-

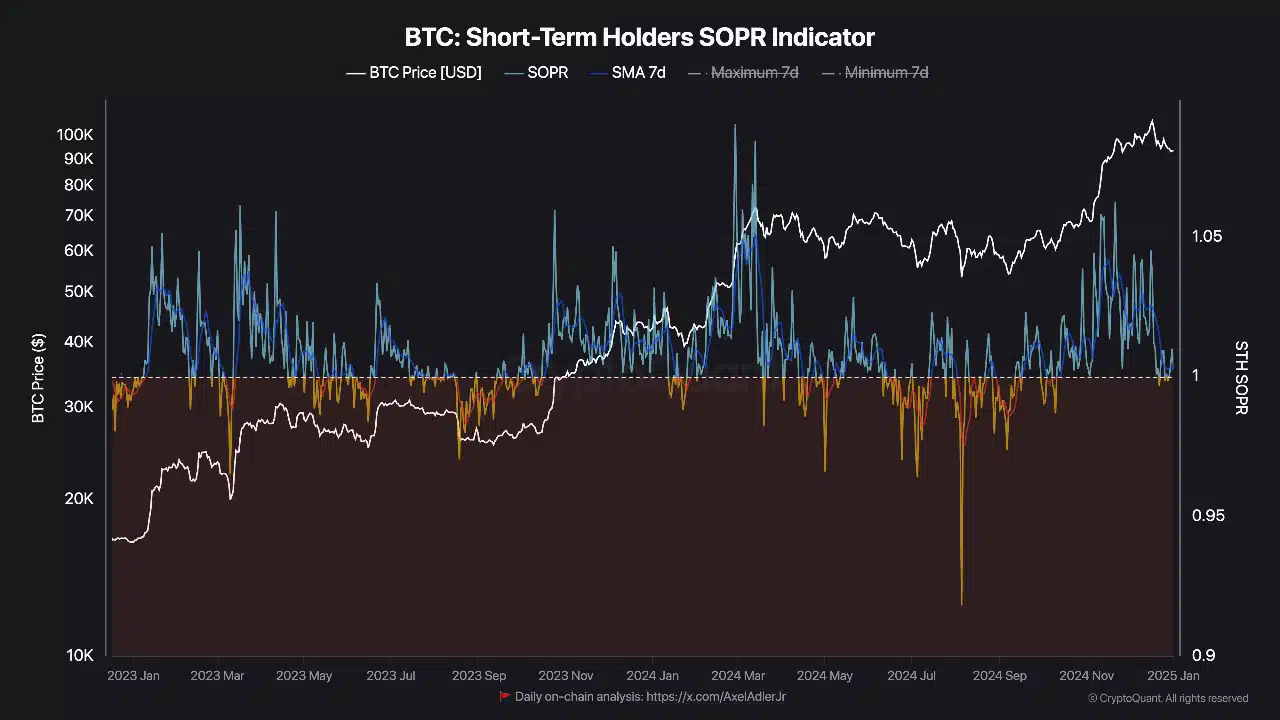

Bitcoin faces potential consolidation or deeper correction as its Short-Term Holder Spent Output Profit Ratio (STH SOPR) declines, signaling investor hesitance.

-

Key support is currently observed at $85,000, while resistance stands at $99,000, essential levels for predicting Bitcoin’s next significant movements.

-

According to market analysts, “The falling STH SOPR indicates the market is at a critical transition, with a move below the support level likely to trigger further declines.”

Bitcoin’s STH SOPR decline raises concerns about potential price corrections, with crucial support and resistance levels to watch in the coming trading sessions.

Trends in STH SOPR and Market Dynamics

Source: Cryptoquant

As of the latest analysis, Bitcoin’s STH SOPR is fluctuating around the neutral mark of 1, indicating a balance between short-term profits and losses. This position suggests a significant shift from the bullish enthusiasm noted during Bitcoin’s recent surge to $108,000. Neutral SOPR metrics are typically indicative of consolidation or potential price corrections within the market.

