USDC market cap is up 80% from 2023 lows

From cointelegraph by Alex O'Donnell

The circulating supply of Circle’s United States dollar-backed stablecoin, USD Coin USDC$1.00 , has risen 80% from cyclical lows as onchain activity picks up, according to data from Blockworks Research.

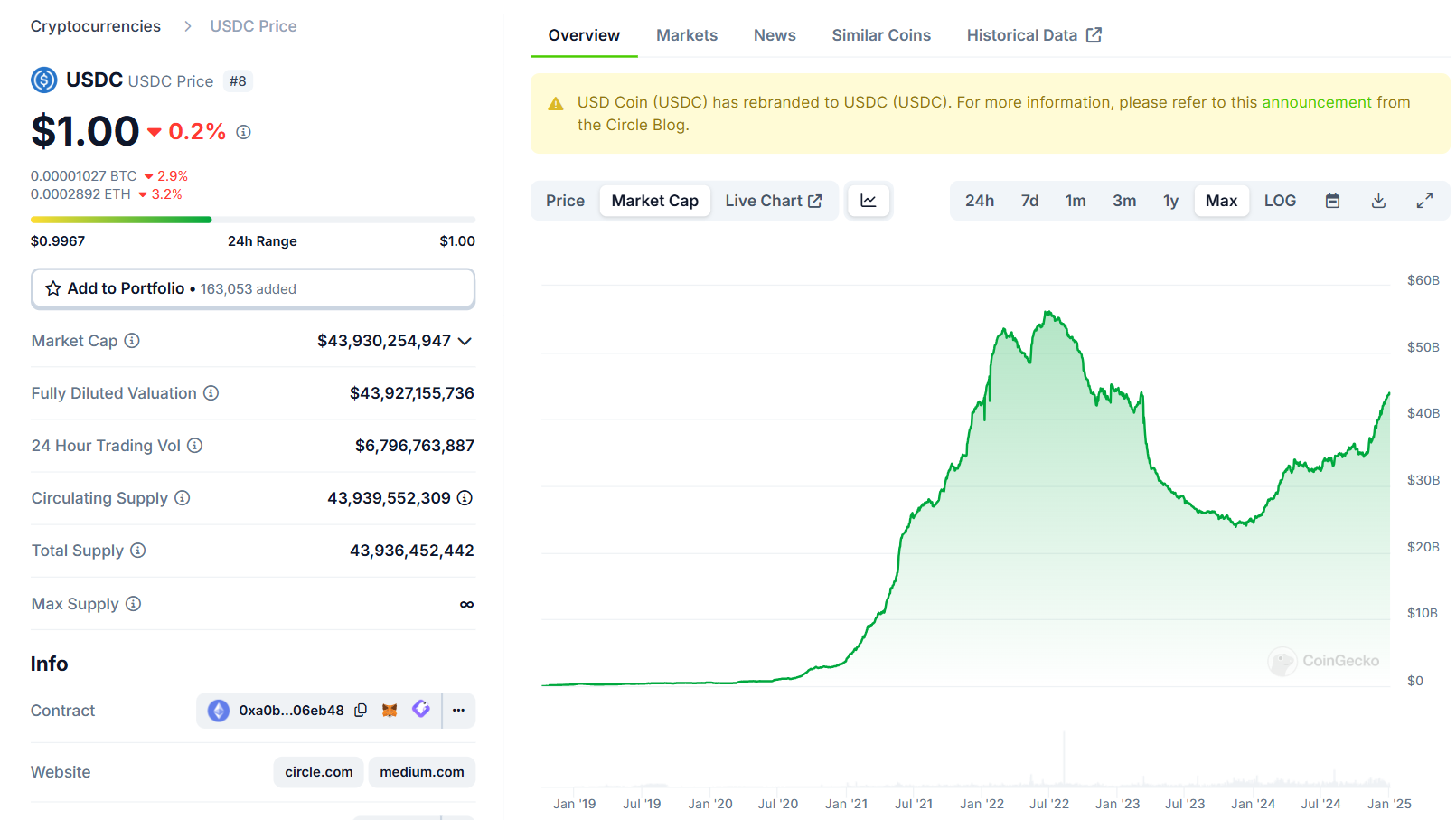

As of Jan. 2, USDC’s circulating supply is approaching $44 billion, nearly double the 2023 low of less than $24 billion, according to CoinGecko.

Meanwhile, holdings are more evenly distributed among blockchain networks as users migrate beyond Ethereum, Blockworks data analytics manager Dan Smith said in a Jan. 2 post on the X platform.

The shift reflects increasing onchain activity and the rise of alternative layer-1 networks such as Solana and Hyperliquid. Analysts expect the trend to continue, with USDC’s market capitalization potentially doubling this year.

Source: Dan Smith

Related: Grayscale adds AI launchpads, Solana DeFi apps to Q1 2025 top tokens

Diversifying networks

As of Jan. 2, approximately 65% of USDC supplies are on Ethereum, 10% are on Solana, and roughly 15% span Base and Arbitrum — both Ethereum layer 2s — as well as Hyperliquid, a layer 1 for low-latency trading.

In 2023, USDC remained heavily concentrated on Ethereum, which held 85% of the stablecoin’s circulating supply, Smith said.

This change is partly because “retail traders increasingly enter the crypto market through Solana [as] speculation intensifies around Solana-based memecoins and AI agent tokens,” Grayscale said in a December research note .

In 2024, the total value locked on Solana surged from around $1.5 billion in January to nearly $8.5 billion by December, according to data from DefiLlama.

Source: CoinGecko

Onboarding users

Stablecoin market capitalizations increased sharply after Donald Trump’s presidential election win in the United States. The combined market capitalizations of the top three stablecoins — Tether’s USDt USDT$0.9991 , USDC, and Dai DAI$1.00 — collectively grew by more than $25 billion, Citi said in a December research note .

cryptocurrency researcher Steno Research expects USDC’s circulating supply to more than double during 2025, reaching highs of around $100 billion.

“This growth hinges on a critical assumption: that Tether, the largest stablecoin, remains unregulated within the European Union,” Steno said, adding:

“If this scenario unfolds, we expect European residents to increasingly adopt USDC as an alternative to Tether’s USDT.”

Accelerating stablecoin adoption is particularly bullish for decentralized finance (DeFi), as “stablecoins are the on-ramp to decentralized finance,” Citi said.

In December, Grayscale added several DeFi applications, including two on Solana, to its list of the top 20 tokens to watch in the first quarter of 2025. They include Ethena, Jupiter and Jito.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!