Bitcoin Could Hit $500,000 in the Current Cycle if This Happens, According to Analyst Michaël van de Poppe

Popular crypto analyst Michaël van de Poppe thinks Bitcoin’s future gains this cycle could dwarf the progress BTC has already made.

Van de Poppe tells his 753,500 followers on the social media platform X that the top crypto asset by market cap could reach $500,000 in price this cycle.

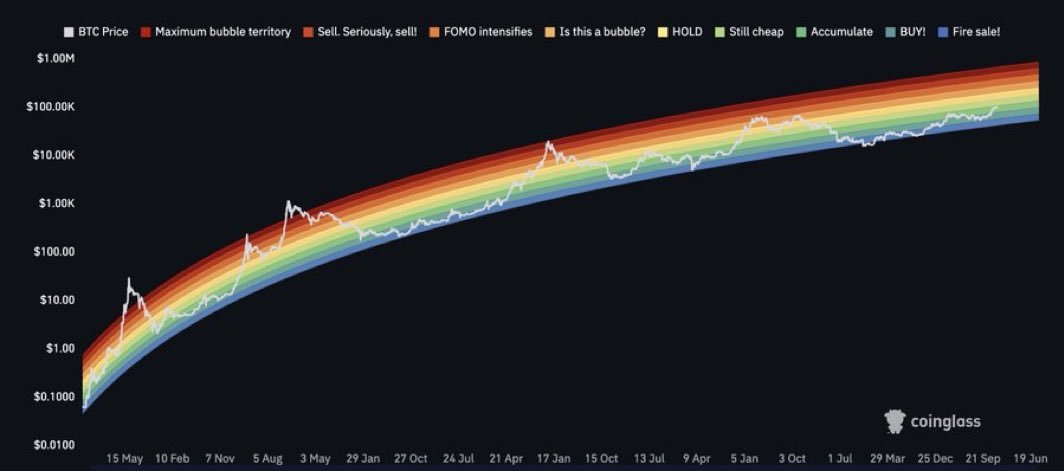

“The rainbow chart shows the following:

- The last cycle should have gone way higher (it didn’t reach the extreme phase).

- If time passes and this cycle is longer for #Bitcoin, the price increases automatically.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

Bitcoin is trading at $105,865 at time of writing. The top crypto asset set a new all-time high of $107,822 on Monday.

Van de Poppe also says the altcoin markets are “ready for their next wave.”

“The game plan is to stick into the positions as this is the time to maximize your returns. This might mean that your positions, depending on your risk appetite, will result in a potential return of 3-5x in BTC valuations.

Why is that a case? Well, most of the altcoins have literally not been breaking out yet, as they are still in the accumulation zone in their Bitcoin pair. That’s a great sign if you’re currently allocated and ready for that next big move.

However, the next move is going to be important to start taking profits from as the run will be volatile with multiple of those crashes that we’ve seen in the past week.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KITEUSDT now launched for futures trading and trading bots

Bitget x BAY Carnival: Grab a share of 4,000,000 BAY!

Front-Run the Chain — Join Onchain Alpha Community & Bag Rewards

Your personal AI trading co-pilot is ready — Join GetAgent TG and grab extra rewards!