After XRP Trust and XRP ETF, Grayscale Launches Dogecoin Trust - What's Next?

Grayscale Investments has unveiled the Dogecoin Trust, a new closed-end fund offering institutional and accredited investors regulated exposure to Dogecoin (DOGE). This strategic move underscores Grayscale’s belief that Dogecoin has transitioned from a meme coin into a viable financial tool, particularly for global financial inclusion.

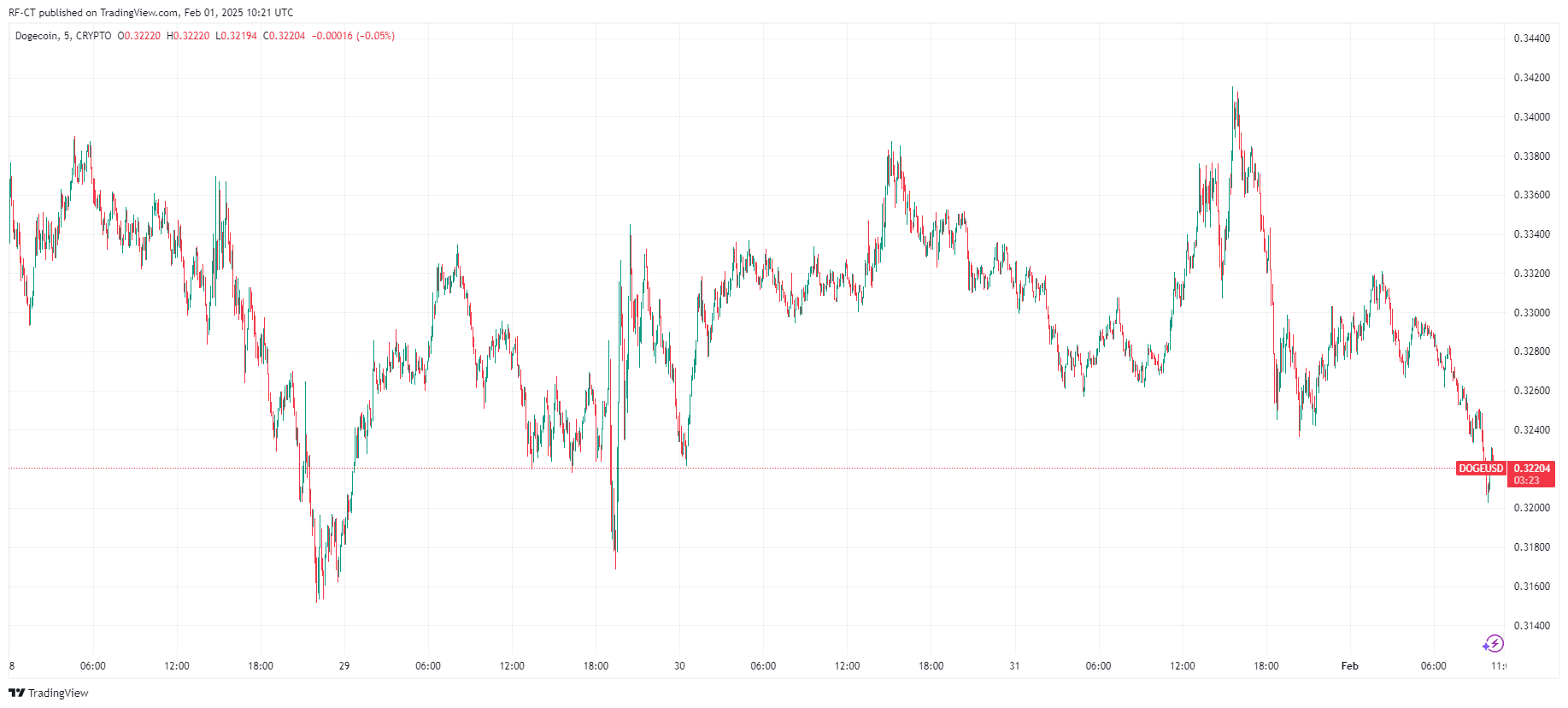

By TradingView - DOGEUSD_2025-02-01 (5D)

By TradingView - DOGEUSD_2025-02-01 (5D)

Dogecoin Trust Targets Institutional Investors

Grayscale’s Dogecoin Trust is designed to provide investors with exposure to DOGE without direct ownership of the token. By integrating Dogecoin into mainstream finance, Grayscale aims to enhance financial accessibility for underserved communities worldwide. The trust follows the firm’s established model for single-asset investment vehicles, offering a structured and compliant approach for those interested in DOGE.

DOGE, the world’s largest meme coin and the eighth-largest cryptocurrency by market capitalization, has seen a surge in adoption due to its affordability, scalability, and rapid transaction speeds. This makes it a promising financial instrument, especially for international remittances and areas with limited banking infrastructure.

Rising Institutional Adoption of DOGE

The launch of the Dogecoin Trust comes amid increasing institutional interest in meme coins. Grayscale had previously listed DOGE among its assets under consideration, and this trust marks a significant step in legitimizing the asset class. Other asset managers, including Bitwise Asset Management, Osprey Funds, and Rex Shares, have also filed for Dogecoin-based exchange-traded funds (ETFs), signaling a broader shift in investment strategies.

