-

Dogwifhat [WIF] presents a mixed outlook as it grapples with bearish pressures, but overall market sentiment continues to show bullish tendencies.

-

The token’s recent performance indicates an uncertain path forward, with traders split on their positions amid fluctuating market conditions.

-

According to insights from COINOTAG, “The upcoming trading sessions will be critical in determining whether WIF can maintain its bullish structure.”

This article explores the current state of Dogwifhat [WIF], examining its price trends, market sentiment, and future projections amidst volatility.

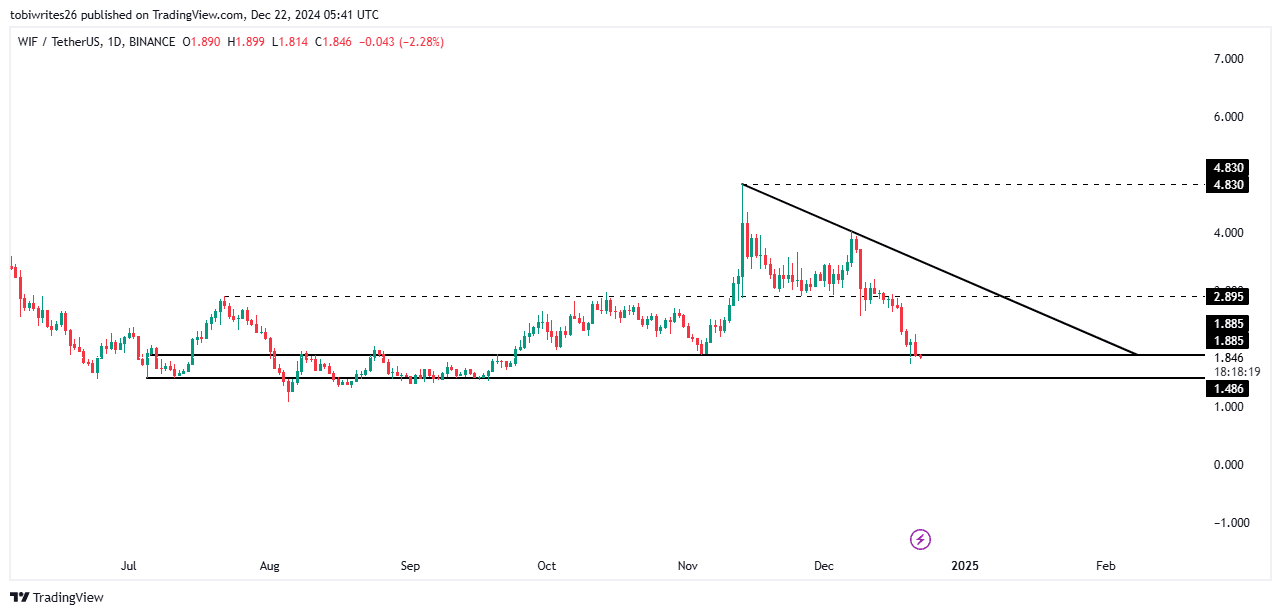

Short-term Price Dynamics of WIF Amidst Bearish Trends

Recently, WIF has faced significant selling pressure, primarily attributed to a broader market decline which has caused its price to dip 14.69% within just 24 hours. At this moment, WIF is trading around $1.885, which represents a crucial support level in the current market structure. Should this support falter, it could trigger a more pronounced price correction.

The overall trading environment suggests a battle between long and short traders keen on reacting to market movements. While there remains a robust bullish pattern, successful bounces will depend heavily on the volume of buying activity at critical supports.

