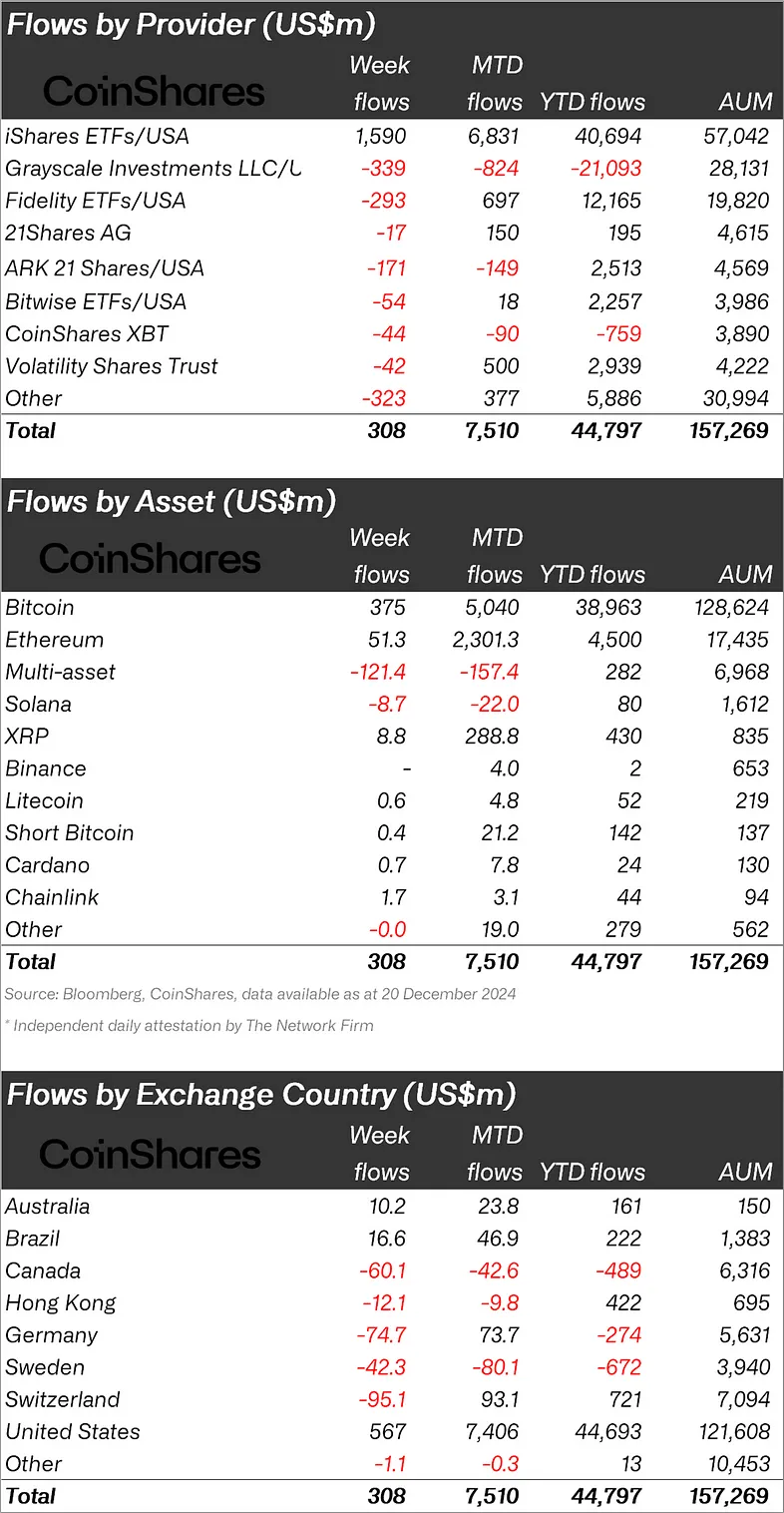

While the leading cryptocurrency Bitcoin (BTC) closed the week with its first loss since Donald Trump's victory, CoinShares published its weekly cryptocurrency report and said that there was an inflow of $ 308 million last week.

“Inflows into cryptocurrency investment products continued last week, totaling $308 million.”

Inflows Continued in Bitcoin and Some Altcoins!

When looking at crypto funds individually, it was seen that the fund inflows were in Bitcoin.

While BTC saw an inflow of $375 million, Ethereum (ETH) saw an inflow of $51.3 million.

There was also an inflow of $0.4 million in the Bitcoin Short fund, which was indexed to the fall of BTC.

When we look at other altcoins, XRP experienced an inflow of $8.8 million, Polkadot (DOT) $1.9 million, Litecoin (LTC) $0.6 million, Chainlink (LINK) $1.7 million, and Solana (SOL) experienced an outflow of $8.7 million.

“Bitcoin saw net weekly inflows of $375 million, despite outflows during the week.

The most dramatic flows came from multi-asset investment products, which saw outflows of $121 million last week.

While many altcoins like XRP ($8.8M), Horizen ($4.8M), and Polkadot ($1.9M) continue to see inflows, it suggests that investors are choosing to take a more selective approach.

While there was an inflow of $51 million into Ethereum, there was an outflow of $8.7 million in Solana.

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an inflow of 567 million dollars.

Brazil came in second after the United States with $16 million.

Against these inflows, Switzerland experienced an outflow of $95.1 million and Germany an outflow of $74.7 million.

*This is not investment advice.