The classic four-year cycle in the Bitcoin market will cease to operate due to hyperbitcoinization, so a significant drop in the cryptocurrency rate should not be expected.

Forum User Reddit under the nickname Few_Temperature7935 is correct noticed , that demand for BTC greatly exceeds supply. For example, this year, issuers bitcoin ETF and MicroStrategy bought about 1,73 million BTC, which is 8,7% of the number of coins created. At the same time, miners mined an average of 450 bitcoins per day and thus released about 164,250 BTC. That is, only the creators of exchange-traded funds and MicroStrategy purchased much more coins than were mined. As a result, demand exceeded supply, and the rate of the digital asset rose sharply.

Few_Temperature7935 rightly believes that a supply shock is imminent in the Bitcoin market next year, which makes him wonder why analysts are still using outdated patterns based on cycle theory to predict the price of the coin.

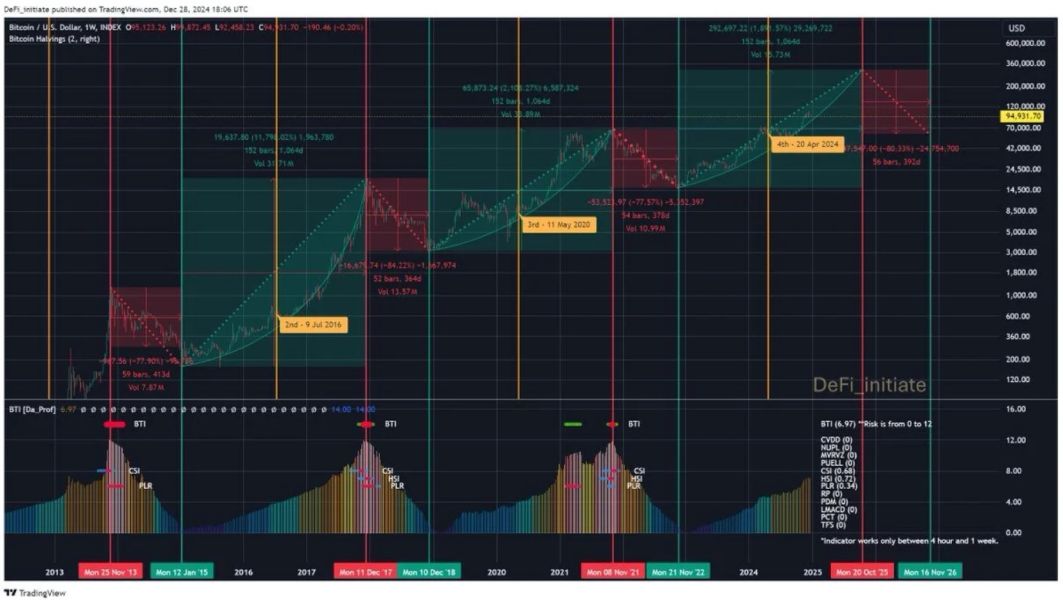

In particular, according to a chart published by an analyst DeFi _initiate, BTC will rise to $292,697 by October 20, 2025 and then fall to $67,547 by November 16, 2026, if the situation observed during previous cycles repeats.

Cycles on the Bitcoin exchange rate chart

However, the user Reddit denfaina is confident that the cycle theory will stop working because the demand for bitcoins exceeds the supply. He said that hyperbitcoinization has come into play, which is characterized by extremely high demand for BTC. If denfaina's point of view is confirmed in practice, then the bitcoin rate will not fall as much as it happened after the end of bullish rallies in the past. Most likely, it will be limited to a small correction by cryptocurrency standards of 15-20%.