BlackRock’s Bitcoin ETF tops rivals in 2024 net inflows

From cointelegraph by Alex O'Donnell

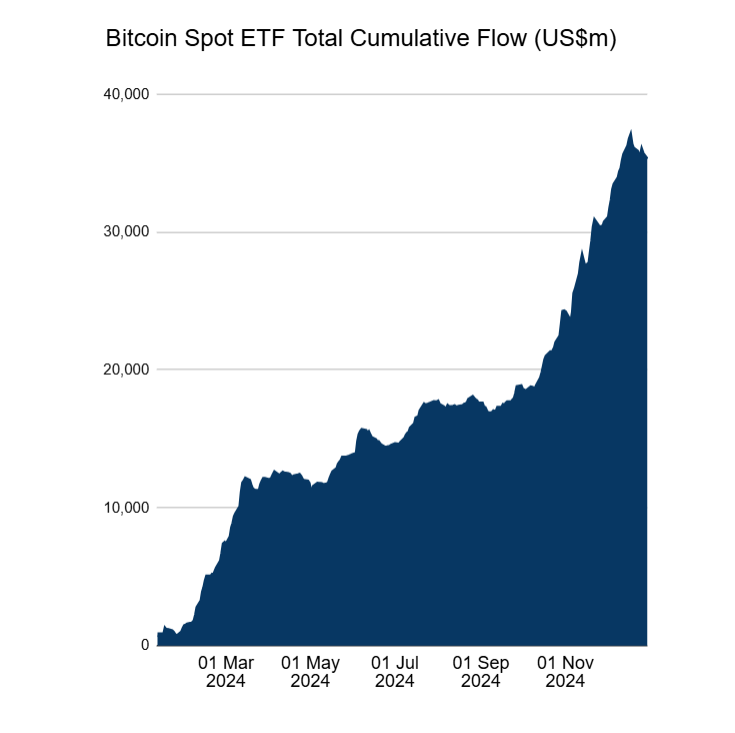

BlackRock’s spot Bitcoin BTC$93,830 exchange-traded fund (ETF) clocked more than $37 billion in net inflows during 2024, outpacing its competitors, according to data from Farside Investors.

BlackRock’s iShares Bitcoin Trust (IBIT) netted more than three times the inflows of runner-up Fidelity Wise Origin Bitcoin Fund (FBTC), which attracted nearly $12 billion in net inflows this year, Farside said in a Dec. 31 post on the X platform.

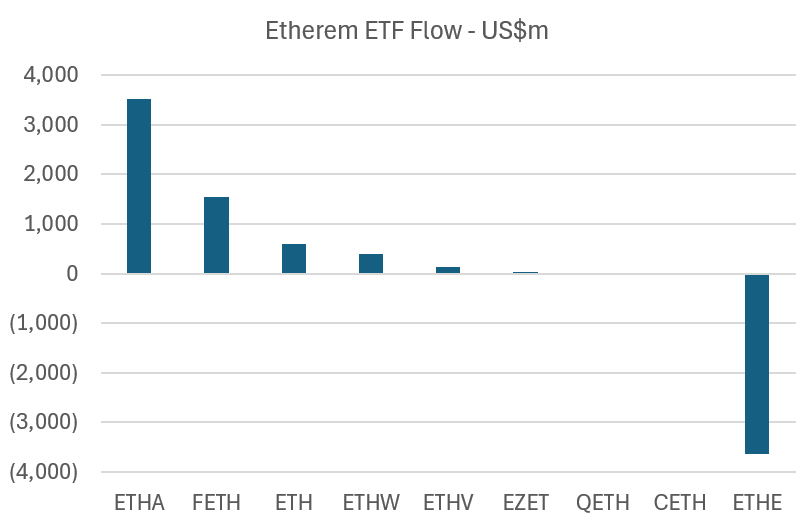

As the world’s largest asset manager, BlackRock also led the pack among Ether ETH$3,340.29 ETFs. The iShares Ethereum Trust (ETHA) pulled $3.5 billion in net inflows during 2024, according to Farside.

Fidelity Ethereum Fund (FETH) again notched second place, with $1.5 billion in net inflows.

“Fidelity is a closer second here, 44% of Blackrock’s total, compared to 31% in Bitcoin,” Farside said.

Source: Farside Investors

Source: Farside Investors

Related: BlackRock’s Bitcoin ETF flips gold fund Overall, United States Bitcoin ETFs saw more than $35 billion in aggregate net inflows for the year. That equates to roughly $144 million in net inflows each trading day, according to Farside.

This figure factors in more than $20 billion in net outflows from Grayscale Bitcoin Trust (GBTC), which the asset manager launched in 2013, initially as a non-listed trust.

Grayscale’s GBTC charges management fees of 2.5%. In July, the asset manager listed Grayscale Bitcoin Mini Trust (BTC) as a cheaper alternative. Its management fees are 0.15% annually.

Source: Farside Investors

Source: Farside Investors

Bitcoin ETF dominance

Bitcoin ETFs were listed in the US in January after a lengthy tussle with regulators.

The crypto market surged following Donald Trump’s victory in the US presidential election, as many believe his win will benefit the industry, Cointelegraph Research said .

On Nov. 21, US Bitcoin ETFs broke $100 billion in net assets for the first time, according to data from Bloomberg Intelligence.

Bitcoin has dominated the ETF landscape this year, accounting for six of the top 10 most successful launches in 2024, Nate Geraci, president of The ETF Store, said in an X post .

Of the approximately 400 new ETFs launched in 2024, the four biggest launches by inflows have all been spot BTC ETFs, Geraci said in September .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!