US Bitcoin ETFs see historic outflows as brutal sell-off shakes crypto markets

Key Takeaways

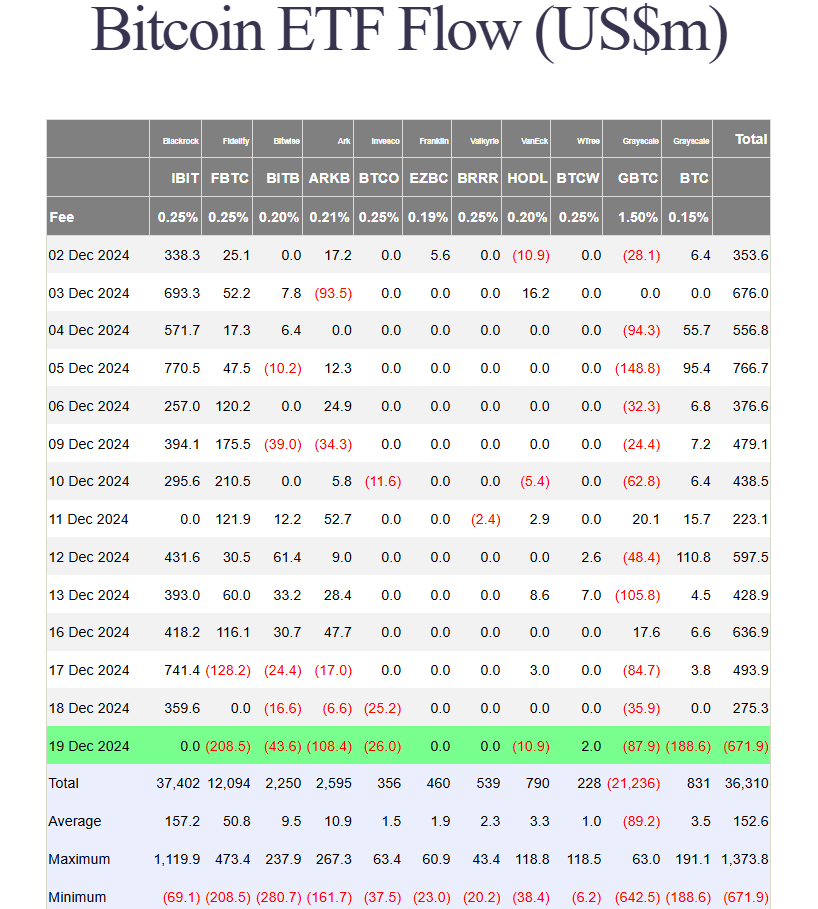

- US Bitcoin ETFs experienced historic outflows with investors withdrawing $672 million in a day.

- Fidelity's Bitcoin Fund led the outflows, followed by Grayscale and ARK Invest ETFs.

US spot Bitcoin ETFs suffered their largest-ever single-day outflow amid a sharp crypto market sell-off following the FOMC meeting. According to Farside Investors data , approximately $672 million exited these funds on Thursday, ending a period of net inflows that began in late November.

The massive withdrawal eclipsed the previous record of nearly $564 million set on May 1, when the group of spot Bitcoin ETFs saw nearly $564 million in withdrawals after Bitcoin dropped 10% to $60,000 over a week.

Fidelity’s Bitcoin Fund (FBTC) led the exodus with $208.5 million in outflows, while Grayscale’s Bitcoin Mini Trust (BTC) recorded its lowest point since launch with over $188 million in net outflows.

ARK Invest’s Bitcoin ETF (ARKB) and Grayscale’s Bitcoin Trust (GBTC) also saw huge withdrawals, with ARKB losing $108 million and GBTC shedding nearly $88 million. Meanwhile, three competing ETFs managed by Bitwise, Invesco, and Valkyrie collectively lost $80 million.

BlackRock’s iShares Bitcoin Trust (IBIT), which logged $1.9 billion in net inflows this week and was a major contributor to the group’s recent strong performance, recorded zero flows for the day.

WisdomTree’s Bitcoin Fund (BTCW) was the sole gainer, attracting $2 million in new investments.

Bitcoin’s price fell below $96,000 during the market downturn and currently trades at around $97,000, down 4% over 24 hours, according to CoinGecko data . The steep decline across all assets triggered $1 billion in leveraged liquidations on Thursday, Crypto Briefing reported .

The market turbulence followed the Fed’s hawkish messaging after its rate cut decision. The Fed implemented a 25-basis-point rate reduction on Wednesday but indicated fewer cuts in 2025.

Although price volatility persists, the Crypto Fear and Greed Index still indicates greed sentiment at 74, down only one point from yesterday.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK