Date: Tue, Jan 21, 2025, 06:11 PM GMT

In the cryptocurrency market today, after a period of significant volatility following recent political developments, Bitcoin (BTC) has shown a strong recovery with a 2% bounce and is now trading above $106K.

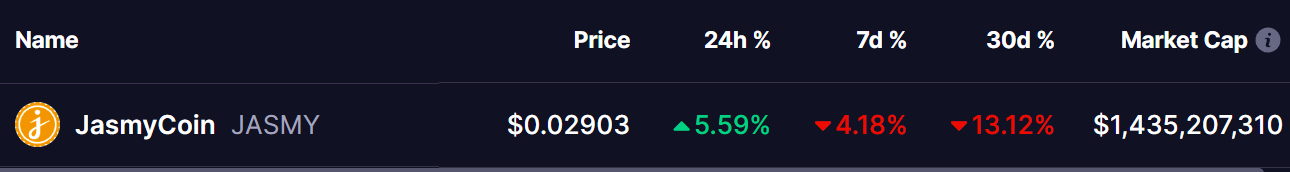

Following Bitcoin’s lead, altcoins are also turning green, including JasmyCoin (JASMY), which recently underwent substantial corrections but is now showing signs of a rebound.

Source: Coinmarketcap

Source: Coinmarketcap

JasmyCoin Holds 200MA Support

JASMY recently experienced a sharp decline, with its price dropping to a low of $0.02580. However, the 200-day Moving Average (200MA) acted as a reliable support level, helping the token bounce back to its current level of $0.029. This rebound from the 200MA is a promising sign for traders, as it often indicates the potential for a price recovery.

JasmyCoin (JASMY) Chart/ Source: @cryptofrontio (X)

JasmyCoin (JASMY) Chart/ Source: @cryptofrontio (X)

According to insights shared by crypto trader @CryptoFrontio , JASMY encountered a similar situation in January 2024. At that time, the price found support at the 200MA and subsequently skyrocketed by over 900% in the following months. If the current setup mirrors last year’s performance, JASMY could be gearing up for another substantial rally.

The next potential target for JASMY lies near its December 2024 high of $0.0059, representing a significant upside if the bullish momentum persists. While the market remains cautious, the historical strength of the 200MA as a support level adds to the optimism surrounding JASMY’s near-term prospects.

What to Watch

As JASMY trades above the 200MA, traders and investors are closely monitoring its price action for further confirmation of a breakout. The 200MA support level has historically been a key indicator of bullish reversals, and if JASMY can sustain its momentum, it could attract renewed buying interest, driving the price higher.

However, it’s important to keep an eye on broader market conditions and any resistance levels that could slow down the rally. For now, JASMY’s ability to hold above the 200MA makes it a token to watch in the coming weeks.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrencies.