BlackRock ETF purchases municipal bonds issued by the city of Quincy, Massachusetts, USA through blockchain

According to Bloomberg, a fund under BlackRock purchased municipal bonds issued earlier this year in a transaction entirely dependent on Blockchain technology. According to the company's spokesperson, BlackRock bought these bonds through its actively managed ETF - iShares Short-Term Municipal Bond Active ETF (abbreviated as MEAR). The fund was established in 2015 and has about $750 million in client assets.

These securities were issued by Quincy City, Massachusetts in April. Underwriter JPMorgan Chase used an application on its private, licensed blockchain platform to facilitate sales. This is the first municipal bond transaction that was fully purchased, settled and held on the platform through blockchain. BlackRock stated that it was one of the first investors to buy part of this transaction's bonds.

Pat Haskell, head of BlackRock's Municipal Bonds Group said: Using blockchain technology throughout the life cycle of bonds is just one example among many where this technology has potential to change capital markets. This deal marks an important moment for the municipal bond market and demonstrates BlackRock’s commitment to innovation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

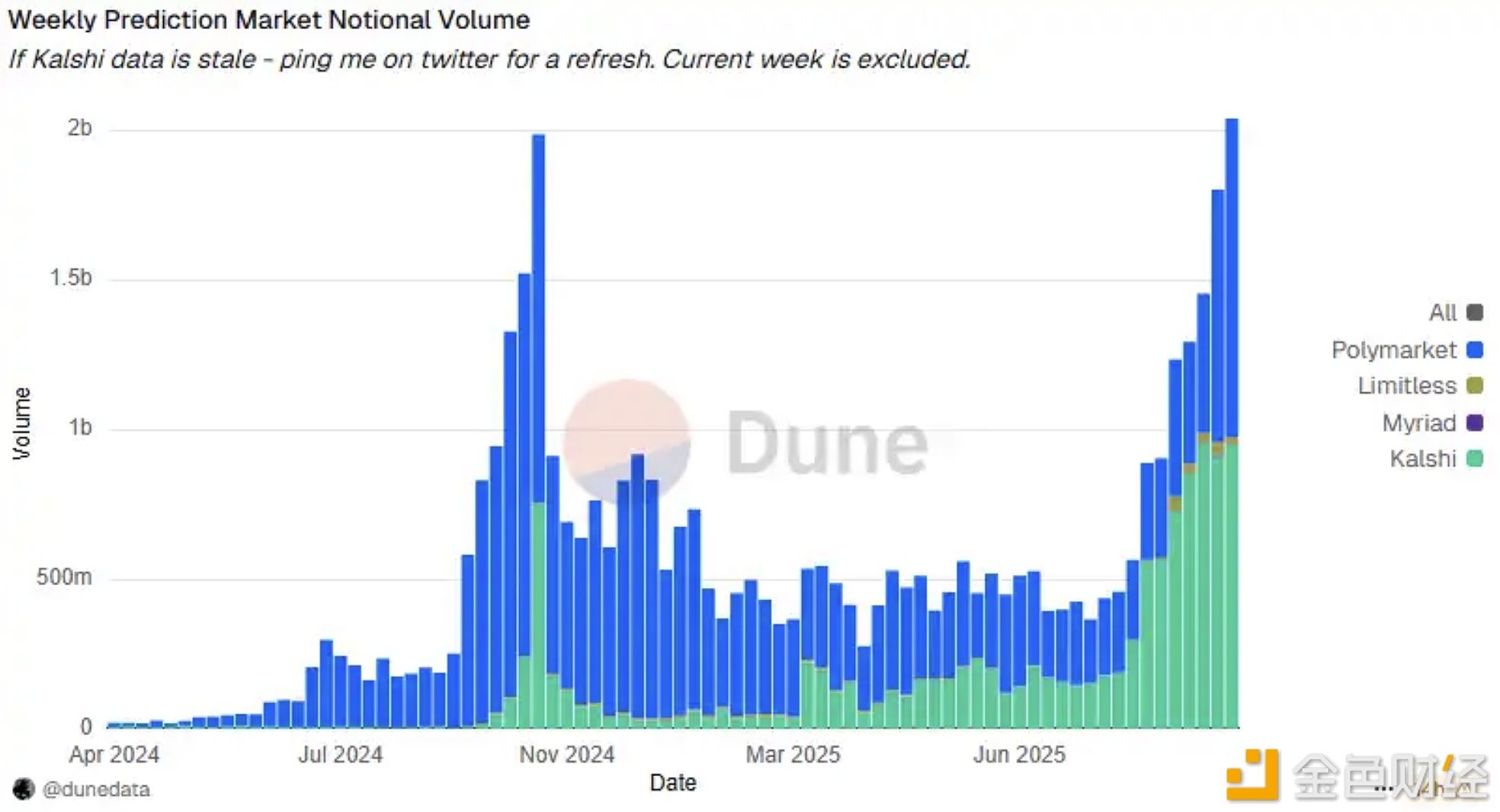

Polymarket and Kalshi Dominate the Prediction Market, Newcomers Struggle to Survive

Vitalik: If validator sets act maliciously, users may have no recourse

Analysis: Polymarket and Kalshi Dominate the Prediction Market

Vitalik: 51% attacks cannot rewrite blocks, but off-chain trust introduces new risks