France’s Groupe BPCE to Offer Bitcoin and Crypto Investments to 35M Users

France's Groupe BPCE gains regulatory approval to offer crypto investments, targeting 35 million users through its subsidiary Hexarq by 2025.

France’s financial markets regulator, the Autorité des Marchés Financiers (AMF), has approved BPCE, one of the country’s largest banking groups, to operate in the crypto space.

This will be done through its subsidiary, Hexarq, after receiving regulatory approval from the country’s financial markets watchdog, the AMF. The services are expected to launch in 2025.

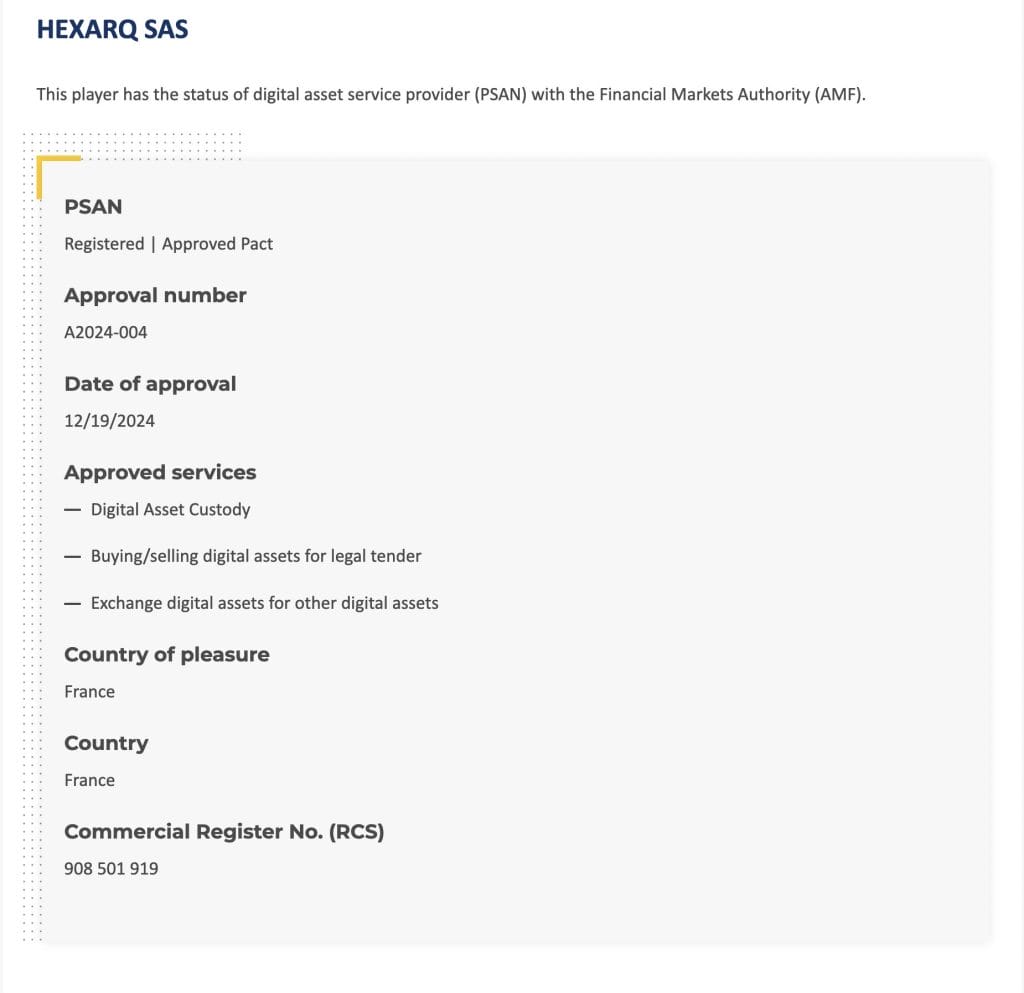

Source: amf-france.org

Source: amf-france.org

France’s Groupe BPCE Prepares Crypto Integration Across Its Products by 2025

Hexarq has received PSAN (Prestataire de Services sur Actifs Numériques) authorization from the AMF.

This allows Hexarq to offer services such as crypto custody and legally buy, sell, and trade cryptocurrencies against the euro in France. The PSAN framework oversees digital asset service providers in France.

With this approval , BPCE’s subsidiary is the fourth crypto business to gain AMF’s CASP authorization. Société Générale’s crypto subsidiary, Forge, received approval first in 2023, followed by Deblock SAS and GOin SAS in 2023 and 2022, respectively.

BPCE, one of Europe’s top ten largest banks, is preparing to offer cryptocurrency services to its vast customer base.

Hexarq plans to integrate its crypto services into BPCE’s two primary banking networks, Banque Populaire and Caisse d’Épargne, by 2025.

Hexarq, launched in January 2021, focuses on digital asset services, including cryptocurrencies and tokenized real-world assets (RWAs).

Following the AMF’s approval, the crypto platform will expand its offerings and use BPCE’s broad banking infrastructure.

BPCE’s entry into the cryptocurrency market is significant, as the group manages assets worth approximately €1.3 trillion (around $1.3 trillion), with a customer base exceeding 35 million.

Hexarq will roll out these services through a dedicated app, which will be integrated into BPCE’s Banque Populaire and Caisse d’Épargne networks.

France Leads EU Crypto Regulation Ahead of MiCA’s Full Rollout

If all goes according to plan, BPCE’s cryptocurrency services will be integrated into its existing networks, allowing millions of bank clients seamless access to digital assets.

Despite this major step, BPCE declined to provide additional details on the exact timeline or the specific services to be launched in 2025.

France has taken a leading role in Europe’s crypto regulation, becoming the first major EU economy to open crypto asset service provider license applications under the MiCA regulation .

The AMF has been actively working to regulate the crypto space in France, having started accepting CASP applications in August 2024.

This move is made before fully enforcing the European Union’s MiCA regulations, which will take effect on December 30.

In the meantime, the French crypto market is experiencing continued regulatory developments. Some exchanges, like Bybit, are preparing to halt operations in France by January 2025.

In addition, a major crypto exchange, Gemini, recently announced its expansion into France last month after securing a VASP (Virtual Asset Service Provider) registration, further solidifying France’s growing importance as a hub for crypto operations within Europe.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!