The U.S. Bitcoin spot ETF has been online for 50 weeks, and BlackRock's IBIT has fully absorbed the selling pressure from Grayscale GBTC

According to HODL15Capital data, the U.S. Bitcoin spot ETF has been online for 50 weeks, and the holdings of BlackRock's IBIT have increased from 2,621 in the first week to 552,555, fully absorbing the selling pressure of Grayscale GBTC. The Bitcoin holdings of Grayscale GBTC decreased from 619,200 in the first week to 206,860.

Note: Previously, Grayscale Bitcoin Trust Fund was a major way for investors to enter the bitcoin market. It had accumulated a large number of positions before the launch of spot bitcoin ETFs with initial holdings as high as 619200 BTC. After transitioning into a spot ETF it directly inherited this huge asset base. The management fee rate (1.5%) of GBTC is higher than other competitors which led investors to redeem their GBTC shares and switch to other ETFs after the launch of spot ETFs resulting in an exchange between BlackRock's IBIT and Grayscale's GBTC mentioned above.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

49,999 ETH were transferred from an exchange to an unknown wallet, valued at approximately $175,445,747.

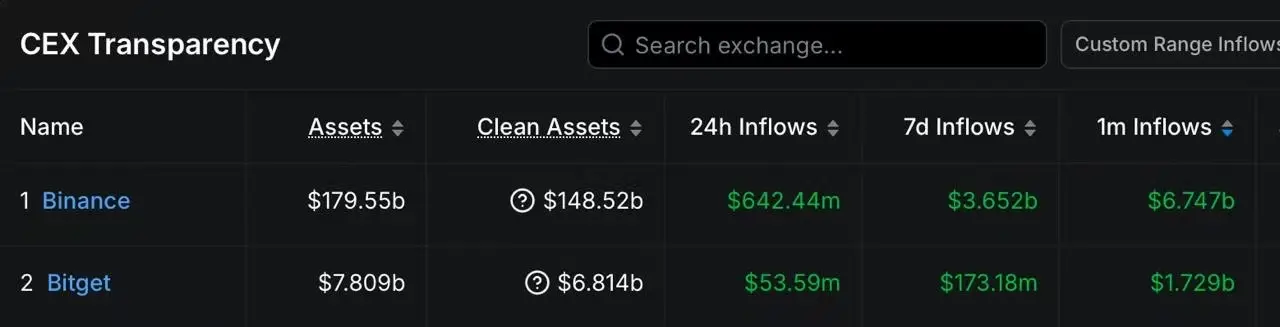

Data: In the past 30 days, the main capital inflows have been to a certain exchange and leading CEXs such as Bitget.

Analysis: Bitcoin’s next key support level is $99,000