Algorand (ALGO) Volume Surges 130%, but Data Points to Possible Correction

Algorand (ALGO) begins 2025 strong with a 130% volume surge, pushing its price to $0.40. However, on-chain data suggests a potential pullback

Algorand (ALGO) trading volume has spiked by 130% in the past 24 hours, pushing the token’s price to $0.40. This rebound has brought 38% of ALGO holders into unrealized profits.

While this trend could increase the number of profitable holders, on-chain analysis indicates that ALGO’s price might encounter a setback.

Interest in Algorand Rises, but Stakeholders Are Letting Go

Algorand’s price surged from $0.33 on January 1, 2025, to $0.40 today, marking a strong start to the year. This rally positions ALGO as one of the top-performing assets among the top 50 cryptocurrencies.

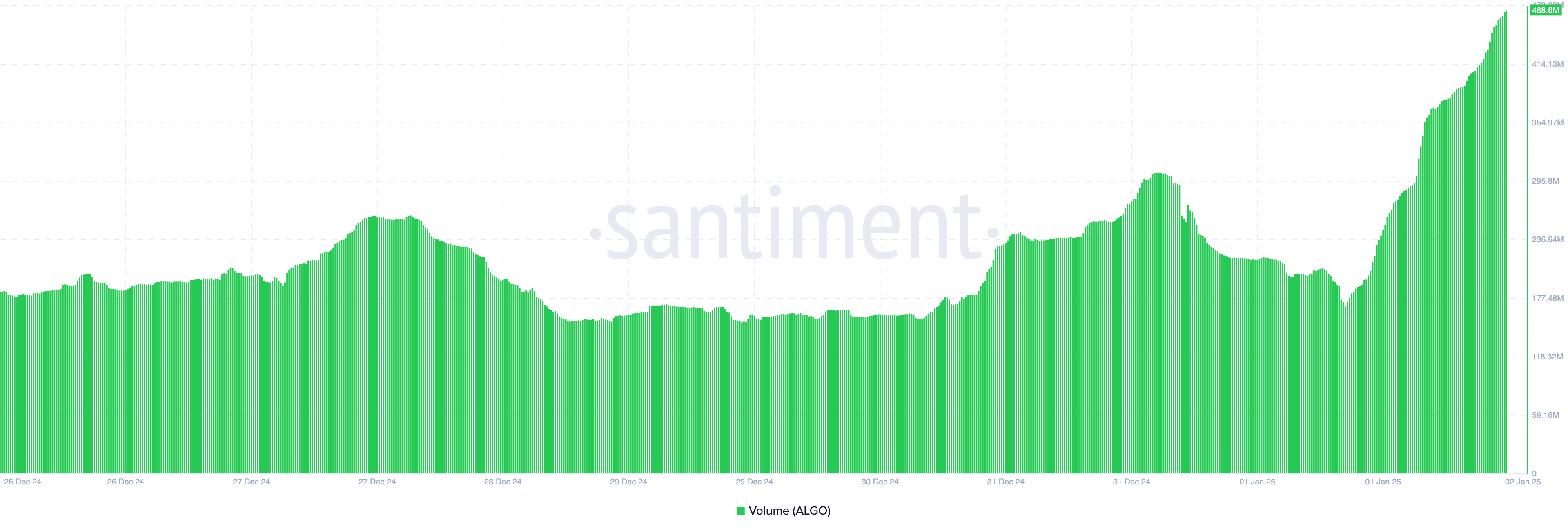

Beyond that, Algorand’s trading volume climbed from $170.67 million to $468.60 million within the same period. The increase in volume indicates rising interest in the cryptocurrency. The upward trend in both volume and price indicates strong bullish momentum, suggesting the token’s value could climb further.

While rising volume has fueled Algorand’s recent hike, a drop in volume could indicate weakening momentum. However, key metrics now suggest that ALGO’s price may struggle to sustain its upswing in the short term.

Algorand Volume. Source:

Santiment

Algorand Volume. Source:

