Tether's USDT stablecoin returns to Bitcoin with Lightning Labs partnership

Quick Take The integration is supported by Taproot Assets, a network that enables interoperability between stablecoins and other assets on the Bitcoin network. The move follows numerous other USDT expansions onto other networks, such as Celo, The Open Network (TON) and Aptos.

Stablecoin issuer Tether plans to bring its token USDT onto the Bitcoin base layer and Layer 2 protocol Lightning Network.

The integration is supported by Taproot Assets , a network that enables interoperability between stablecoins and other assets on the Bitcoin network. Taproots Assets is developed by Lightning Labs, the same firm developing the Bitcoin-based payments protocol Lightning Network .

“By enabling USDT on the Lightning Network, we are not only reinforcing Bitcoin’s foundational principles of decentralization and security but also creating practical solutions for remittances, payments and other financial applications that demand both speed and reliability," Tether CEO Paolo Ardoino told the The Block.

The move follows numerous other USDT expansions to other networks, such as Celo , The Open Network ( TON ) and Aptos . Tether has become increasingly focused on Bitcoin with Paolo Ardoino serving as chief executive, including adding the asset to its balance sheet and opening mining operations in El Salvador.

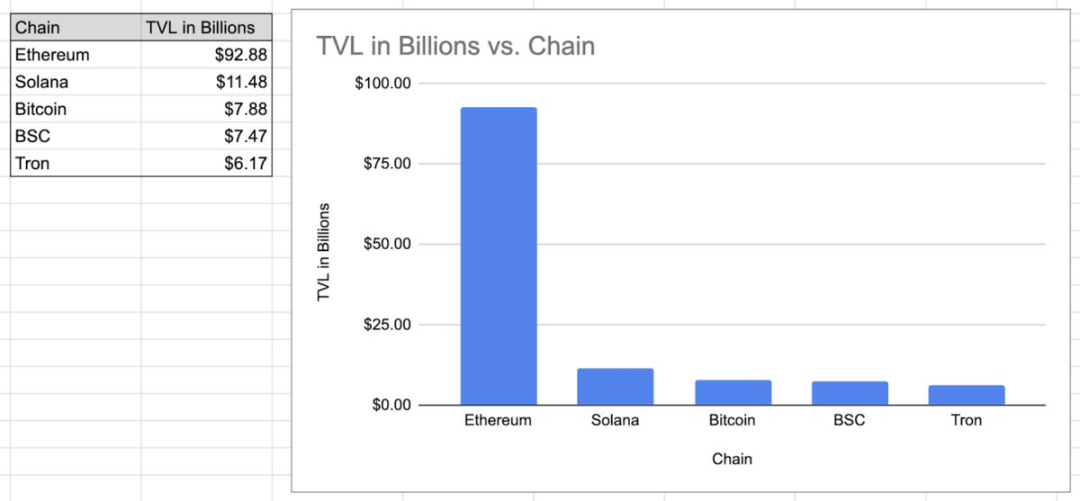

In 2023, Tether stopped issuing its stablecoins on the Omni, Kusama and Bitcoin Cash SLP networks due to insufficient demand. Omni, a Bitcoin "meta-layer" created in 2013, was the first network USDT was issued on when it was launched. Today the vast majority of tethers are issued on the Ethereum and Tron blockchains, according to its transparency page.

USDT is the largest stablecoin by market share, controlling nearly 140 billion, or 66%, of the roughly 212 billion total USD-pegged stablecoin supply, The Block's Data Dashboard shows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AiCoin Daily Report (September 11)

Cboe to debut bitcoin and ether Continuous futures in November

Cboe Futures Exchange aims to introduce long-dated crypto contracts under US regulatory oversight

The Internet is building a native financial system, and the key to success or failure still lies in user experience.

Infrastructure provision is possible, but user experience wins everything.

Why are perpetual contracts inevitably part of general-purpose blockchains?

The future trend is that perpetual contracts (and all "killer applications") will make leading general-purpose blockchains even more powerful.