Recent reports suggest that the Department of Government Efficiency (DOGE), a new initiative led by Elon Musk under the Trump administration, is exploring blockchain applications for federal systems. This unit is assessing potential on-chain solutions for tracking government spending, managing assets, and facilitating payments. While discussions remain in their early stages, the initiative has fueled speculation that DOGE could play a larger role in future financial applications.

DOGE ETF Possibilities and Market Growth

With a market capitalization of nearly $50 billion, Dogecoin has cemented its status as a major player in the crypto space. Bloomberg’s senior ETF analyst Eric Balchunas commented, “Today’s satire is tomorrow’s ETF,” suggesting that DOGE could soon be wrapped in an exchange-traded product similar to Bitcoin and Ethereum.

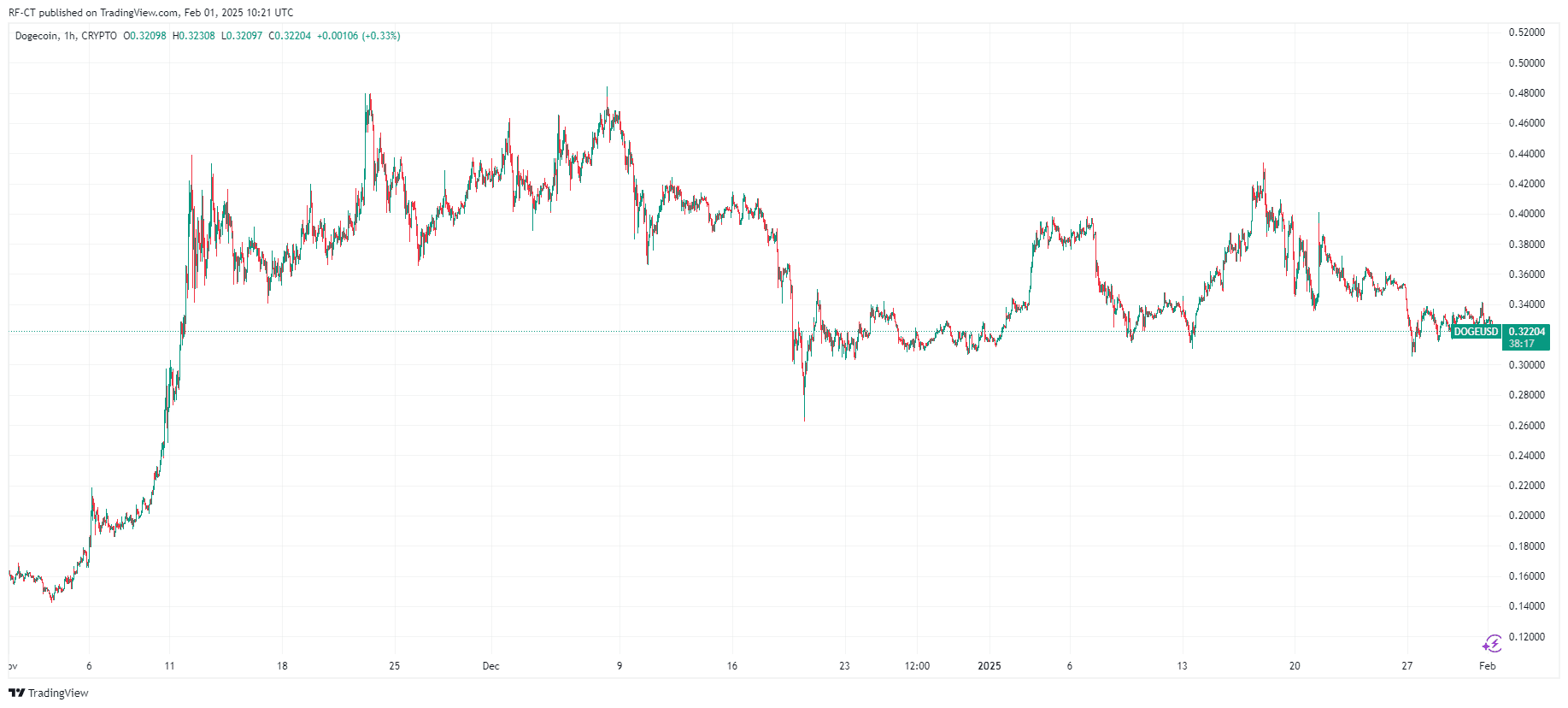

By TradingView - DOGEUSD_2025-02-01 (3M)

By TradingView - DOGEUSD_2025-02-01 (3M)

Despite growing enthusiasm, some analysts remain skeptical. Louis Sykes of All-Star Charts noted, “I’m quite confident we’ll see a Solana ETF trading in the first half of 2025. DOGE is far less likely… let’s just say Wall Street prefers assets that weren’t born as a meme.” However, the shifting regulatory landscape and the new administration’s pro-crypto stance could accelerate the approval of a Dogecoin ETF in the near future.

DOGE’s Evolution into a Financial Asset

Grayscale’s confidence in Dogecoin reflects a broader transformation within the crypto space. What started as a joke in 2013 has evolved into a globally recognized digital asset with real-world utility. The Dogecoin Trust aims to tap into the remittance market and provide a cost-effective solution for global transactions, further solidifying DOGE’s role in modern finance.

As institutional adoption of meme coins gains momentum, the launch of Grayscale’s Dogecoin Trust may mark the beginning of a new era—one where DOGE is no longer just a meme, but a serious financial instrument.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!