Japan's Banks Set to Fully Adopt XRP: A Game-Changer for Global Finance

Japan’s Banks Fully Adopting XRP: A Financial Revolution

The Japanese banking sector is on the verge of a historic transformation, as all banks in the country are set to integrate Ripple’s XRP for financial transactions . This unprecedented shift, confirmed by SBI Holdings CEO Yoshitaka Kitao, is expected to enhance cross-border payments, reduce costs, and establish XRP as a global bridge currency. With Japan’s $6.372 trillion banking sector embracing XRP, this move could be a game-changer for the cryptocurrency industry and the broader financial landscape.

The Impact on Cross-Border Transactions

The integration of XRP into Japan’s banking system aims to streamline remittances and currency conversions. The move is expected to modernize Japan’s financial sector by leveraging XRP’s high-speed and low-cost transaction capabilities. As a bridge currency, XRP eliminates the inefficiencies of traditional banking methods, allowing seamless international transactions. Analysts predict that this adoption will solidify XRP’s role in global finance and set a precedent for other countries.

XRP’s Market Potential: Price Projections and Adoption Scenarios

With XRP adoption gaining traction in Japan, analysts forecast significant price growth. Even a small-scale implementation could yield substantial value appreciation:

- 1% adoption rate: XRP could surge to $3.50 per token.

- 10% adoption rate: XRP could reach $13.48, making it one of the most valuable digital assets.

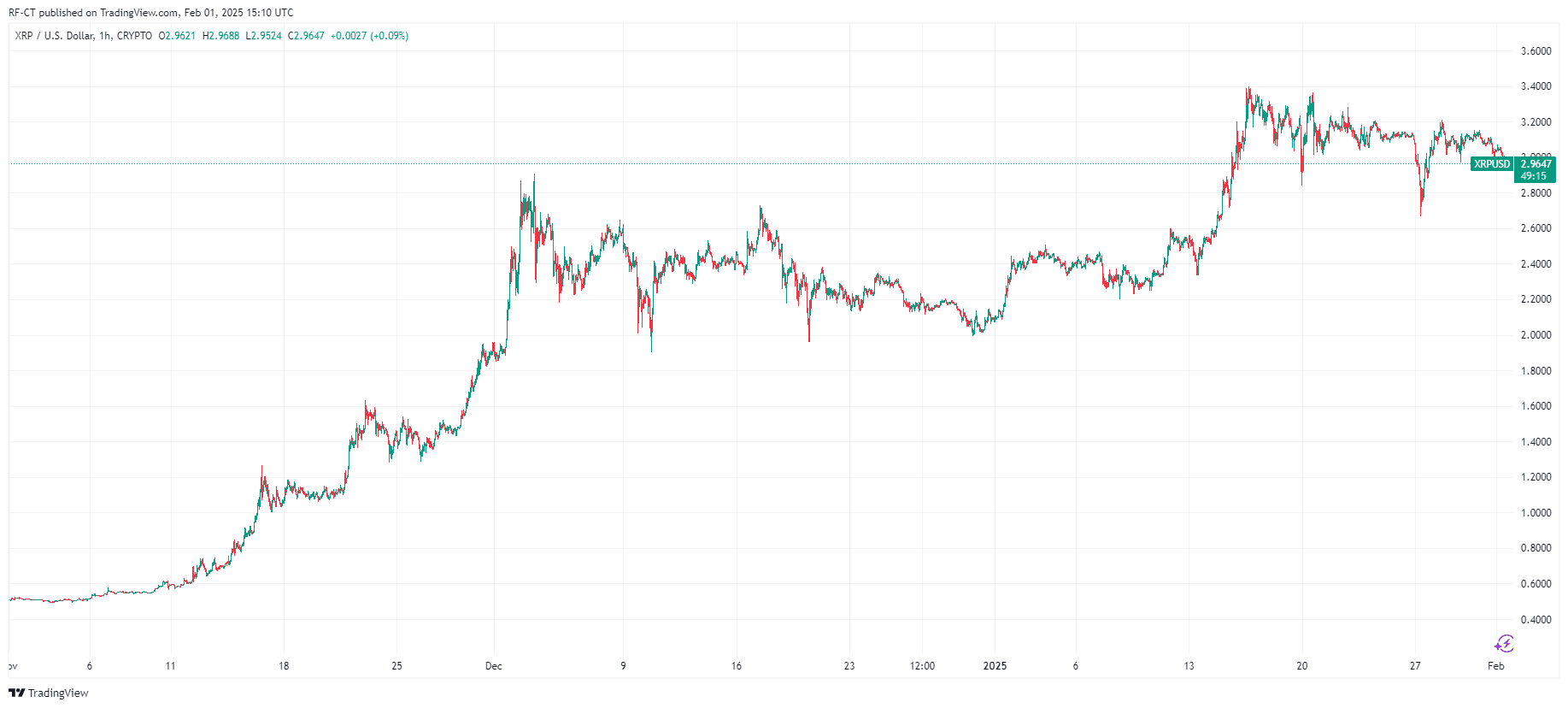

By TradingView - XRPUSD_2025-02-01 (3M)

By TradingView - XRPUSD_2025-02-01 (3M)

Should Japan’s success influence other global banks, XRP’s use case could expand exponentially, further increasing its market cap and overall demand.

SBI’s Strategic Vision for XRP

SBI Holdings , one of Japan’s largest financial groups, has been a vocal proponent of XRP. CEO Yoshitaka Kitao has consistently argued that XRP holds greater real-world utility compared to Bitcoin, which he claims lacks intrinsic value. SBI’s extensive partnership with Ripple dates back to 2016, and its ongoing efforts in remittance technology have demonstrated XRP’s effectiveness in international payments.

SBI’s Advanced Remittance Technology & Ripple’s Interledger Protocol

SBI’s remittance technology, built on the XRP Ledger (XRPL) and Ripple’s Interledger Protocol (ILP), facilitates seamless global transactions. This advanced framework allows banks to bypass traditional multi-currency exchange systems, reducing transaction costs and increasing speed. Notably, this approach has drawn interest from major financial institutions, including the Bank of England, underscoring XRP’s potential as a financial cornerstone.

The Ripple Effect: Will Other Countries Follow?

Japan’s regulatory environment has been progressive toward cryptocurrencies, creating fertile ground for XRP’s integration. If successful, this move could encourage other nations to consider similar blockchain-based solutions. XRP’s efficiency and ability to reduce remittance costs could be particularly beneficial for countries with large expatriate populations, making it a preferred digital asset for international banking.

A Monumental Shift in Global Finance

As Japan spearheads the adoption of XRP across its banking sector , the financial world watches closely. This shift not only strengthens XRP’s credibility but also has the potential to redefine international banking infrastructure. If other nations follow suit, XRP could become a dominant force in global finance, driving its adoption and market value to new heights.

By TradingView - XRPUSD_2025-02-01 (All)

By TradingView - XRPUSD_2025-02-01 (All)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK