Businessman Martin Shkreli, who made his fortune speculating on drugs in the US, has promised to sell shares in MicroStrategy and raise the Bitcoin rate to $250,000.

MicroStrategy shares are below $300. Do we dump them and drive Bitcoin to $250,000 without Saylor? The best Saylor can do is build up his stockpiles, wrote Shkreli.

Martin made the announcement after MicroStrategy shares broke through the $31 support barrier on Dec. 300 and fell to $293. The firm's shares fell despite another buying bitcoins in the amount of $209 million. It is obvious that the downward trend was caused by the fall in the BTC rate that began on December 17.

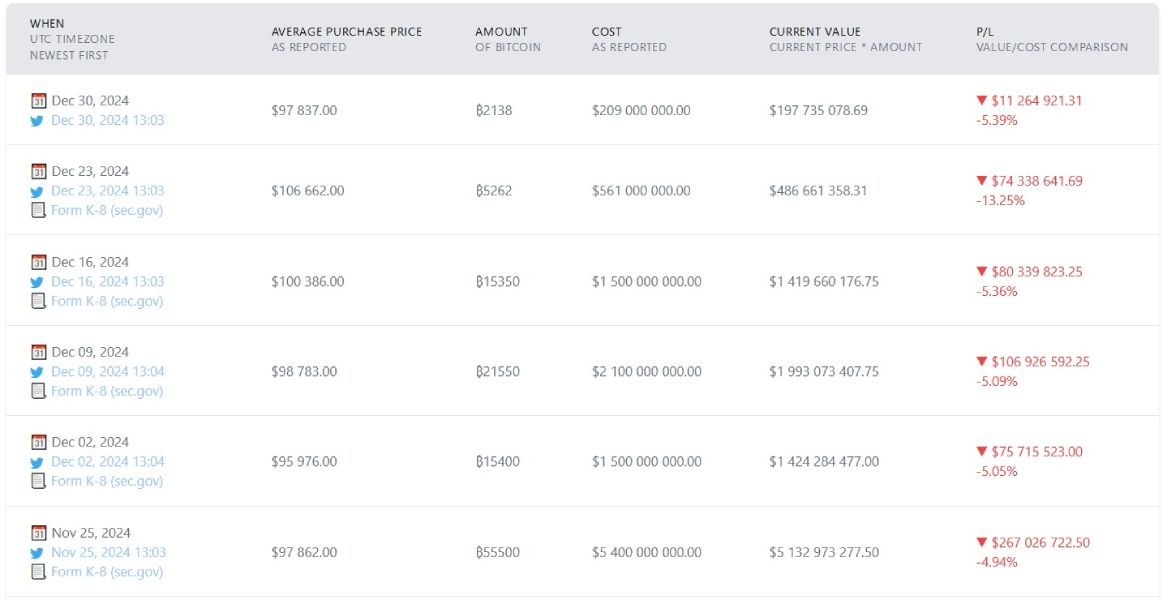

MicroStrategy continued to invest in Bitcoin when the cryptocurrency surpassed $95,000. BTC is currently worth $92,450, so the last six purchases of the digital asset resulted in an unrealized loss of $615,6 million for the company. However, taking into account past transactions, investments in BTC brought MicroStrategy a profit of $13,5 billion (48,4%). Now the organizations owns 446,400 bitcoins worth $41,3 billion.

MicroStrategy's Six Latest Bitcoin Purchases

Economist Peter Schiff, who has been critical of MicroStrategy's business strategy, has warned the firm's shareholders of the risks of the company defaulting. Bitcoin would fall significantly in price, causing the organization's stock price to crash, and MicroStrategy employees would be unable to pay off the convertible bonds the institution issued to raise the capital needed to buy BTC.