Solana's 24-hour on-chain trading volume hits a historic high, ETF review period opens simultaneously

西格玛学长2025/01/26 05:59

On January 25th, Solana made significant progress in both on-chain trading volume and traditional finance. According to the latest data from SolanaFloor, the 24-hour trading volume on the Solana chain reached $1.322 billion, accounting for 52.04% of the total market trading volume, surpassing the total trading volume of all other blockchains and ranking first. Ethereum ranked second with a 24-hour trading volume of $4.37 billion, accounting for 12.11%. Binance Smart Chain (BSC) and Arbitrum followed. Solana's outstanding performance further proves its advantages as a high-performance blockchain, and its transaction speed and low cost have attracted more and more developers and users.

Meanwhile, Solana has also received good news in the traditional financial sector. Solana ETF applications submitted by several well-known financial institutions, including VanEck, 21Shares, Canary, and Bitwise, have entered their first review period. It is reported that these applications are based on the 19b-4 application process officially accepted by the SEC on November 21, 2024. According to regulations, the SEC needs to make the first round of rulings within 45 days, which may be approved, rejected, or postponed. Market analysis believes that the SEC tends to handle these ETF applications in a unified manner, which means that Solana is gradually entering a broader traditional financial market.

From the explosion of on-chain data to the potential approval of ETFs, Solana is demonstrating cross-domain competitiveness from blockchain ecology to mainstream finance.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

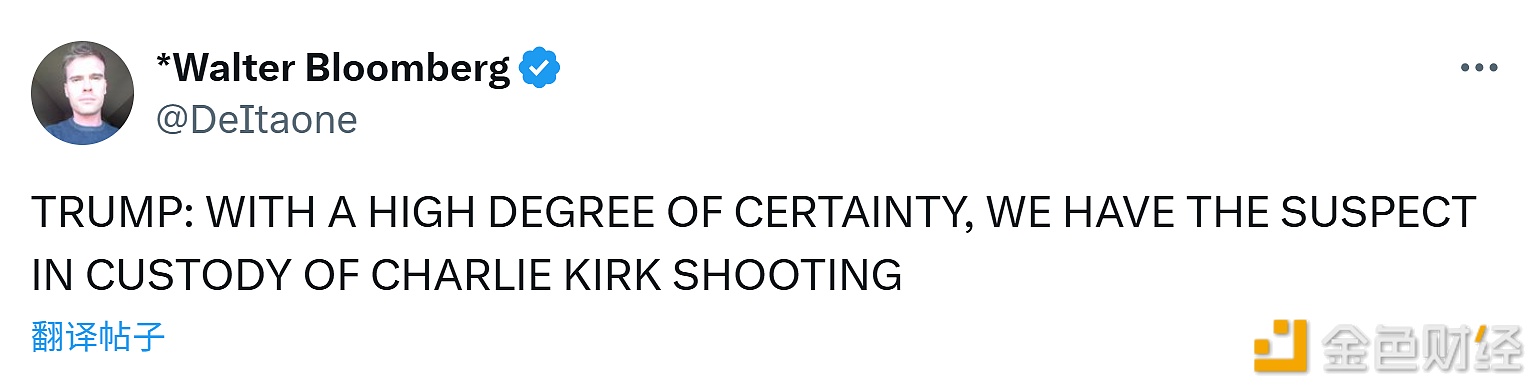

Trump: Suspect in the attempted assassination of Charlie Kirk has been detained

金色财经•2025/09/12 12:19

Fidelity: Data Indicates Bitcoin May Be Entering a Mature Phase Surpassing High-Risk Assets

Chaincatcher•2025/09/12 12:09

Moody's: Due to uncertainty, the Bank of Japan will continue to stand pat

金色财经•2025/09/12 12:08

Analyst: Fed rate cuts will lead to continued weakness of the US dollar

Chaincatcher•2025/09/12 11:50

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$114,854.55

+0.59%

Ethereum

ETH

$4,510.94

+1.34%

XRP

XRP

$3.03

+0.39%

Tether USDt

USDT

$1

-0.00%

Solana

SOL

$237.86

+4.48%

BNB

BNB

$905.18

+0.68%

USDC

USDC

$0.9996

-0.01%

Dogecoin

DOGE

$0.2592

+3.11%

TRON

TRX

$0.3483

+0.30%

Cardano

ADA

$0.8849

-0.43%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now