-

Litecoin (LTC) has shown significant bullish momentum recently, signaling a potential recovery in the face of previous market challenges.

-

The altcoin has recorded a remarkable 6.69% surge within the past 24 hours, raising interest among investors.

-

“With the recent price uptrend, long-term holders are regaining confidence in LTC as profit margins increase,” stated a chief analyst at COINOTAG.

Discover how Litecoin’s recent bullish momentum is affecting investor confidence and market positioning as it recovers from prior declines.

Unraveling Litecoin’s Bullish Momentum Amid Market Dynamics

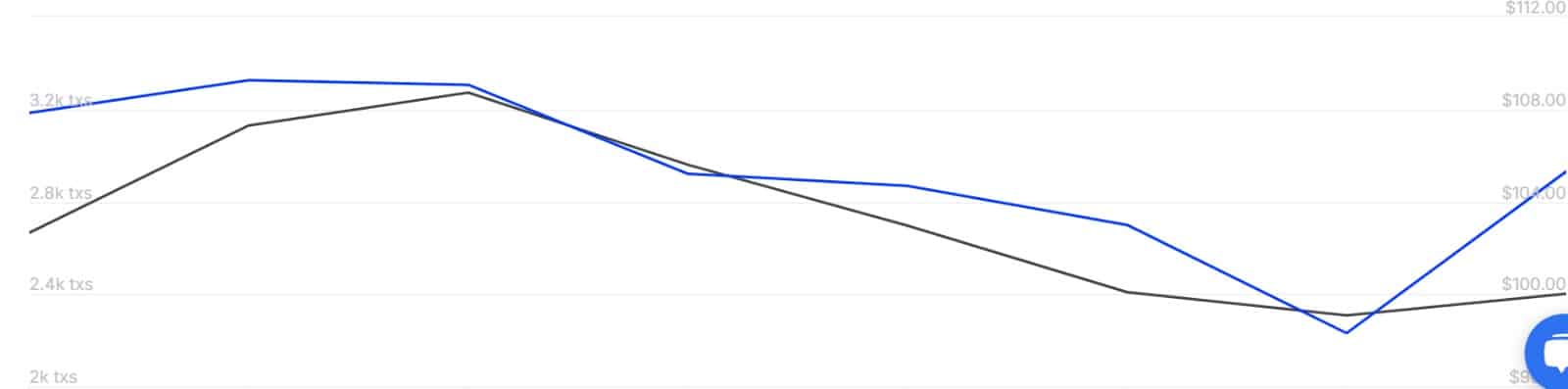

Recent analysis indicates that Litecoin is gaining traction as buying pressure intensifies. The altcoin has experienced a significant price shift, currently trading at $105 after a notable dip to $96 just days prior. This marks a compelling 9.38% increase during the recovery phase, part of a larger trend that has caught analysts’ attention.

Source: TradingView

Several indicators support this positive trend. The Stochastic indicator recently signaled a bullish crossover, indicating potential for further increases. Likewise, the Relative Strength Index (RSI) also confirmed this shift, with both metrics suggesting a robust market entry point for traders.

