-

Uniswap witnesses an extraordinary 200% surge in large transactions even as its price plummets 9% within two days, signaling volatile market activity.

-

Despite the increase in whale transactions, exchange inflows have continued to decline, raising questions about market sentiment surrounding the altcoin.

-

“The fluctuating behavior hints at possible strategic moves among large holders, but market direction remains unclear,” stated a representative from COINOTAG.

Uniswap sees a spike in large transactions while its price drops 9% in 48 hours, stirring speculation on market direction and whale activity.

Uniswap whale activity skyrockets, but why?

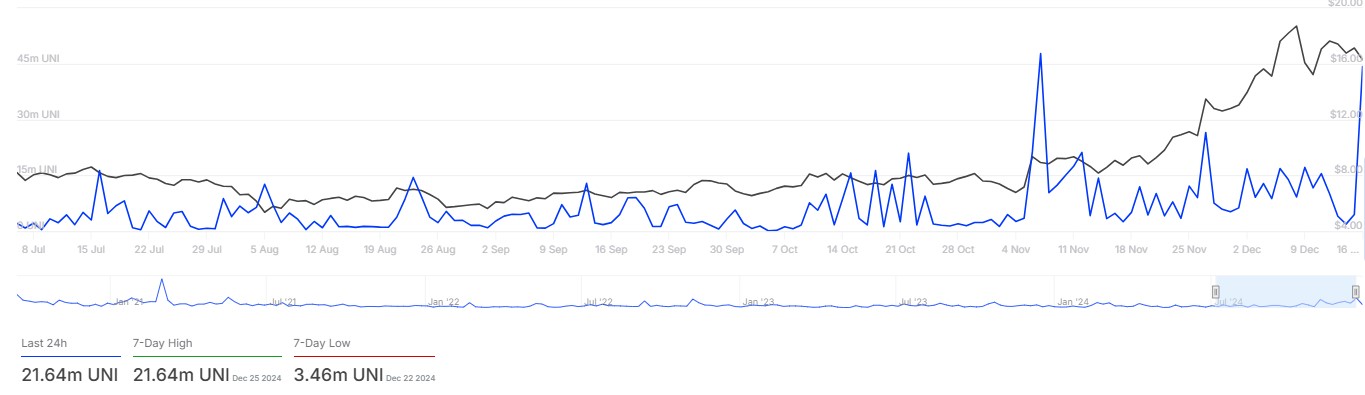

Historically, large transactions reflect significant whale activity, and the recent spike, reported by IntoTheBlock, is indeed noteworthy. The 200% increase in large transactions over the last 24 hours indicates that substantial market players are making substantial moves. This pattern typically stirs excitement in the market, as it can foreshadow strategic positions being established.

Nonetheless, the ambiguity remains: are these whales accumulating UNI tokens in anticipation of a price increase or are they poised to offload their holdings? The current situation leaves many users guessing as the market navigates through uncertainties.

Source: IntoTheBlock

The lack of clarity continues to create a charged atmosphere, compelling market participants to proceed with caution.

