Riot Platforms buys more bitcoin, raising holdings to 17,429 BTC

Riot has increased its holdings to 17,429 BTC, currently valued at $1.8 billion based on the current market price of BTC of $103,873.Riot shares (ticker RIOT) are up more than 20% over the past five trading days.

Riot Platforms has used proceeds from a recent convertible senior notes offering to increase its bitcoin holdings.

"With the additional proceeds from Riot’s upsized $594 million, 0.75% coupon convertible bond issue, the Company has acquired 667 BTC at an average price of $101,135 per BTC," the company said Monday morning. "As a result, Riot has increased its holdings to 17,429 BTC, currently valued at $1.8 billion based on the current market price of BTC of $103,873."

The bitcoin miner had already used a portion of these net proceeds from this offering to acquire 5,117 bitcoin between Dec. 10 and Dec. 12.

Riot’s stock (ticker RIOT) was down 25% this year as miners struggled to maintain profitability following the latest Bitcoin halving in April. However, its fortunes began to change following a Dec. 12 report from The Wall Street Journal that activist hedge fund manager Starboard Value bought a stake in Riot and wants to convert some of its bitcoin mining facilities into capacity for hyperscalers.

Riot shares are up more than 20% over the past five trading days. The stock was up 7.4% in the first hour of Monday's session, trading around $13.95 at publication time.

Through today's acquisition and overall mining production, Riot said it has generated a BTC Yield per share of 37.2% year to date.

"Putting bitcoin on the balance sheet was once a reality for only the crypto-native; it’s now going mainstream on the back of a promising post-election outlook," Nathan McCauley, CEO and co-founder of Anchorage Digital, previously told The Block . "With the floodgates starting to open, expect more and more publicly traded names to put excess treasury cash to work by looking toward bitcoin as a reserve asset."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Valour launches bitcoin staking ETP on London Stock Exchange

The yield-bearing product offers institutional investors exposure to bitcoin with staking rewards under UK regulatory oversight

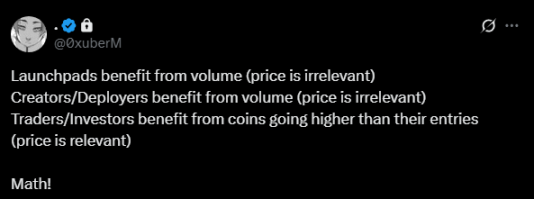

Incentive Misalignment: Can Traders Escape the "Suicide Squad" Dilemma?

This game centered around "trading volume" and "short-term speculation" will continue to consume the chips of the "daredevil squads."

The Next Decade of Ethereum: Comprehensive Upgrades from Beam Chain to Lean Ethereum

In-depth analysis of the impact of the lean roadmap on the Ethereum ecosystem.

How will PeerDAS improve Ethereum's data availability?

To ensure efficient data management and secure validation, Ethereum has evolved from DA to DAS, ultimately introducing PeerDAS.