data: LuBian labeled address transfers 2,129 BTC to a new address again, worth approximately $238.6 million

Chaincatcher•2025/10/15 12:02

Data: sUSDD TVL surpasses 1 million USD, offering 12% APY savings yield

Chaincatcher•2025/10/15 11:44

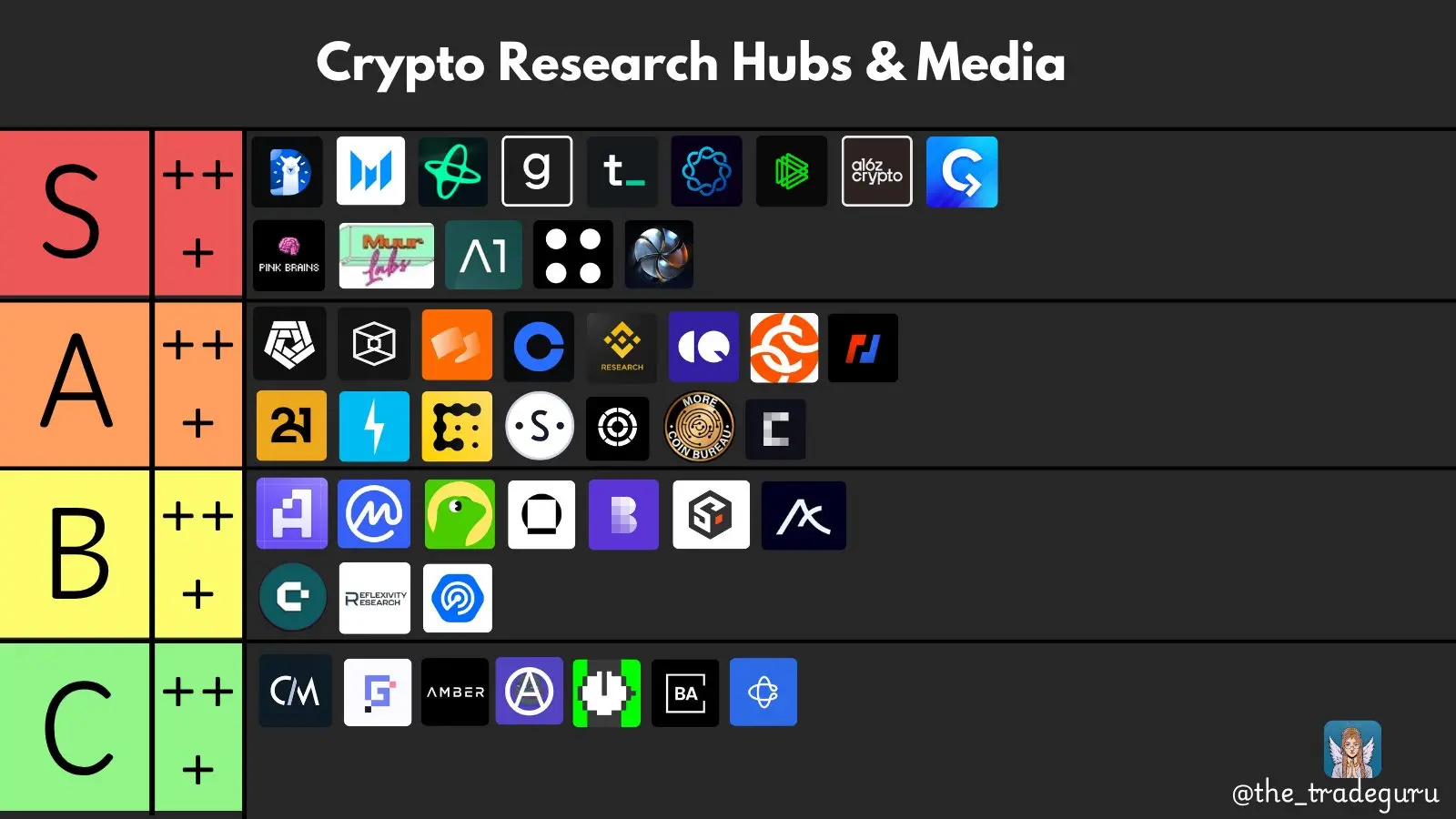

RootData Recognized on Crypto Research KOL A++ List, Ranked Alongside Arkham and CryptoQuant

Chaincatcher•2025/10/15 11:44

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$112,063.02

+0.66%

Ethereum

ETH

$4,104.62

+3.31%

Tether USDt

USDT

$1

-0.02%

BNB

BNB

$1,189.8

+1.49%

XRP

XRP

$2.5

+2.29%

Solana

SOL

$203.22

+4.41%

USDC

USDC

$0.9998

-0.03%

Dogecoin

DOGE

$0.2025

+2.04%

TRON

TRX

$0.3184

+2.22%

Cardano

ADA

$0.6923

+2.47%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now