XRP options data suggests bullish sentiment says Nansen analyst, as market cap nears $200 billion

XRP derivatives activity is surging, with a rising interest in call options implying a bullish sentiment.XRP futures open interest has surged since Monday to hit an all-time high, signaling heightened market anticipation, according to Coinglass data.

Derivatives activity around XRP has surged alongside the cryptocurrency's price rally, with key metrics pointing to growing bullish sentiment, according to an analyst.

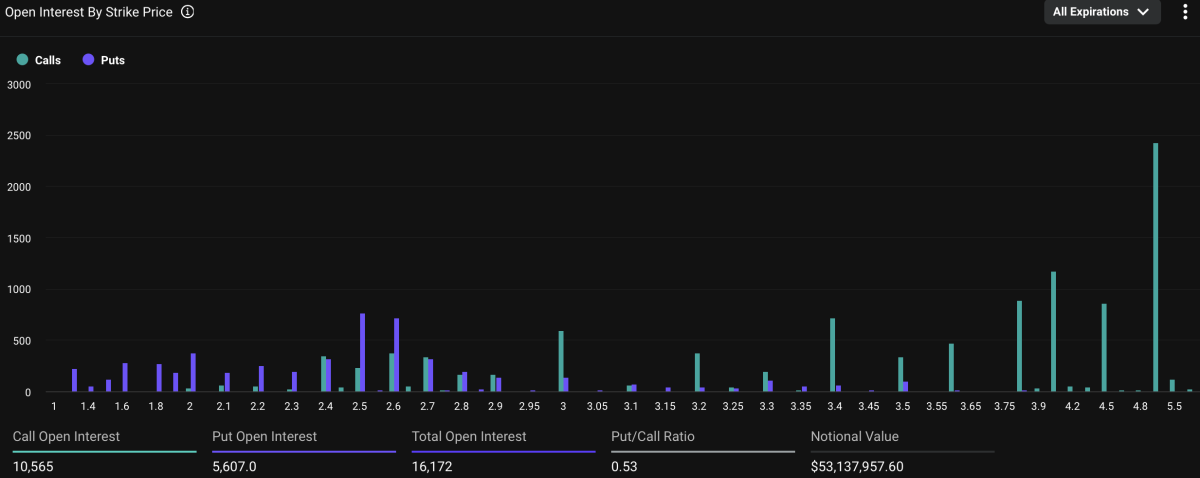

"Looking purely at XRP options data, there is a larger interest in calls as opposed to puts, indicating bullish sentiment," Nansen Research Analyst Nicolai Sondergaard told The Block. "The put-call ratio is likewise below 1, further proving the higher interest in calls."

In derivatives trading, a call option gives the buyer the right, but not the obligation, to buy the underlying asset at a specified price before or on a specified expiration date. A put option is similar but for selling assets instead.

Sondergaard emphasized that the put-call ratio has increased over the past day, indicating that traders are increasingly hedging their long positions with put options.

Open interest of XRP options for all expirations shows a concentration around the $5 strike price. Image: Deribit.

XRP futures open interest on major crypto derivatives exchanges has continued to hit new record highs since midweek. Open interest represents the total number of unsettled futures contracts and often signals heightened market anticipation of significant price movements.

The open interest has grown 46% since Monday to reach an all-time high of $7.6 billion, according to Coinglass data . This marks the highest level of open interest recorded by the analytics firm.

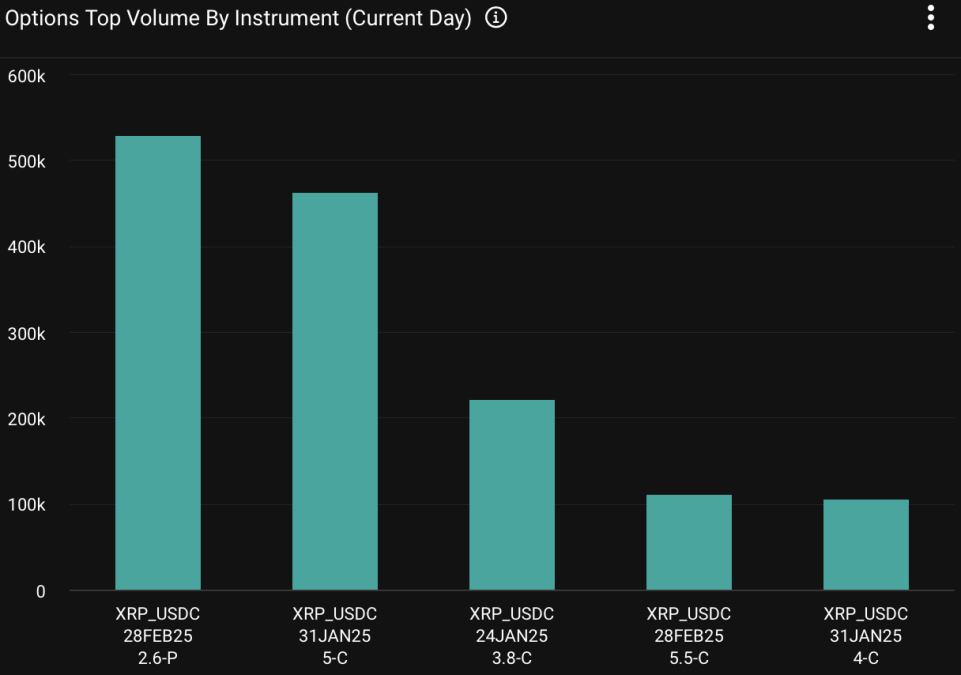

XRP options top volume by instrument shows traders are hedging with puts for the end-of-February expiry. Image: Deribit.

Despite the bullish signals in derivatives metrics, the price of XRP has experienced notable volatility in the past 24 hours. Total liquidations of XRP positions reached $31 million, comprising $16 million in long positions and $15 million in short positions, according to Coinglass data . The near-equal split between long and short liquidations reflects a market in flux, where traders are reacting to rapid price movements in both directions.

Anticipation surrounding the possibility of a spot XRP ETF

Unity Wallet Chief Operating Officer James Toledano emphasized the role of anticipated regulatory clarity in XRP’s recent breakout.

“XRP’s momentum reflects growing optimism around potential regulatory clarity and the possible approval of an XRP ETF in the coming months," Toledano told The Block. "If approved, an XRP ETF could attract significant institutional capital, propelling the asset to new heights in 2025."

However, Toledano added a cautionary note about altcoin volatility. "While an XRP ETF could open the floodgates of capital inflow, real, long-term success will depend on adoption within real-world payment networks and broader market conditions," Toledano said. "Altcoins often experience episodic interest, unlike Bitcoin, which benefits from its established status as 'digital gold.'"

The idea of a spot XRP ETF has gained significant traction, bolstered by anticipation surrounding Trump administration policies. Companies such as Bitwise, Canary Capital, WisdomTree, and 21Shares have already filed applications with the U.S. SEC for a spot XRP ETF. On Polymarket , users predict a 67% chance of the SEC approving a spot XRP ETF in 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!