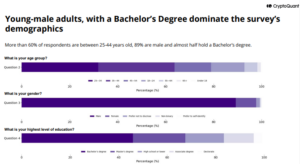

The survey , released on January 15th, 2024, revealed that over 60% of crypto investors are aged between 25 and 44.

The majority of these crypto investors fall into the younger, educated, and financially cautious category. This paints a picture of a market driven by young, savvy investors who are still dipping their toes into the crypto waters, investing under $10,000 annually.

Young, Educated, and Under $10K

According to CryptoQuant’s “2024 Crypto Survey: Exchange Use and Investor Behavior,” the age breakdown shows that 35% of crypto investors are between 25 to 34 years old, while 26% fall within the 35 to 44 range. Education is also a key factor, with nearly half of the respondents holding a bachelor’s degree, and 28% possessing advanced degrees.

However, despite their educational backgrounds, the survey reveals that most investors are still taking a conservative approach, with most investing less than $10,000 annually. This highlights the fact that retail investors—who are more cautious with their funds—dominate the crypto market.

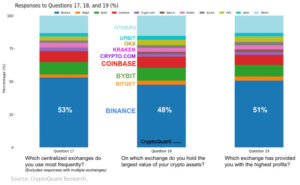

Binance Dominates the Market

Binance stands out as the go-to platform for many crypto investors, with 53% of participants using it as their primary exchange. It also ranks the highest in profitability, with 51% of users reporting that their largest gains came from Binance.

The exchange is particularly popular in Asia, Africa, and South America, where usage rates top 50%. In North America, however, Coinbase takes the lead, with 45% of respondents citing it as their primary exchange.

Investor Behavior and Preferences

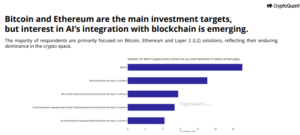

The survey also delves into the behavior of crypto investors when making decisions. Around 22% of respondents rely on their research, while 16% follow social media influencers or key opinion leaders. Interestingly, recommendations from friends, communities, or media outlets have a smaller impact on decision-making.

When it comes to trading, 76% of investors prefer spot trading over derivatives or staking. Only 28% of investors engage in products like staking and yield farming.

The survey also reveals that 83% of respondents are cautious about exchanges with regulatory issues, with Binance being viewed as the most compliant by 32% of investors, followed by Coinbase at 14%.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted risk tolerance levels of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses you may incur due to any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.