XRP Outflows Top $70 Million Amid Profit-Taking Trend

XRP faces a critical juncture as profit-taking drives $74M in outflows. Declining trading volume hints at a weakening rally, raising reversal risks.

Ripple’s XRP has witnessed a remarkable surge recently, climbing to a new all-time high of $3.41 on January 16. However, this rally has triggered a wave of profit-taking among traders, which now threatens the sustainability of its recent gains.

With mounting selloffs, XRP is poised to reverse the current trend.

Ripple Rally Not Backed By High Demand

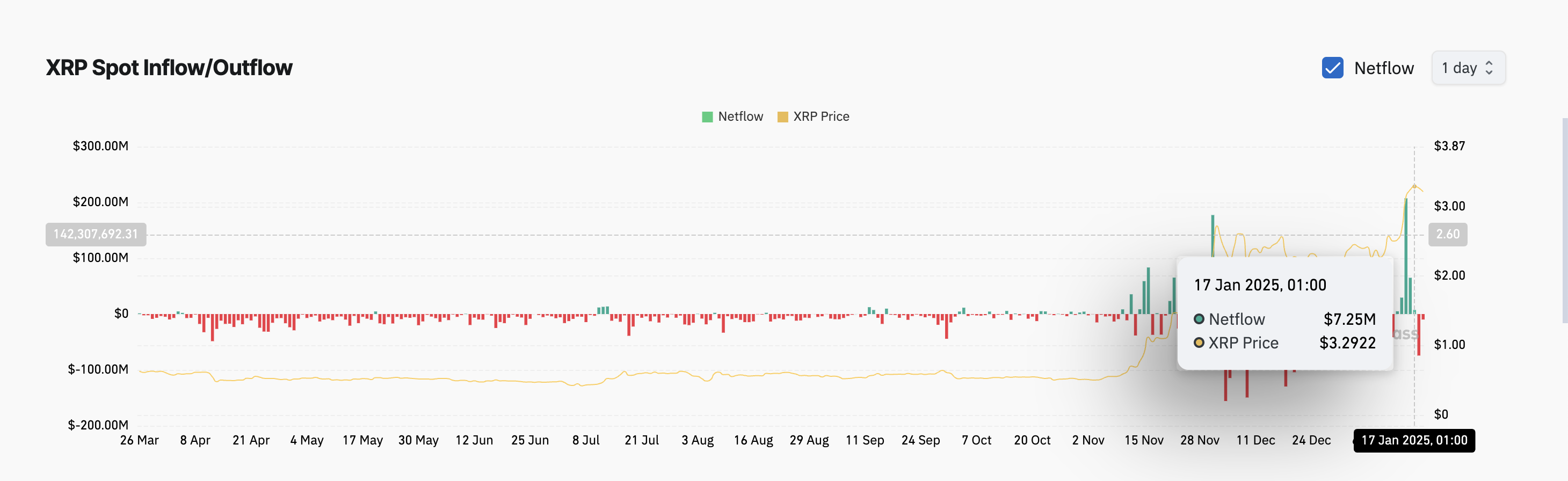

During Saturday’s trading session, outflows from XRP’s spot markets totaled $74 million. This represents its single-day highest capital outflow in the past 30 days. This follows a profit-taking trend that began after the altcoin reached an all-time high on January 16.

When an asset experiences spot outflows, it suggests that investors may be selling or withdrawing the asset. This indicates caution or a lack of confidence, as some participants might be taking profits or moving assets elsewhere.

Large spot outflows like XRP’s can put downward pressure on an asset’s price as more sellers enter the market. This can create a negative feedback loop, leading to further selling and a steeper price decline.

XRP Spot Inflow/Outflow. Source:

Coinglass

XRP Spot Inflow/Outflow. Source:

Coinglass

Moreover, XRP’s declining daily trading volume confirms the surge in selloffs. Over the past 24 hours, the token’s price has climbed by 2%. However, its trading volume plunged 26% during the same period, creating a negative divergence.

This negative divergence is formed when an asset’s price rallies while its trading volume plummets. It indicates the weakening of the uptrend, as the price increase lacks broad market participation.

XRP Price and Trading Volume. Source:

Santiment

XRP Price and Trading Volume. Source:

Santiment

This divergence suggests that XRP’s rally in the past 24 hours may not be sustainable and could be followed by a reversal or consolidation.

XRP Price Prediction: One of Two Things

At press time, XRP trades at $3.19. If selloffs continue, the token’s price will fall further from its all-time high of $3.41 to trade at support at $2.45.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, if it sustains its current uptrend, it will revisit its all-time high and rally past it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!