Ethena Unveils 2025 Roadmap with Telegram Payments App and TradFi Adoption

Ethena's 2025 roadmap introduces a Telegram payments app, iUSDe launch, and expanded stablecoin products, driving innovation in DeFi.

Ethena Labs unveiled its 2025 roadmap on January 3, introducing a Telegram-based payment and savings application leveraging its sUSDe stablecoin.

The platform aims to deliver a streamlined neobank experience directly through Telegram.

Ethena’s Roadmap Outlines Ambitious Plans for TradFi Adoption

According to the roadmap, the Telegram app will allow users to send, spend, and save sUSDe directly within the messaging platform. The app will also integrate with Apple Pay, allowing seamless transitions between sUSDe savings and mobile payments.

Also, Ethena’s roadmap outlined its strategy to compete with Tether by transforming from a single-asset issuer into Ethena Network, a platform designed for on-chain financial innovation.

“Rather than compete directly with payments companies on their own turf, we plan to address the payments and savings tool use case via building a dedicated application on Telegram and within the TON ecosystem,” Ethena Labs wrote.

As part of this transformation, the blockchain platform plans to launch iUSDe in February. iUSDe will be built on Ethena’s synthetic dollar, sUSDe. It will incorporate token-level transfer restrictions through a “simple wrapper contract.”

A key priority for the first quarter of 2025 is partnering with traditional finance institutions to distribute iUSDe to their clients. Ethena intends to announce these collaborations by the end of January.

Remarkable Growth Backed by Strong Partnerships

Ethena achieved remarkable growth in the crypto sector, becoming the second-fastest protocol to surpass $100 million in revenue. The network reached the milestone in just 251 days.

This placed it behind the Solana meme coin platform Pump.fun, which hit the same figure in 217 days.

In 2024, Ethena introduced significant advancements, including the December launch of USDtb, a stablecoin backed 90% by BlackRock’s BUIDL fund.

Unlike USDe, USDtb features a cash-equivalent reserve model. It offers scalable and unrestricted transfers to enhance market stability.

The company also partnered with Trump-backed World Liberty Financial (WLFI), linked to a governance proposal under review. If approved, sUSDe, a staked version of USDe, will serve as a core collateral asset on WLFI’s Aave instance.

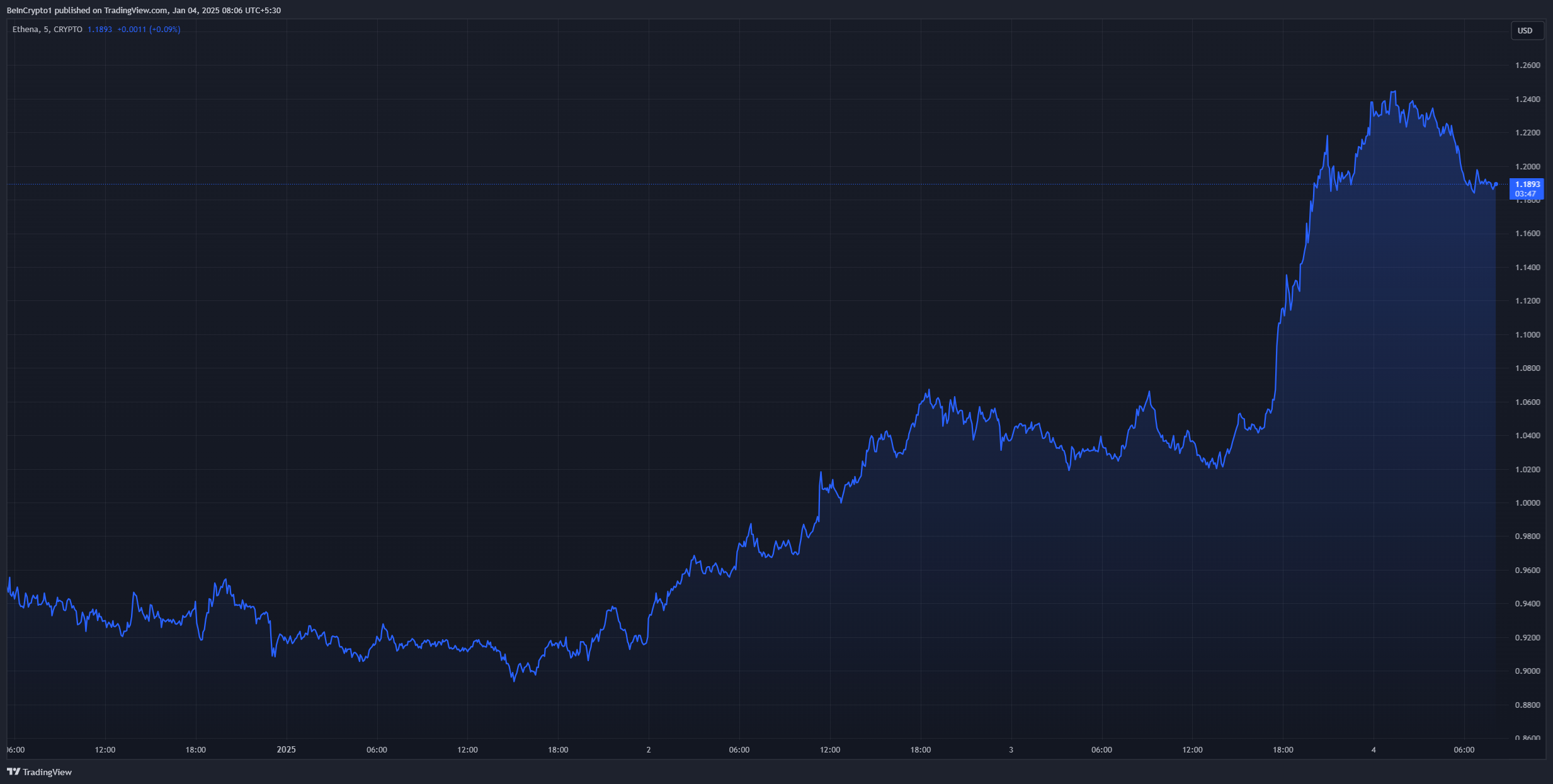

Also, Ethena’s native token, ENA, has seen a sharp rally since December. The altcoin climbed 33% over the past week, including a 15% surge following the roadmap announcement.

Ethena ENA Weekly Price Chart. Source:

TradingView

Ethena ENA Weekly Price Chart. Source:

TradingView

The roadmap also hinted at several stablecoin-powered products set for release this quarter, including perpetual products, prediction markets, gamble finance platforms, and undercollateralized lending.

These developments align with Ethena’s focus on expanding its presence within the decentralized financial ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!