Shrinking exchange inflows add to the mystery

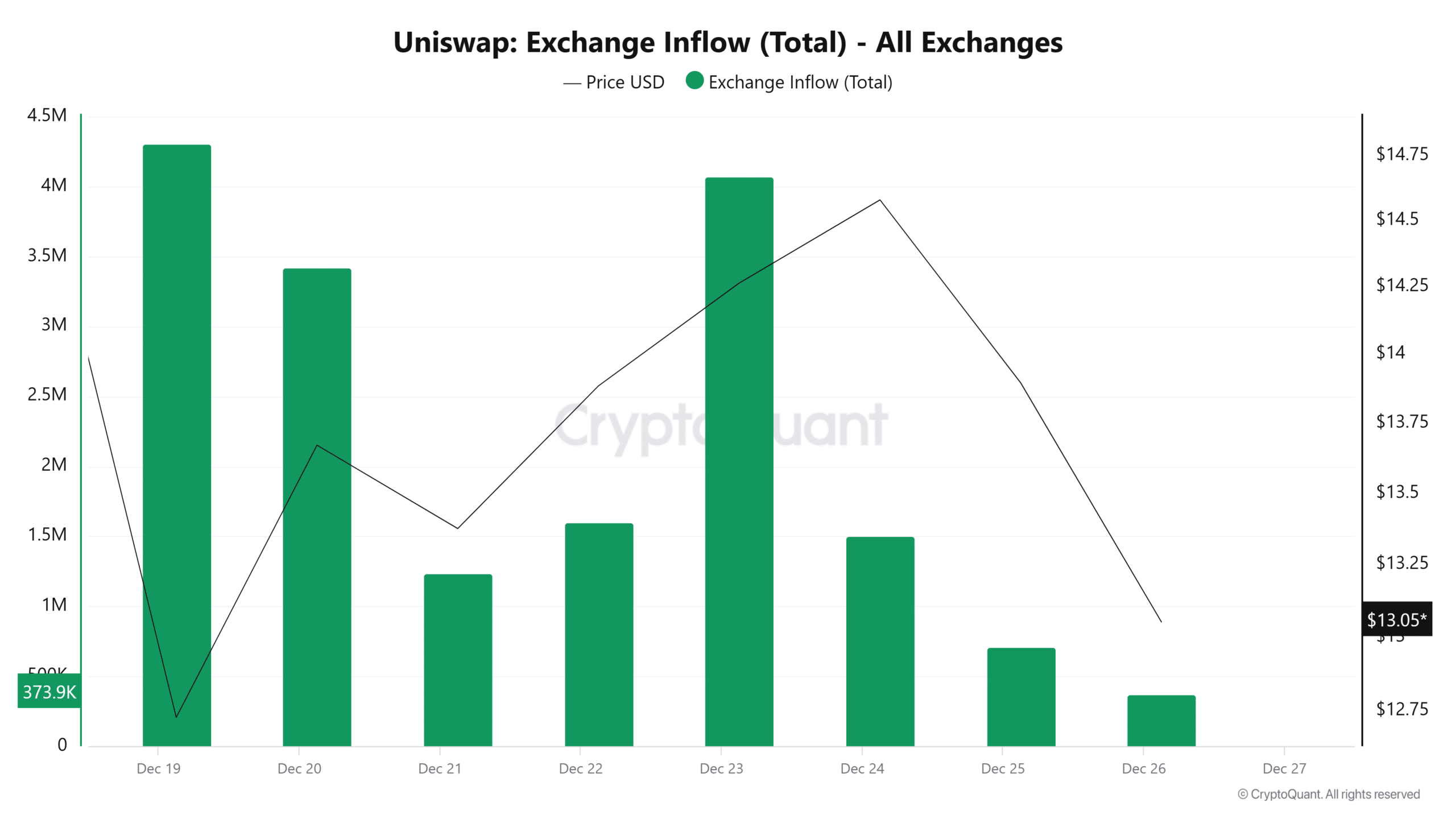

While whale activity is heating up, exchange inflows appear to be on a cooling trend. Data from CryptoQuant highlights a significant decline in tokens flowing to exchanges over the past three days. This general downtrend is typically a sign that traders are choosing to hold onto their assets rather than liquidating them.

However, this diminishing inflow could also be indicative of a decline in retail interest—a troubling sign for an asset’s liquidity. The resulting contrast between rising whale activity and decreasing inflows creates a perplexing scenario. Are large holders capitalizing on opportunities that retail investors may overlook, or is there more profound market disquiet at play?

Source: CryptoQuant

Uniswap price plunges despite market activity

The complexity of the situation intensifies as Uniswap’s price records a drop of 9% in under 48 hours, suggesting bearish forces are at work. This situation begs the question: Are whales supporting this declining market or leveraging its current weakness?

