Solana’s price action indicates a continuation of its bullish rally, bolstered by a burgeoning ecosystem and record Total Value Locked (TVL).

-

Solana consolidated in a rising wedge pattern below the $200 level, showcasing potential for further upward movements.

-

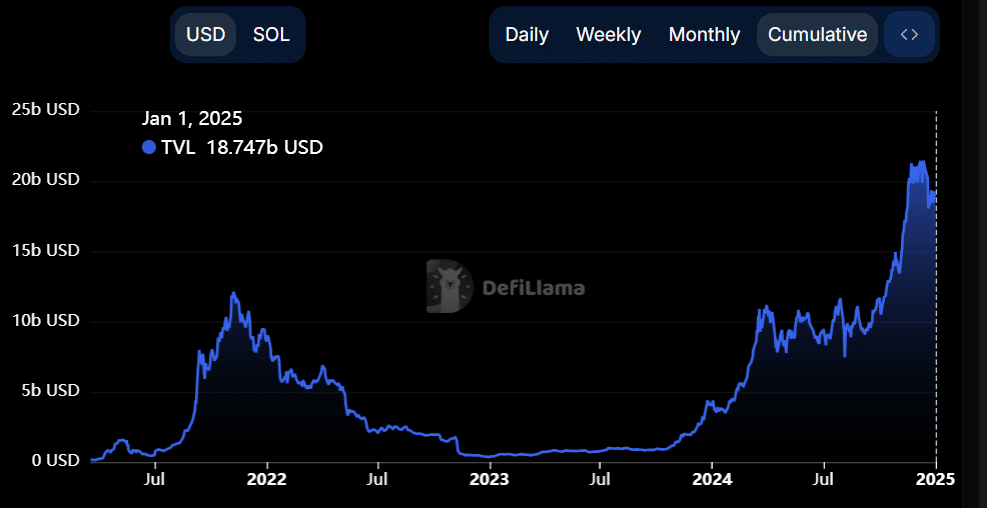

SOL’s TVL, encompassing staking, borrows, and liquid staking, has hit an impressive $20 billion, signifying strong ecosystem engagement.

Solana’s price is currently $191 with a recent 1.50% decline while trading volume has dropped 16% to $2 billion, poised for possible breakout opportunities.

Market Dynamics and Price Levels for Solana

Recent charts reveal that Solana’s price has formed a rising wedge pattern beneath the critical $200 resistance level. This pattern often serves as an indicator of a potential bullish reversal during the prevailing positive market sentiment.

Despite a slight downturn, the asset’s ascending support line demonstrates resilience, affirming a series of higher lows that hint at a robust bullish inertia.

Solana’s struggle at the $200 mark highlights its importance as a significant resistance. Should the asset break through this level, analysts forecast a surge beyond $236 and possibly exceeding $400 by Q1 2025. However, failing to conquer the $200 resistance could see it retreat to near-term support levels around $180.

Investors are advised to closely monitor trading volumes and market sentiment, as these factors will likely dictate Solana’s trajectory in the coming months.

Solana’s Total Value Locked: A Sign of Robust Ecosystem Activity

In 2024, Solana achieved a Total Value Locked (TVL) of $20 billion, marking an all-time high and underscoring its thriving financial ecosystem. This milestone is attributed to increased activity in both staking and borrowing, highlighting robust participation among users.

Source: DefiLlama

The market’s stablecoin concentration peaked at $5.226 billion, reinforcing the liquidity structure essential for the platform’s sustainability. Daily fees reached $3.22 million, indicative of strong usage rates, and total trading volume hit $3.293 billion.

Additionally, the network saw 803.19 million in perpetual volume with active addresses totaling 4.12 million, highlighting significant engagement that could foster future price increases.

Trade Dynamics: Insights from Pumpdotfun’s Revenue

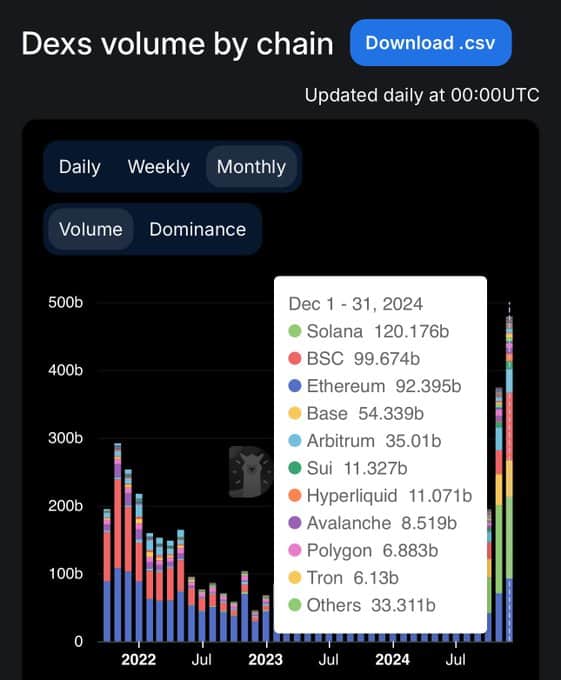

December 2024 showcased Solana’s financial prowess, specifically through DEX trading volume attributed to Pumpdotfun, surpassing $80 million. This surge positioned Solana within larger trading dynamics, achieving $120 billion in DEX volume with a market dominance of 25%.

Source: DefiLlama

Competitors like BSC and Ethereum followed closely, with respective trading volumes of $99.674 billion and $92.395 billion, illustrating heightened competition in the DeFi space.

However, Pumpdotfun faced scrutiny stemming from the large-scale offloading of SOL tokens, which has led to concerns regarding investor sentiment and trust. Nevertheless, Solana’s traction from meme coin launches and community engagement may indicate a bullish potential for 2025, provided the platform maintains its public trust and market position.

Conclusion

Solana is currently navigating pivotal resistance levels and showcasing significant market engagement through its rising TVL and trading volumes. As it heads into 2025, the observations on upward price momentum and ecosystem activity suggest a cautiously optimistic outlook, pending the ability to breach the critical $200 resistance. Investors should keep an eye on market developments and the impact of broader sentiment on Solana’s trajectory.