Aiccelerate DAO: The 2025 First Major Crypto Flop

A Promising Start Turns Sour

In the world of decentralized finance (DeFi) , new projects often capture the community's attention with their bold visions. Aiccelerate DAO , a venture focused on merging cryptocurrency and artificial intelligence (AI), was no different.

Aiccelerate DAO Crypto x AI

Aiccelerate DAO Crypto x AI

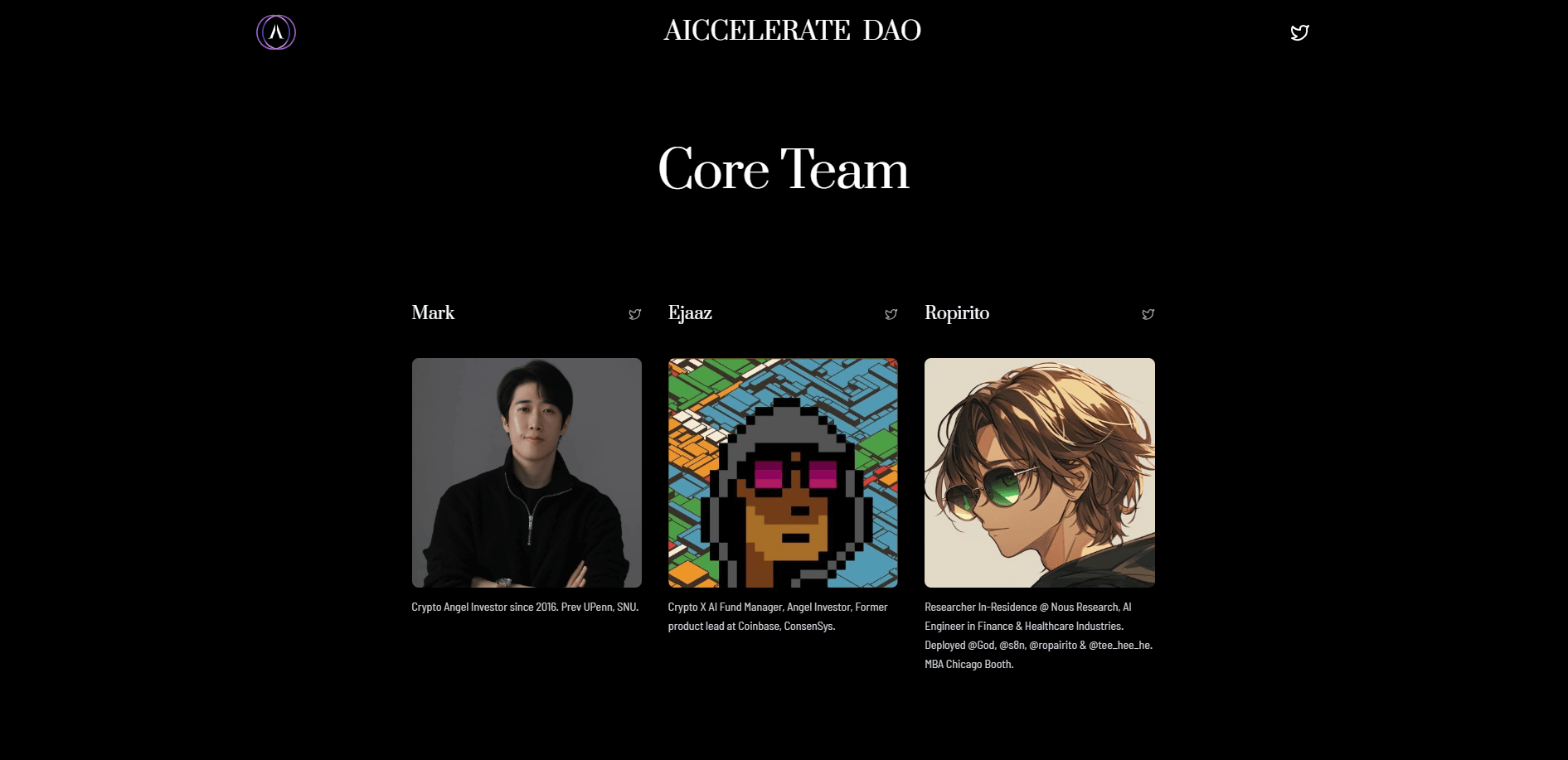

Boasting high-profile founders: Mark (@markus9x) , Ejaaz (@cryptopunk7213) , and Ropirito (@ropirito) .

Aiccelerate DAO Team

Aiccelerate DAO Team

And with over 150 advisors, including influencers from Bankless , ai16z and more, the project launched with great fanfare.

Aiccelerate DAO Members Source

Aiccelerate DAO Members Source

However, within days, Aiccelerate DAO became infamous as the first major crypto flop of 2025. What went wrong, and what lessons can investors take away from this debacle?

Aiccelerate DAO: The First Big Rug of 2025

1- Aiccelerate DAO Vision: Crypto x AI

Aiccelerate DAO was designed to revolutionize decentralized AI by funding and accelerating promising projects. The initiative attracted top-tier talent and significant interest, setting it apart as a potential game-changer. However, the project’s downfall wasn’t due to its vision but its execution.

2- What caused the Aiccelerate DAO downfall?

The root cause of Aiccelerate DAO downfall was the flawed launch of its $AICC token . Unlike most projects, Aiccelerate neglected to implement basic safeguards, such as:

- Token Lock-Up Periods: Ensures that early investors and insiders cannot immediately sell their holdings.

- Liquidity Provider Plans: Maintains token stability post-launch.

Without these measures, early contributors were free to sell their tokens as soon as the project launched, resulting in a sharp price decline and leaving retail investors in the lurch.

By CoinMarketCap - AICCUSD_2025-01-14

By CoinMarketCap - AICCUSD_2025-01-14

3- $AICC Token Crash: What happened?

After the public launch on January 11, 2025, the $AICC token experienced a near-instantaneous crash. Early investors reportedly made 1000x returns, while retail investors faced significant losses. Despite the backlash, the founders claimed the rollout was not malicious but rather a result of rushed decision-making.

4- Community Response and Damage Control

The Aiccelerate team has since acknowledged the mistakes and announced plans to restructure their tokenomics, including the introduction of vesting periods. However, the damage to their reputation and the financial impact on their community will not be easily reversed.

Key Lessons for DeFi Investors

Aiccelerate DAO’s story serves as a cautionary tale for DeFi participants. Here are the key takeaways:

- Conduct Thorough Due Diligence: Investigate the project's tokenomics, governance structure, and safeguards before investing.

- Beware of Rushed Launches: Rapid rollouts often overlook critical details, increasing risk.

- Understand the Risks of Decentralization: While revolutionary, decentralized systems lack many of the protections found in traditional finance.

A Wake-Up Call for DeFi

The downfall of Aiccelerate DAO highlights the volatility and risks inherent in the DeFi space. As the ecosystem grows, so does the need for robust governance and investor education. While Aiccelerate’s intentions may not have been malicious, their oversights underscore the importance of meticulous planning and transparency in project launches.

Investors must remain vigilant, ensuring they understand the risks before diving into the next big thing in DeFi.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK

[Initial listing] Bitget to list Cysic (CYS) in the Innovation zone