Santiment

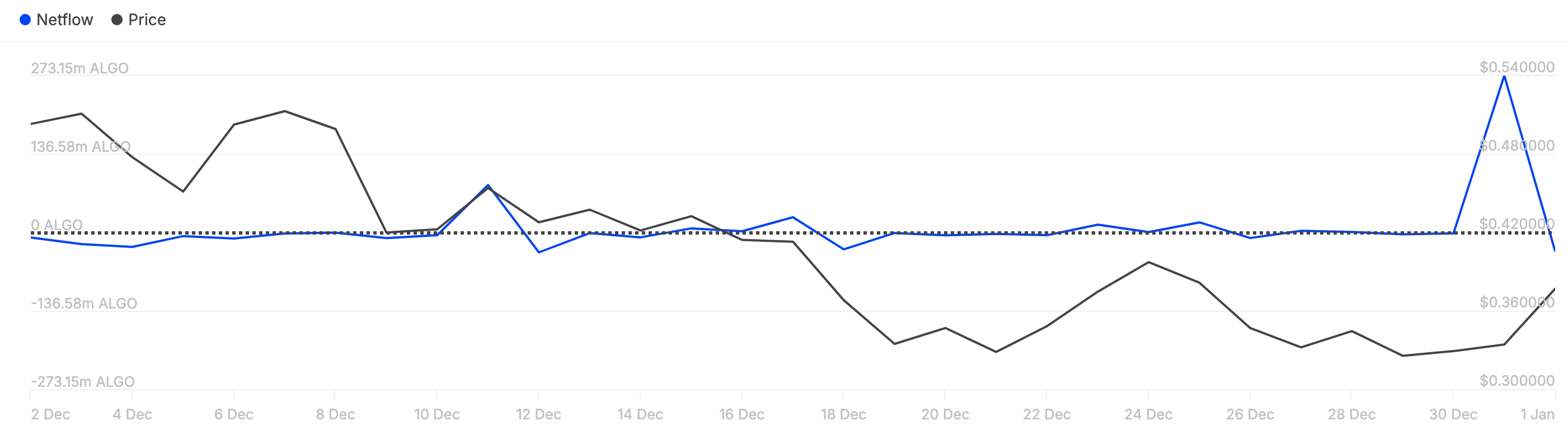

One metric that aligns with this bias is the large holders’ netflow. According to IntoTheBlock data, the netflow, a key metric measuring the balance of buying and selling by addresses holding 0.1% to 1% of Algorand’s circulating supply, has turned negative.

When large holders’ netflow is positive, it indicates that most are accumulating more tokens than they are selling. Conversely, a negative reading signifies distribution, with holders offloading more than they are buying.

This shift indicates these ALGO holders are selling more than buying. If this trend persists, ALGO’s price, currently at $0.40, could face significant downside pressure.

Algorand Large Holders Netflow. Source:

IntoTheBlock

Algorand Large Holders Netflow. Source:

IntoTheBlock

ALGO Price Prediction: Retracement Likely

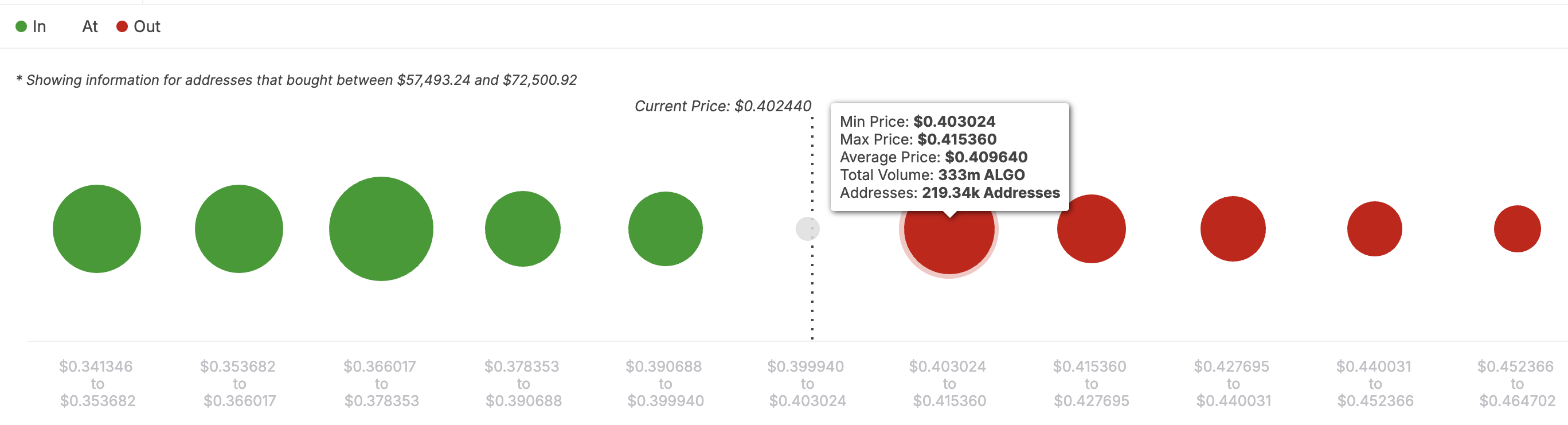

From an on-chain perspective, the In/Out of Money Around Price (IOMAP) shows that ALGO’s price is less likely to trade higher. The IOMAP classified addresses based on those in the money, at the breakeven point, and others out of the money.

Using this data, one can spot support and resistance. Typically, the higher the volume or addresses, the stronger the support or resistance. At press time, 146,530 addresses hold 48.64 million ALGO in the money, purchased at an average price of $0.40.

But at $0.42, 219,340 addresses hold 333 million ALGO and are out of the money. This indicates that Algorand’s price faces significant resistance, which could push it back.

Algorand In/Out of Money Around Price. Source:

IntoTheBlock

Algorand In/Out of Money Around Price. Source:

IntoTheBlock

If this remains the case, ALGO could pull back to $0.35. However, if Algorand trading volume rises with intense accumulation, the value could jump toward $0.50.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!