Economists warn of three major risks: technology bubble, tariff policy, and geopolitics

According to NBD, 2024 is about to pass. Looking back on the past year, against the backdrop of continued AI fever, the Fed's shift towards easing and the upcoming "Trump 2.0", all three major US stock indices have continuously refreshed historical records in 2024. The S&P has closed at a record high nearly 60 times within the year, NASDAQ has broken through 20,000 points for the first time in history, and Dow Jones has stood above 45,000 points for the first time. However, there are also voices of warning in the market. Bank of America believes that the biggest risk in 2025 will be a tech bubble. In an interview with reporters, Dr David Seif , chief economist for developed markets at Nomura warned that tariffs and geopolitical shocks are two biggest potential risks; among them tariffs are most likely to interrupt US bull market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: If ETH falls below $3,747, the cumulative long liquidation intensity on major CEXs will reach $1.302 billion.

Trending news

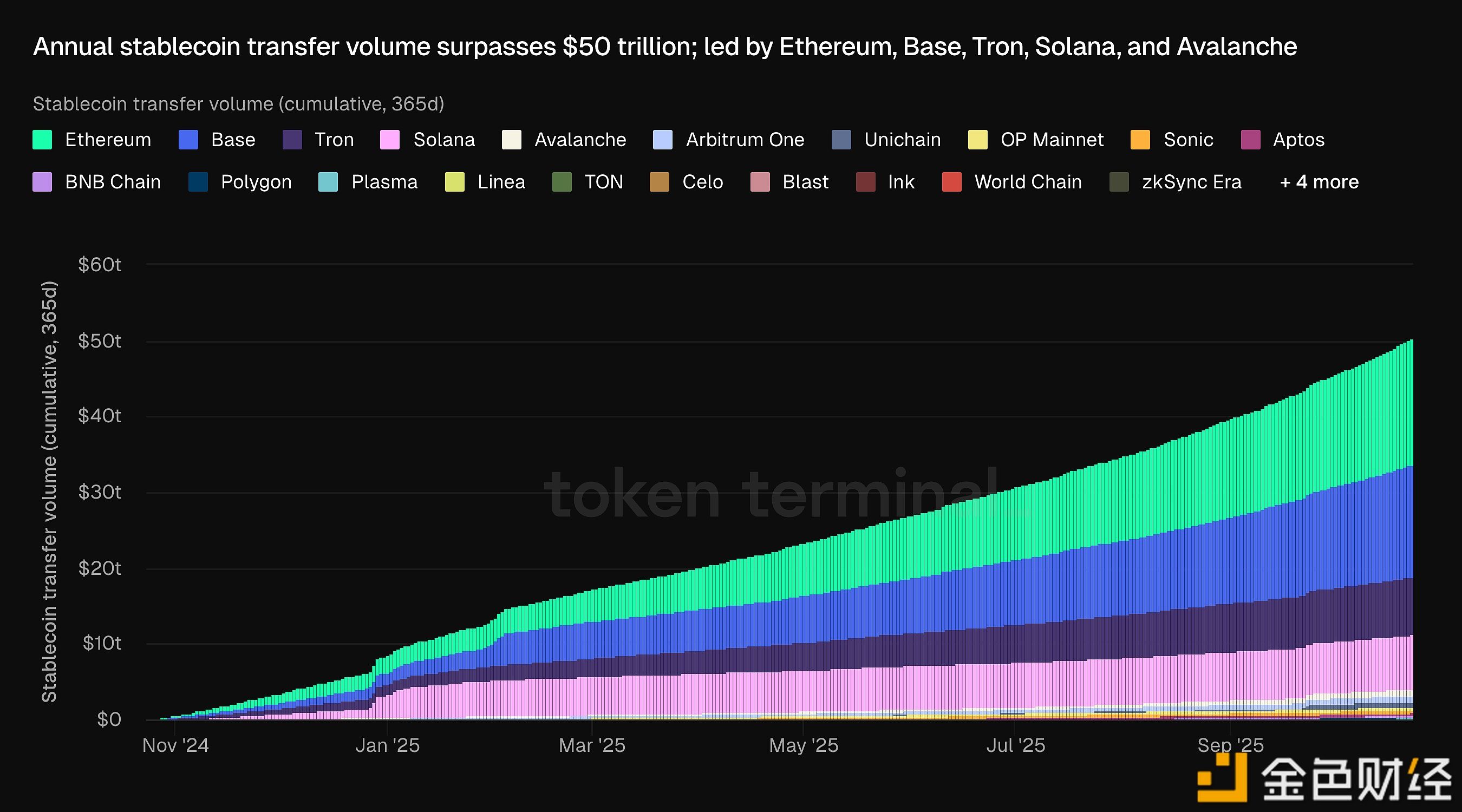

MoreData: Annual stablecoin transfer volume surpasses $50 trillion, with Ethereum and Base ranking as the top two transfer networks

Data: In the past 24 hours, total liquidations across the network reached $127 million, with long positions liquidated for $55.43 million and short positions liquidated for $71.97 million.