Bitcoin spot ETF net inflow of $560 million last week, BlackRock IBIT net inflow of $751 million

Bitget2025/02/03 06:57

According to SoSoValue data, the net inflow of Bitcoin spot ETF last week (January 27th to January 31st Eastern Time) was $560 million. The largest net inflow of Bitcoin spot ETF last week was Blackrock Bitcoin ETF IBIT, with a weekly net inflow of $751 million and a total historical net inflow of $40.48 billion. The second largest net inflow was canary release (Grayscale) Bitcoin Mini Trust BTC, with a weekly net inflow of $111 million and a total historical net inflow of $1.23 billion. Last week, the Bitcoin spot ETF with the highest weekly net outflow was the canary release (Grayscale) Bitcoin Trust GBTC, with a weekly net outflow of $139 million. Currently, the historical net outflow of GBTC has reached $21.89 billion. As of press time, the total Net Asset Value of the Bitcoin spot ETF is $119.66 billion, the ETF's net asset ratio (market value compared to the total market value of Bitcoin) is 5.94%, and the historical cumulative net inflow has reached $40.50 billion.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Data: ETH surged briefly, then dropped over 5.04% within 5 minutes

Chaincatcher•2025/12/11 18:56

As competition with Google intensifies, OpenAI launches GPT-5.2

金色财经•2025/12/11 18:41

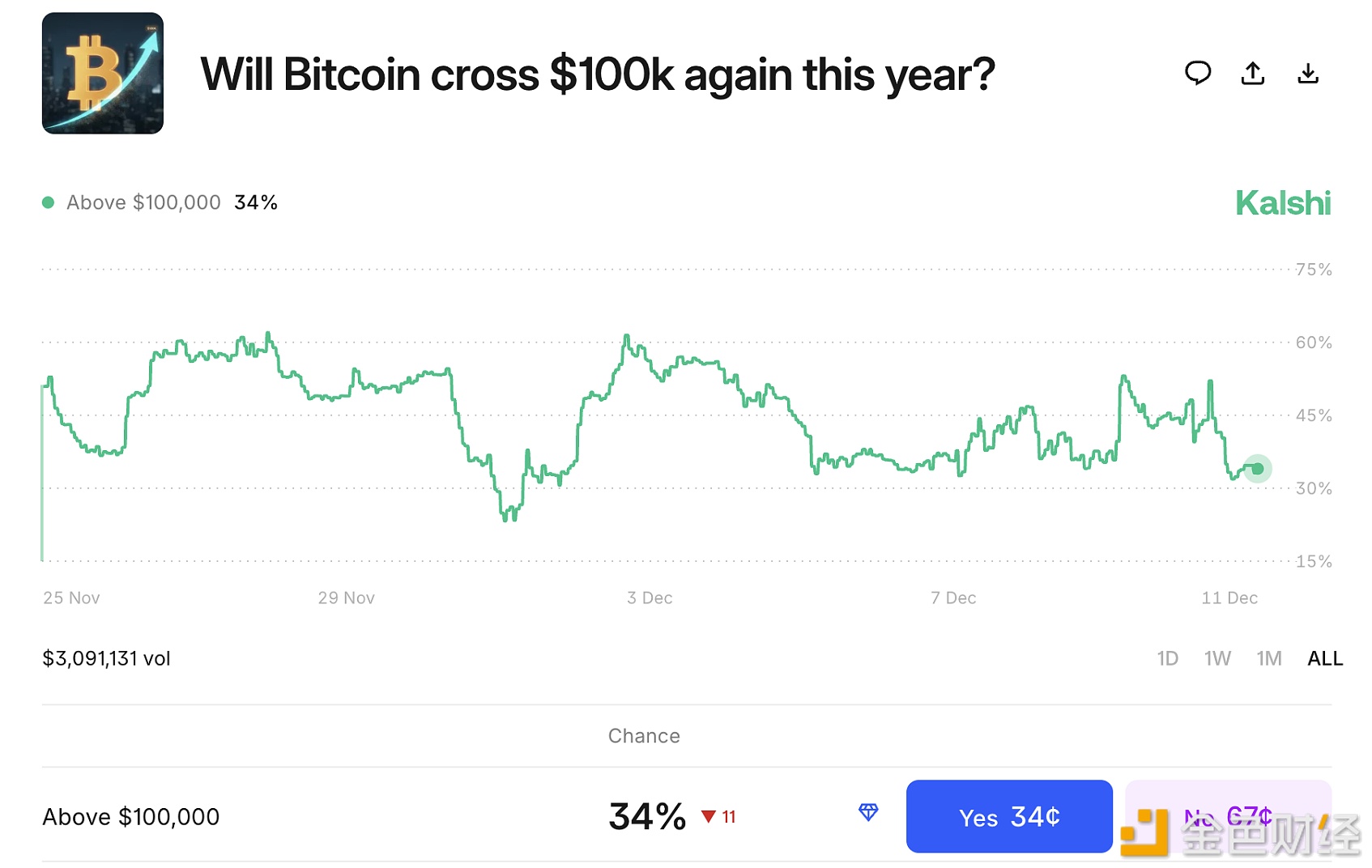

Prediction markets bet that bitcoin will not reach $100,000 by the end of the year

金色财经•2025/12/11 18:04

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$90,648.18

-1.97%

Ethereum

ETH

$3,199.81

-5.66%

Tether USDt

USDT

$1

+0.01%

XRP

XRP

$2.01

-2.87%

BNB

BNB

$876.02

-2.51%

USDC

USDC

$1.0000

-0.00%

Solana

SOL

$134.32

-2.52%

TRON

TRX

$0.2799

+0.77%

Dogecoin

DOGE

$0.1382

-6.19%

Cardano

ADA

$0.4149

-10.88%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now