Why Are Crypto Prices Going Up Today?

The cryptocurrency market is showing signs of recovery today, with the total market capitalization rising by 1%. This upward trend is backed by a noticeable increase in liquidity, as seen in the positive Chaikin Money Flow (CMF) indicator at 0.18. A positive CMF often signals growing investor confidence and bullish momentum, suggesting that buyers are stepping in to support prices. In this article, we’ll explore what’s driving this market movement and what it could mean for crypto investors.

How has the Crypto Market Moved Recently?

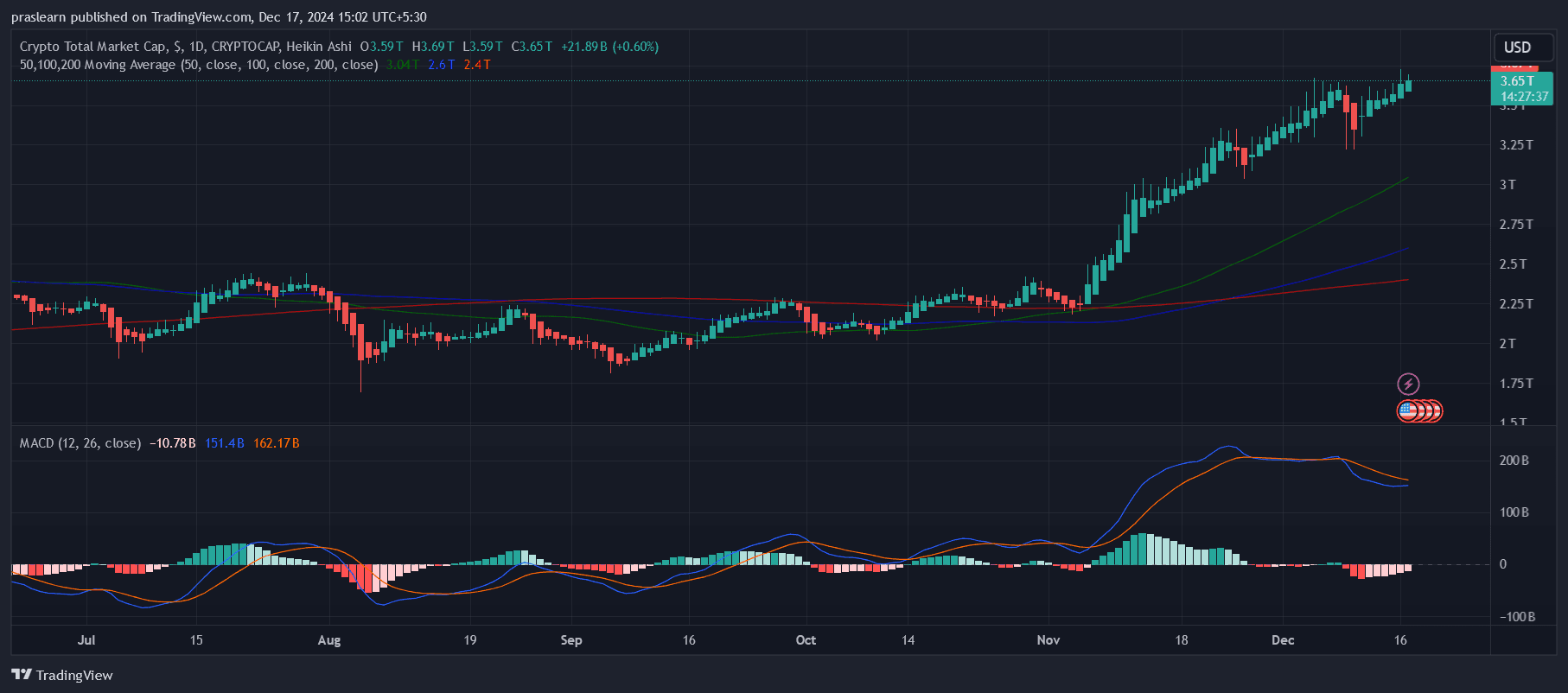

Crypto Market Cap- TradingView

Crypto Market Cap- TradingView

The total cryptocurrency market cap stands at $3.78 trillion , reflecting a 1.68% increase over the past 24 hours. Bitcoin remains the dominant asset, representing 56.20% of the overall market capitalization.

The total market cap is determined by summing up the market values of all cryptocurrencies combined. The market cap reached its all-time high of $3.80 trillion on December 16, 2024. At present, it is down 0.46% from that peak.

Why Are Crypto Prices Going Up Today?

The crypto market is on the rise today, fueled by a surprising shift in political sentiment and growing institutional support. President-elect Trump’s recent comments about cryptocurrency have sent waves of excitement through the market. By saying, “We’re gonna do something great with crypto,” Trump signaled a major pivot from his previous dismissive stance.

His idea of creating a strategic Bitcoin reserve, similar to the country’s oil stockpile, has sparked optimism, hinting at Bitcoin’s growing importance as a long-term strategic asset.

Backing this pro-crypto shift, Trump’s appointments of David Sacks as the White House cryptocurrency czar and Paul Atkins to head the SEC are seen as game-changing moves. Both figures have a reputation for supporting innovation in digital assets, and their leadership could bring much-needed clarity to crypto regulations.

For investors, this could mean reduced uncertainty and a friendlier environment for crypto adoption, driving further confidence in the market.

Adding to the positive sentiment, MicroStrategy —well-known for holding the largest corporate stash of Bitcoin—has secured a spot in the prestigious Nasdaq 100 index. This move is a big deal because it highlights how traditional finance is warming up to companies deeply tied to Bitcoin .

MicroStrategy’s shares have soared over 500% this year, which not only boosts its profile but also reinforces the idea that Bitcoin is being embraced as a legitimate store of value by institutional players.

Looking forward, this mix of political support, regulatory optimism, and institutional adoption sets a bullish tone for the crypto market. If the proposed policies take shape and more institutions jump on board, we could see further momentum building. Of course, it all depends on how quickly these changes roll out and how the broader economy reacts, but for now, the market is riding high on this wave of good news.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

As the crypto market recovers in 2025, Digital Asset Treasury (DAT) firms and protocol token buybacks are drawing increasing attention. DAT refers to public companies accumulating crypto assets as part of their treasury. This model enhances shareholder returns through yield and price appreciation, while avoiding the direct risks of holding crypto. Similar to an ETF but more active, DAT structures can generate additional income via staking or lending, driving NAV growth. Protocol token buybacks, such as those seen with HYPE, LINK, and ENA, use protocol revenues to automatically repurchase and burn tokens. This reduces circulating supply and creates a deflationary effect. Key drivers for upside include institutional capital inflows and potential Fed rate cuts, which would stimulate risk assets. Combined with buyback mechanisms that reinforce value capture, these assets are well-positioned to lead in the next market rebound.