Solana Price Analysis Hints $300 Recovery Amid TVL Spike

This week, the cryptocurrency market recorded damped volatility as Bitcoin wavers between the $100k and $90k levels. This consolidation trend has stalled the prevailing correction sentiment in most major altcoins, including SOL. The Solana price holding above a confluence of major support signals a potential for a bullish recovery.

According to Coingecko, SOL price currently trades at $184.5, with an intraday loss of 2.5%. The asset market cap stands at $88.5 Billion, while 24-hour trading is at $3.6 Billion.

Key Highlights:

- A renewed uptrend in Solana’s TVL and open interest signals increased adoption and investor confidence if further rally.

- A downsloping trendline drives the current correction in Solana price.

- The $175 support is closely aligned with the 50% Fibonacci retracement level, and the 200-day Exponential moving average creates a high accumulation zone.

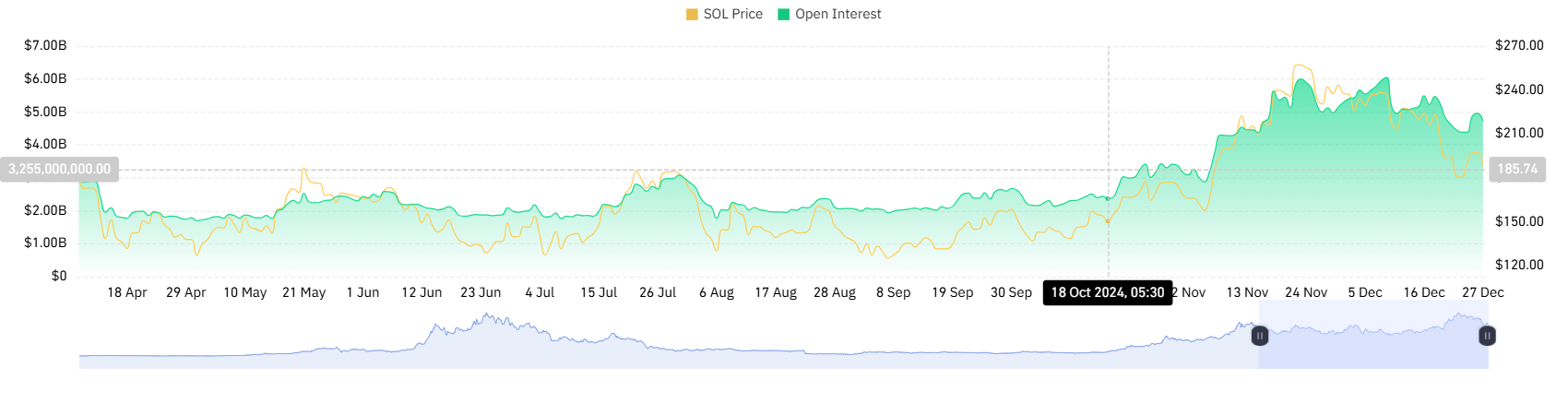

SOL Rebounds as Open Interest and TVL See Notable Increases

According to Coinglass data, the SOL futures open interest records a notable surge from $4.38 to $4.96— a 13% increase since last week. Open interest refers to the total number of outstanding derivative contracts that have not yet been settled.

A rise in open interest often suggests increased trader activity, signaling heightened interest and confidence in SOL’s price movements.

In the same period, Solana’s Total volume locked (TVL) records a jump from $8.06 to $8.67 Billion, registering a 7%. A growing TVL showcases increased trust in Solana’s DeFi platforms, suggesting that more users are staking, lending, or providing liquidity within its ecosystem.

Solana Price Correction Hits Key Support

For over a month, the Solana price has witnessed a major correction from $264 to $183, registering a 30% loss. The pullback is currently seeking support at $175, a horizontal coinciding with 50% FIB, 50-day EMA, and an emerging support trendline.

This creates a high area of interest for buyers to recuperate the bullish momentum and drive price reversal. An analysis of the daily chart shows the support trendline has acted as suitable pullback support for SOL since mid-September.

A potential reversal could drive the price 7.8% before a key breakout from the downsloping trendline. A successful breakout will further accelerate the bullying pressure to drive a rally past $300.

Also Read: Bitwise Files for Bitcoin Standard Corporations ETF with the SEC

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AAVE up 3.51% over the past week following Aave Labs’ acquisition of Stable Finance to broaden its retail DeFi services

- Aave Labs acquires Stable Finance to expand retail DeFi offerings, enhancing consumer-friendly yield solutions. - Aave (AAVE) rose 3.51% in 7 days despite 17.48% monthly decline, reflecting mixed investor sentiment. - The $37B TVL platform navigates regulatory ambiguity as U.S. lawmakers restrict yield-bearing stablecoins. - Strategic moves like Maple Finance integration and Horizon RWA launch aim to strengthen DeFi market dominance.

Hoffman's Bold NFT Move: What Drives This Crypto Expert to Embrace Cryptopunks

- Reid Hoffman, LinkedIn co-founder and VC, joined Cryptopunks NFT community by updating his X profile picture to a Cryptopunk avatar. - His move highlights long-term blockchain investment history and supports Cryptopunks' resilience amid broader NFT market declines. - Cryptopunks remain iconic NFTs with recent $170K+ sales, contrasting newer projects like Pudgy Penguins which saw 76% sales drops. - Hoffman's NFT endorsement intersects with AI governance debates, defending Anthropic against Trump administr

AAVE slips 0.17% after Aave Labs acquires Stable Finance to strengthen its retail DeFi services

- Aave Labs acquires Stable Finance to expand retail DeFi offerings, integrating $37B TVL and Mario Baxter Cabrera's team. - AAVE token fell 0.17% in 24 hours but gained 3.27% weekly, amid 17.67% monthly decline and 26.85% annual drop. - The acquisition strengthens Aave's position in on-chain yield markets despite regulatory uncertainties and competitive DeFi expansion. - Technical analysis suggests long-term bullish potential for Aave's metrics post-integration of Stable Finance's yield-generating solutio

Bittensor's Move Toward Institutions and BlockDAG's Presale Momentum: The Crypto Turning Point of 2025

- Bittensor (TAO) faces short-term price dips but gains 6.02% weekly amid institutional interest and its December 2025 halving event. - BlockDAG (BDAG) surges past $430M in presales with $0.0015 token price, leveraging DAG-Proof-of-Work hybrid tech and F1 team partnerships. - Analysts debate whether TAO's supply reduction and BDAG's presale momentum will drive broader crypto trends or remain isolated developments.