Source: TradingView

Despite these short-term challenges, Uniswap’s price performance on longer timeframes suggests a predominantly bullish trend. Forecasts imply that this could serve as a temporary correction prior to a potential rally.

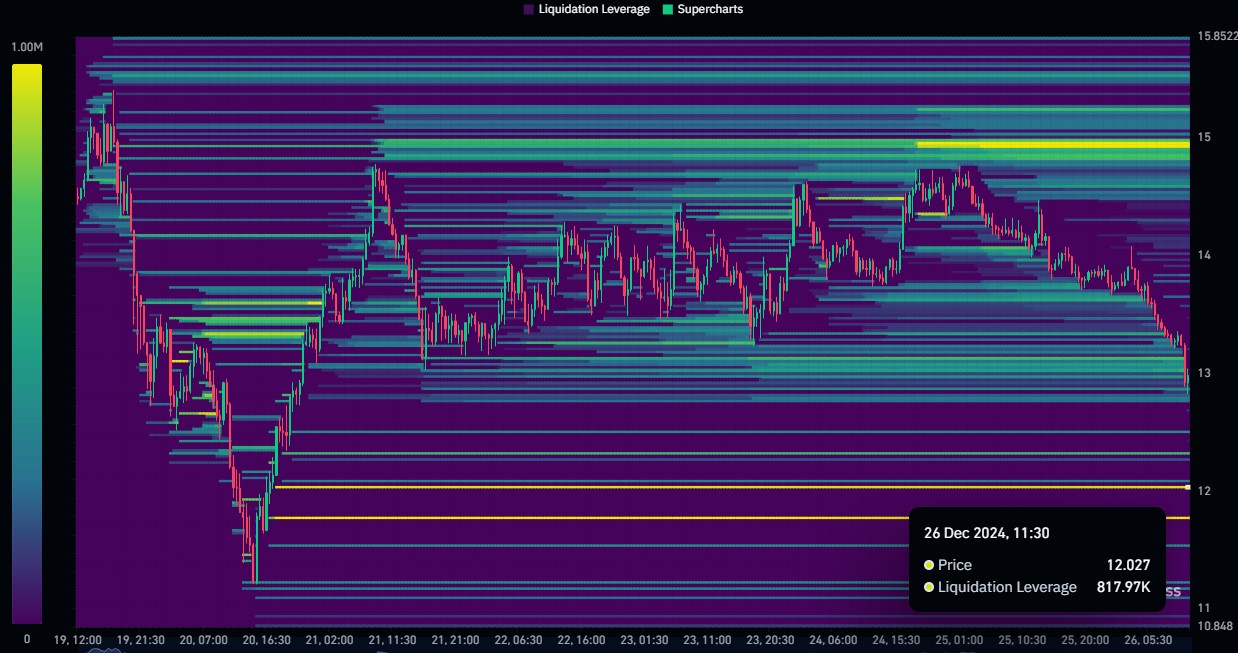

Technically, it appears Uniswap may revisit the critical $12 support level—previously a resistance point that has turned supportive in recent rallies.

Insights from COINOTAG indicate potential liquidation triggers within the market; approximately $818,000 of UNI positions are vulnerable if prices dip further toward the $12 mark. This scenario could lead to additional selling pressure before possible accumulation driven by whale activities unfolds.

Source: Coinglass

Conclusion

In conclusion, Uniswap’s recent market activity presents a tapestry of conflicting signals—surging large transactions from whales juxtaposed against dwindling exchange inflows and a notable price decline. Traders and analysts must decipher these developments to determine the altcoin’s forthcoming trajectory. The current market dynamics suggest cautious optimism, as the involvement of whales could hint at strategic accumulation despite short-term volatility. Observing the unfolding scenarios, particularly around the $12 support level, will be crucial for understanding how this altcoin will navigate its path forward.