Bitcoin’s price has fallen below the $96,000 mark, now trading at $95,943, reflecting a 24-hour decline of 2.31%. The cryptocurrency market continues to experience turbulence, with significant liquidations reported across exchanges.

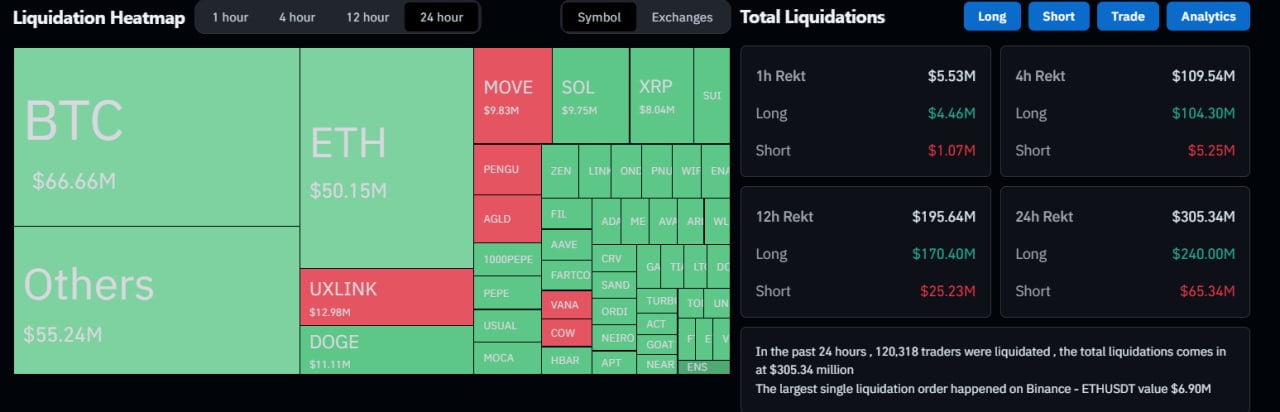

According to Coinglass , the crypto market saw a total liquidation of $109 million over the past four hours, with $104 million attributed to long positions.

Over the last 24 hours, 120,238 traders globally were liquidated, with a total liquidation value of $305 million. The single largest liquidation was recorded on Binance in an ETHUSDT position, amounting to $6.9 million.

Binance Bitcoin Reserves Reach New Lows

Bitcoin reserves on Binance, the world’s largest cryptocurrency exchange by trading volume, have dropped to levels not seen since January 2024.

Current reserves are below 570,000 BTC, as highlighted by CryptoQuant analyst “Darkfost.” Historically, a decline in exchange reserves often signals a trend of investors moving assets into cold storage, suggesting bullish sentiment for Bitcoin’s long-term prospects.

This trend mirrors the January 2024 period when reserves dropped significantly, followed by a 90% surge in Bitcoin’s price by March.

Analysts speculate that if Bitcoin’s current price of $95,943 follows a similar trajectory, it could climb to approximately $187,500 in the coming months.

“When periods of withdrawals occur, it is often a sign of positive momentum building in the market,” Darkfost commented.

Bitcoin Dominance and Market Challenges

Bitcoin’s dominance in the cryptocurrency market currently stands at 58.4%, according to TradingView. While this figure hovers near the 60% threshold, some analysts interpret this as a sign of possible market rotation into altcoins. Historical data shows that Bitcoin dominance breached the 60% level in late 2024, leading to broader market shifts.

Meanwhile, Bitcoin has struggled to hold above the $100,000 psychological threshold since first surpassing it on December 5, 2024.

After reaching a high of $108,300 on December 17, Bitcoin’s price has traded below $100,000 since December 19.