JPMorgan Chase Predicts XRP, Solana ETFs Will Attract up to $8,000,000,000 Each: Report

JPMorgan Chase expects that potential Solana ( SOL ) and XRP exchange-traded funds (ETFs) could see multi-billion dollar inflows.

VanEck’s head of digital asset research Matthew Sigel reports on the social media platform X that JPMorgan says SOL and XRP ETFs could attract up to $16 billion in total.

“SOL XRP exchange-traded products (ETPs) Could Attract $3-8bn Each: JPM

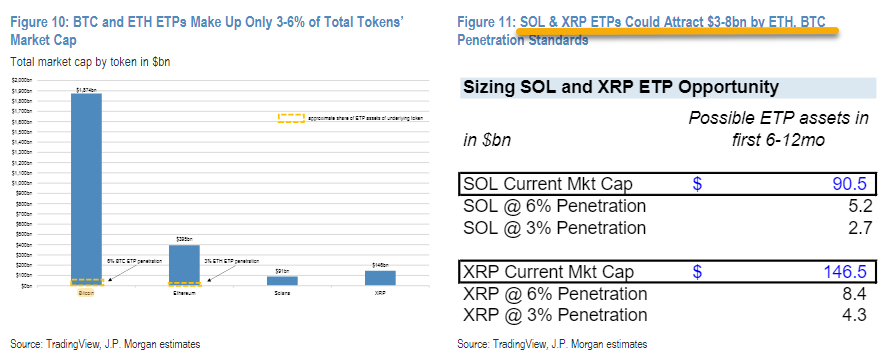

ETP assets ($108bn) make up 6% of the total Bitcoin market cap ($1,874bn) after the ETPs’ first year of trading; likewise, ether ETP assets ($12bn) have a 3% penetration rate of the total Ethereum market cap ($395bn) within its first 6 months since launch.

When applying these so-called “adoption rates” to SOL and XRP, we see SOL attracting roughly $3-6bn of new net assets and XRP gathering $4-8bn in net new assets.”

Source: Matthew Sigel/X

Source: Matthew Sigel/X

Last year , the chief executive of VanEck said that a Solana ETF could only be possible if the Republicans won the US Presidential Election.

And last winter , Ripple CEO Brad Garlinghouse said it “makes sense” for an XRP ETF to eventually be approved.

“I think it makes sense that there will be other ETFs. It’s sort of like the earliest days of the stock market – you don’t really want exposure to one stock, or one company, you want to typically think about diversifying risk and what have you. I think we will see other [crypto] ETFs.

When we will see them is hard to predict. The sad reality of what we saw with the Bitcoin ETF is [it happened] only because the courts forced the SEC’s hand, and really [SEC Chair] Gary Gensler’s hand.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Redshinestudio/Sensvector

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!