-

NFT sales have surged to $8.8 billion in 2024, led by dominant blockchains Ethereum and Bitcoin, despite facing significant market challenges.

-

The late-year growth in Q4 managed to counter a seven-month downturn, showcasing resilience in the NFT market.

-

According to COINOTAG, “oversaturation in the market left 98% of collections with little to no trading activity in 2024,” reflecting the complexities of consumer interest.

NFT sales reached $8.8 billion in 2024, showing resilience after a challenging market period, with Ethereum and Bitcoin leading the surge.

Recovery Signs in the NFT Market: An Overview of 2024

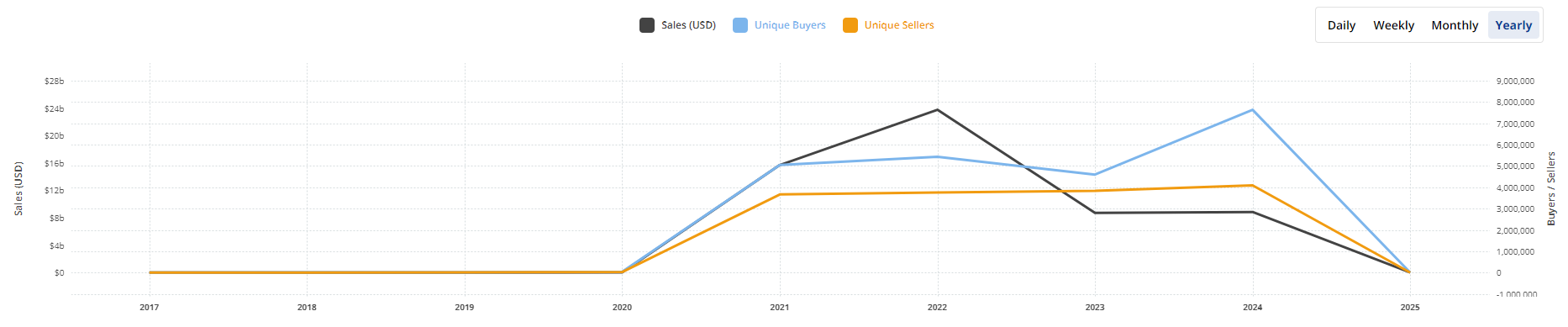

NFTs recorded a total sales volume of $8.8 billion in 2024, marking a slight increase of $100 million from the previous year. This 1.1% year-on-year growth reflects both the potential and challenges existing in the digital collectibles market. The year was characterized by significant fluctuations, demonstrating the volatile nature of NFT investments.

The Leading Blockchains for NFT Sales

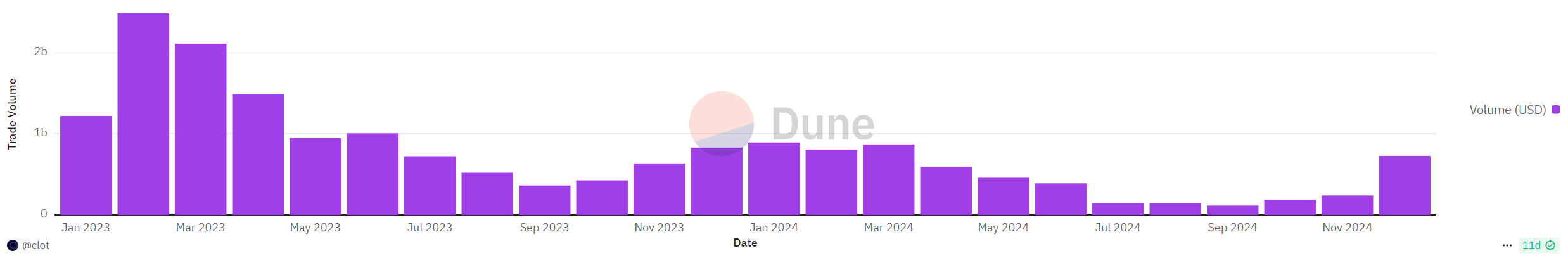

Throughout the year, Ethereum and Bitcoin emerged as the leading blockchains for NFT sales, each generating $3.1 billion. Solana ranked third with a sales volume of $1.4 billion. Cumulatively, Ethereum maintains its dominance with $44.9 billion in all-time NFT sales, while Solana follows with $6.1 billion, and Bitcoin-based NFTs have amassed $4.9 billion in total sales. The market faced significant hurdles in 2024, including a seven-month downturn, with September experiencing the lowest sales volumes since 2021.

However, a rebound began in October, with NFT sales reaching $353 million, an 18% increase from the previous month. Momentum continued into November, seeing sales of $562 million, marking a six-month high. December closed the year robustly with $877 million in sales, its fifth-best month of 2024, with Ethereum collections alone generating $482 million.

Market Innovations Amidst Continued Challenges

In 2024, notable collections such as Pudgy Penguins led the market with a sales volume reaching $115 million. Meanwhile, platforms like Magic Eden began launching their own tokens, signaling a shift towards innovation and adaptation within the NFT space.

Furthermore, \strong>Mythical Games and FIFA generated excitement with the announcement of FIFA Rivals, a mobile football game that integrates NFTs, aiming for release in the summer of 2025.

Despite these progressive steps, the market continued to face serious challenges. For instance, in November, Kraken decided to shut down its NFT marketplace, redirecting focus to other projects. Users were informed they have until February 27, 2025, to withdraw their assets.

Oversaturation presented further issues, as around 98% of NFT collections experienced minimal trading activity. Alarmingly, only 0.2% of NFT drops were deemed profitable, with many collections losing over 50% of their value shortly after release. This highlights a decreasing speculative demand in the market.

While there are signs of recovery in the NFT market, particularly with the gains noted in late 2024, the underlying challenges indicate a significant shift from speculative trading towards more utility-driven applications. As innovation continues within the industry, 2025 will be pivotal in determining if NFTs can maintain a sustainable growth trajectory.

Conclusion

The NFT landscape in 2024 proved to be a complex interplay of challenges and recovery. The total sales volume of $8.8 billion underscores a market that, while resilient, must contend with oversaturation and waning speculative interest. Moving forward, as user engagement evolves and utility gains precedence, stakeholders within the NFT industry will closely monitor emerging trends and innovations to gauge future potential.