Driven by Whales: Understanding the Dynamics of Litecoin’s Recovery

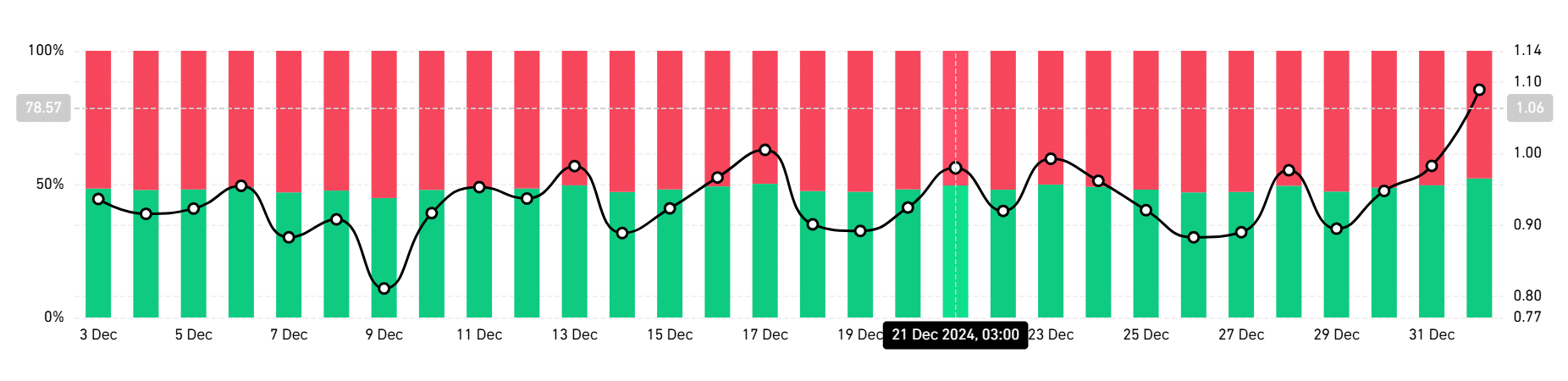

This upward trajectory is also bolstered by significant activity among large investors, commonly referred to as whales. With whale transactions surging by 31.3% over the past day, there is a clear indication of heightened interest from major players in the market.

Source: IntoTheBlock

The rising demand for long positions is also noteworthy, with 53% of traders opting for long bets as tracked by Coinglass. This trend illustrates a prevailing belief among traders that LTC prices are poised for additional growth.

Source: Coinglass

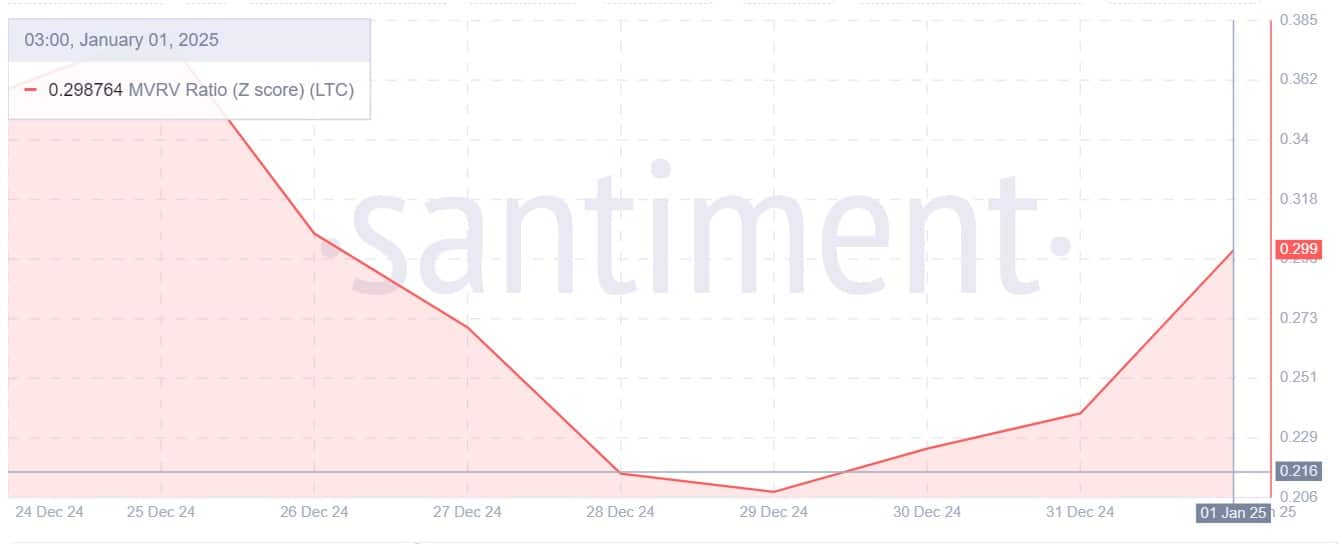

Additionally, the market’s sentiments are echoed in Litecoin’s MVRV (Market Value to Realized Value) ratio, which has recently shown signs of recovery from an undervalued zone. The MVRV ratio moved from 0.208 to 0.29, indicating renewed buying interest.

Source: Santiment

With ongoing price increases, holders of Litecoin are increasingly optimistic as profit margins expand. This bullish sentiment may drive LTC towards reclaiming crucial resistance levels. Currently, analysts suggest that a sustained push could allow LTC to breach the $115 resistance, with targets set for as high as $130.

Conclusion

In conclusion, the recent bullish dynamics surrounding Litecoin signify a potentially significant shift in market conditions. As indicators suggest upward momentum, traders and investors should remain vigilant. Continued activity from whales and increasing long positions both point towards a more confident outlook for LTC. It will be crucial to monitor whether this trend can consolidate above $115 for further growth, or if price corrections will occur, possibly dipping back to previous lows.