Moreover, the ongoing transition of Bitcoin from Long-Term to Short-Term Holders is a classic sign that often accompanies local price peaks. If the STH SOPR continues on a downward trajectory, heightened selling pressure can be expected particularly near the pivotal price points of $85,000 and $99,000.

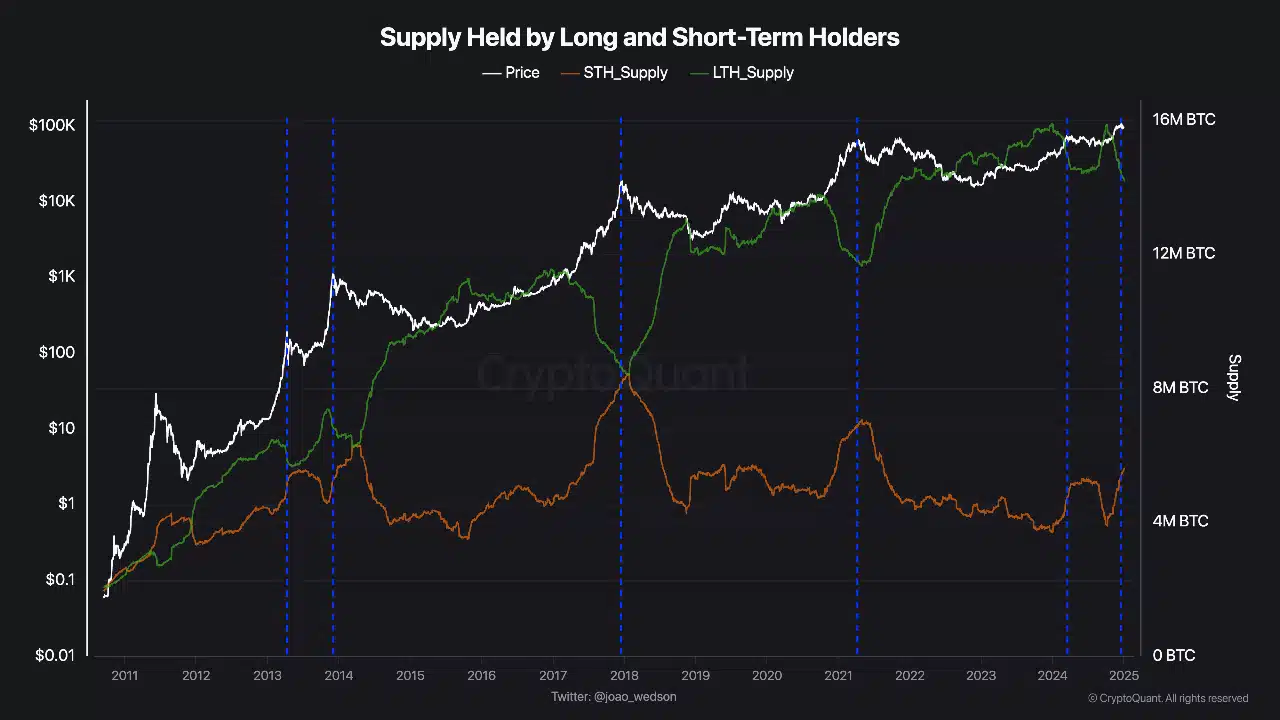

Bitcoin: Supply Dynamics and Market Behavior

Source: Cryptoquant

The interplay between Long-Term and Short-Term Holders is critical in dictating Bitcoin’s price movements. Recent increases in STH supplies have often signified market tops, thereby contributing to higher volatility levels. The current neutral positioning of the STH SOPR exhibits the presence of selling pressure at breakeven points—this is fostering a climate of investor hesitation.

Resistance within the $85,000 to $99,000 range further reinforces the notion of either consolidation or cautious accumulation strategies among investors, with prospects of escalated volatility in the short term.

