Bernstein: The encryption industry enters the "infinite era", with a target price of $200,000 for Bitcoin by 2025

According to The Block, Bernstein analysts have released ten predictions for the crypto industry in 2025, reiterating a Bitcoin price target of $200,000 and pointing out that the stablecoin market size will break through $500 billion. Net inflows into spot Bitcoin ETFs are expected to exceed $70 billion, and the integration of crypto with artificial intelligence will deepen further.

Bernstein refers to 2025 as the beginning of an "infinite era", considering it a long-term period where cryptocurrency technology continuously evolves and is widely accepted. Analyst Gautam Chhugani stated that the crypto industry will gradually move away from cyclical fluctuations, integrate into the financial system and become an important part of the intelligent era. The report predicts that US spot Bitcoin ETFs will attract over $70 billion in net inflows as institutional adoption rates rise rapidly; ETF investment holdings are projected to increase from 22% in 2024 to 40%. Meanwhile, capital expansion plans by MicroStrategy and Bitcoin miners are expected to drive corporate finance adoption scale up to $50 billion by 2025. In addition, Bernstein expects innovations such as decentralized AI blockchains, AI-integrated crypto wallets and verification services based on "human authentication" due to fusion between AI and crypto industries; Bitcoin miners would increasingly turn towards AI for optimizing business models attracting wider institutional investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South African fast food chain WIMPY now supports Bitcoin payments at 450 locations

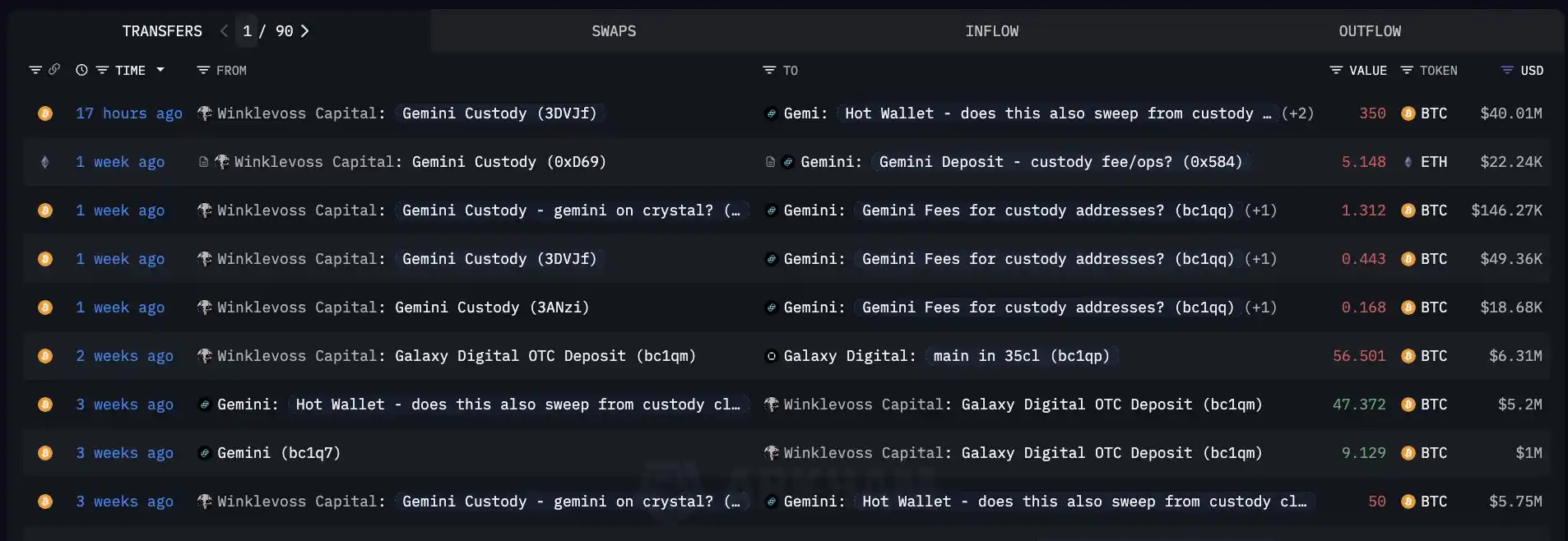

Before the exchange's listing, Winklevoss Capital transferred 350 BTC from the exchange's Custody address.

Bitcoin Core releases v30.0rc1 version, now open for testing

MoonPay launches MoonTags feature, allowing users to send and receive cryptocurrencies via personalized identifiers.