XRP Traders Double Down on Bullish Bets Despite $40 Million Spot Outflow

XRP traders shrug off $40M spot outflows as bullish bets dominate. With a strong bull flag formation, XRP eyes rallies to $3.25 or beyond.

In the last 24 hours, XRP price has been swinging sideways around $2.40, indicating almost equal strength between bulls and bears. However, XRP traders seem to believe that the token is likely to climb higher.

This sentiment comes amid spot outflows worth millions of dollars. Will the altcoin prevail?

XRP Bulls Remain Unfazed By the Negative Signs

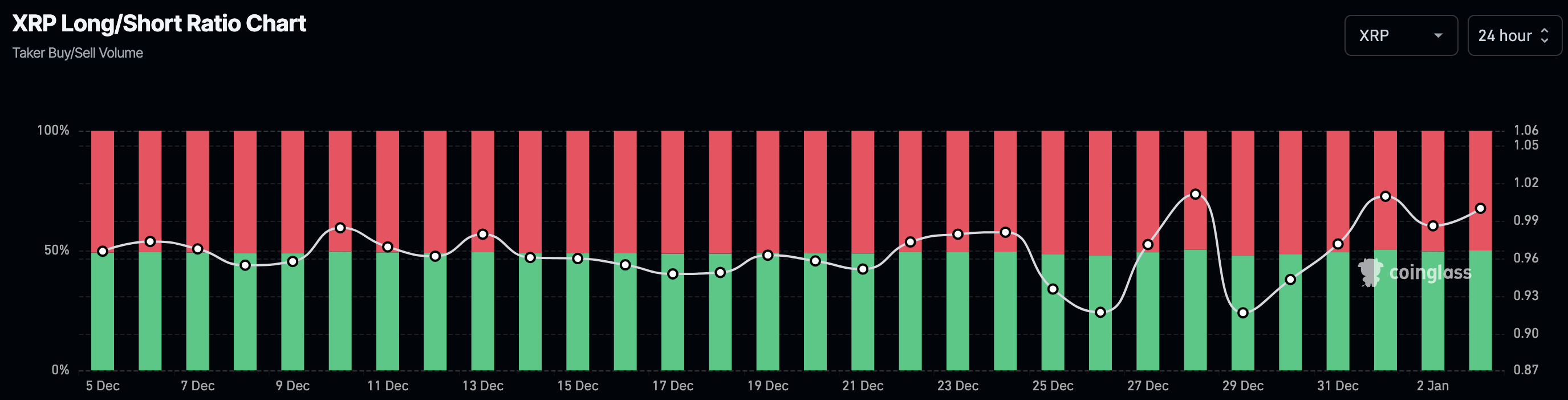

According to Coinglass, the XRP Long/Short ratio has risen above 1. The ratio measures traders’ expectations. When the rating is above 1, it means that there are more long-positioned traders than shorts.

On the other hand, a reading below 1 indicates the dominance of shorts, who are betting on the price to decrease. Therefore, the current ratio tilts toward bullish dominance, suggesting that many traders expect the XRP price to add to its 10% seven-day rally.

Interestingly, this development comes amid a wave of spot outflows. As of this writing, Coinglass data shows a $40 million outflow from the XRP spot market within the last two days.

XRP Long/Short Ratio. Source:

Coinglass

XRP Long/Short Ratio. Source:

Coinglass

Typically, increased spot inflows reflect direct investment in the asset at current market prices, indicating strong bullish sentiment. Such trends often boost demand, potentially applying upward pressure on the altcoin’s price.

However, when the outflow increases, it indicates low demand for the cryptocurrency. If sustained, this could put downward pressure on XRP’s price. But still, as stated above, XRP traders do not expect the altcoin to experience a significant correction.

XRP Spot Inflow/Outflow. Source:

Coinglass

XRP Spot Inflow/Outflow. Source:

Coinglass

XRP Price Prediction: Chart Stays Bullish

On the daily chart, XRP’s price has maintained the bull flag formation. The bull flag, resembling a flag on a pole, is a significant pattern in analysis. It appears after a sharp upward price movement and signals the potential for another strong rally.

Typically, this pattern acts as a bullish continuation, anticipating further price increases driven by sustained trading volume. Therefore, if XRP sees an increase in buying pressure and its volume continues to rise, the price might rally to $3.25.

XRP Daily Analysis. Source:

TradingView

XRP Daily Analysis. Source:

TradingView

Should the altcoin see an intensified wave of demand, this target could be higher, and XRP’s price might trade above $4. However, a drop below the flag’s lower trendline could invalidate this prediction. If that happens, XRP might sink to $1.40.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!