Source: Trading View

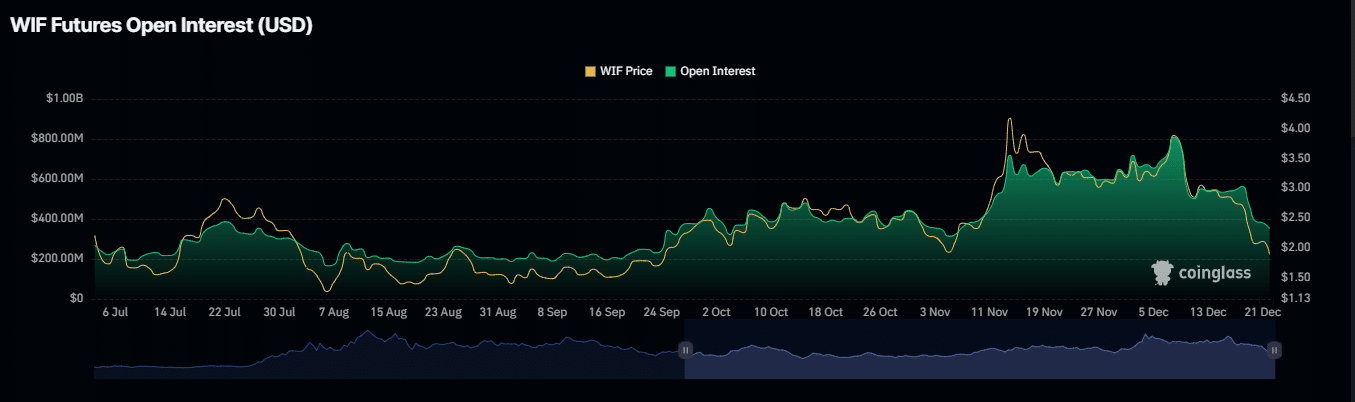

Market Sentiment and Open Interest Trends for WIF

The market’s Open Interest (OI) figures have started showcasing a downward trajectory, currently resting at $360.94 million. This decline suggests a reduction in open derivative positions as traders react to ongoing price drops. The 14.29% decrease in market capitalization highlights the cautious approach that many traders are adopting in this turbulent environment.

Moreover, the long-to-short ratio of 0.89 reflects a bearish dominance, as short positions are currently outpacing longs. This sentiment is further corroborated by the Average Directional Index (ADX), reading at 30.19, indicating that the bearish trend remains strong. With these indicators in alignment, traders should anticipate potential movements below current support levels.

Source: Coinglass

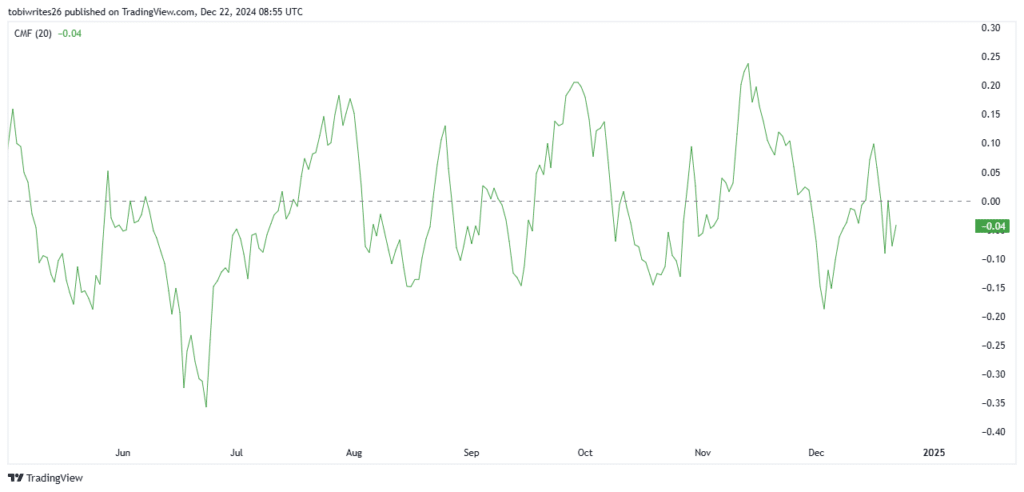

Bullish Indicators Amid Price Corrections

Despite the looming challenges, there are signs suggesting that bullish strength could resurface. The Chaikin Money Flow (CMF) has shown upward momentum, nearing the critical zero line, indicating that buying volume potentially outweighs selling pressure. This could mark the onset of a price reversal. Observing further investment behavior, a notable $5.50 million of WIF has transitioned to private wallets, pointing towards long-term holding strategies among investors.

Source: Trading View

Conclusion

While WIF is positioned amidst significant bearish trends, the overall bullish sentiment remains intact. Traders should prepare for potential short-term price adjustments as the market recalibrates. With proper analysis and attention to key indicators, WIF traders can position themselves advantageously as long-term bullish opportunities arise ahead.