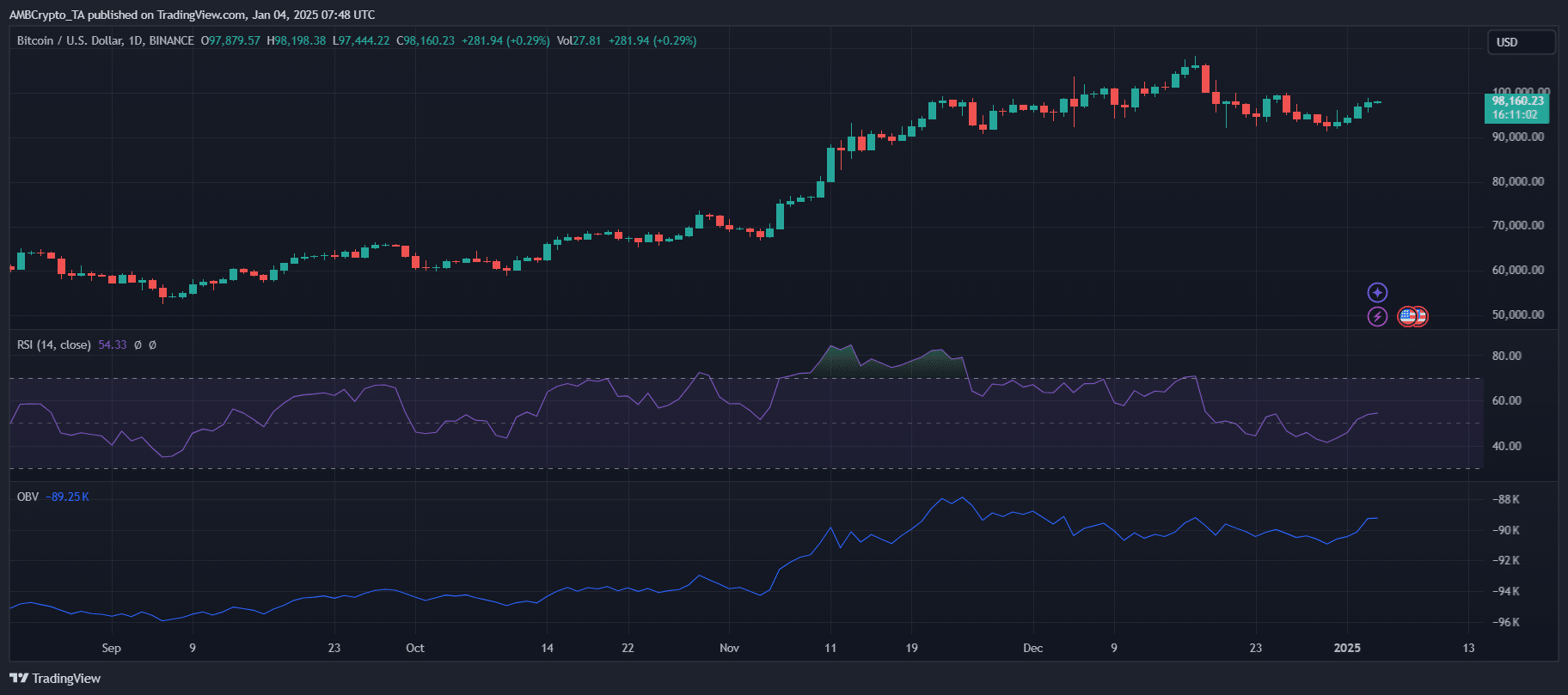

The Way Forward

Source: TradingView

Bitcoin’s current STH SOPR trends suggest the market is navigating a critical phase in sentiment analysis. Investors must closely observe the defined support level at $85,000 and the resistance bracket at $99,000 as indicators for forthcoming market movements.

A potential break below the $85,000 threshold could invoke further selling pressure, while a rebound beyond the $99,000 mark might signal a renaissance in bullish sentiment. As the market finds its footing in this consolidation phase, prudent investors might consider gradual accumulation, but should remain vigilant for indications of possible volatility shifts.

Conclusion

In summary, the trajectory of Bitcoin’s STH SOPR is indicative of an evolving market sentiment that necessitates careful monitoring. Investors should be aware of the critical price levels to navigate upcoming market decisions. Fostering a disciplined approach amidst fluctuations will be vital for capitalizing on Bitcoin’s price movements, offering attentiveness to the overarching patterns before making significant trades.