THORChain plans to tackle $200 million debt crisis by issuing TCY equity tokens

Quick Take THORChain’s governance approved a proposal to address a nearly $200 million debt crisis. The approved plan involves converting defaulted debt into equity by issuing creditors a new token called TCY. TCY token holders are entitled to 10% of THORChain’s revenue in perpetuity.

THORChain's governance body passed a key proposal as part of restructuring efforts to resolve the debt crisis, converting defaulted debt into equity tokens.

A majority of THORChain's validators passed its governance proposal 6, indicating community consensus on how to tackle the nearly $200 million debt crisis that emerged within the protocol.

On Jan. 23, THORChain suspended its THORFi services, including “Savers and Lending” programs, due to financial uncertainties. A 90-day restructuring plan is in place to address and reduce the issues stemming from accumulated unserviceable debt in these programs.

The community-approved plan is to convert debt into equity, specifically into a new token called TCY (Thorchain Yield) with a supply of 200 million.

This means that instead of repaying loans in bitcoin or ether, lenders and savers will receive TCY tokens, effectively turning their debt claims into equity in the THORChain ecosystem.

Holders of TCY will be entitled to 10% of THORChain's revenue in perpetuity. "THORChain will convert ~$200M of debt into equity through a new token that will receive 10% of network revenue in perpetuity," the team at THORChain said.

The proposal includes minting 200 million TCY tokens, distributed at a rate of 1 TCY per dollar of defaulted debt. The core team is expected to create a RUNE/TCY liquidity pool with $500,000 liquidity at $0.1 per TCY, funded by $5 million from the treasury.

This means that for those with money in the network's lending and savings programs (ThorFi), their holdings are converted into TCY rather than being repaid in the original asset — although how long it will take for recovery remains unclear.

Despite the announcement of restructuring efforts and proposal 6, RUNE experienced another price drop of 35% over the past week amid a broader altcoin sell-off, going from $2 to $1.3 at the time of writing, according to The Block's price page . The token has shed over 70% of its value in the past 30 days.

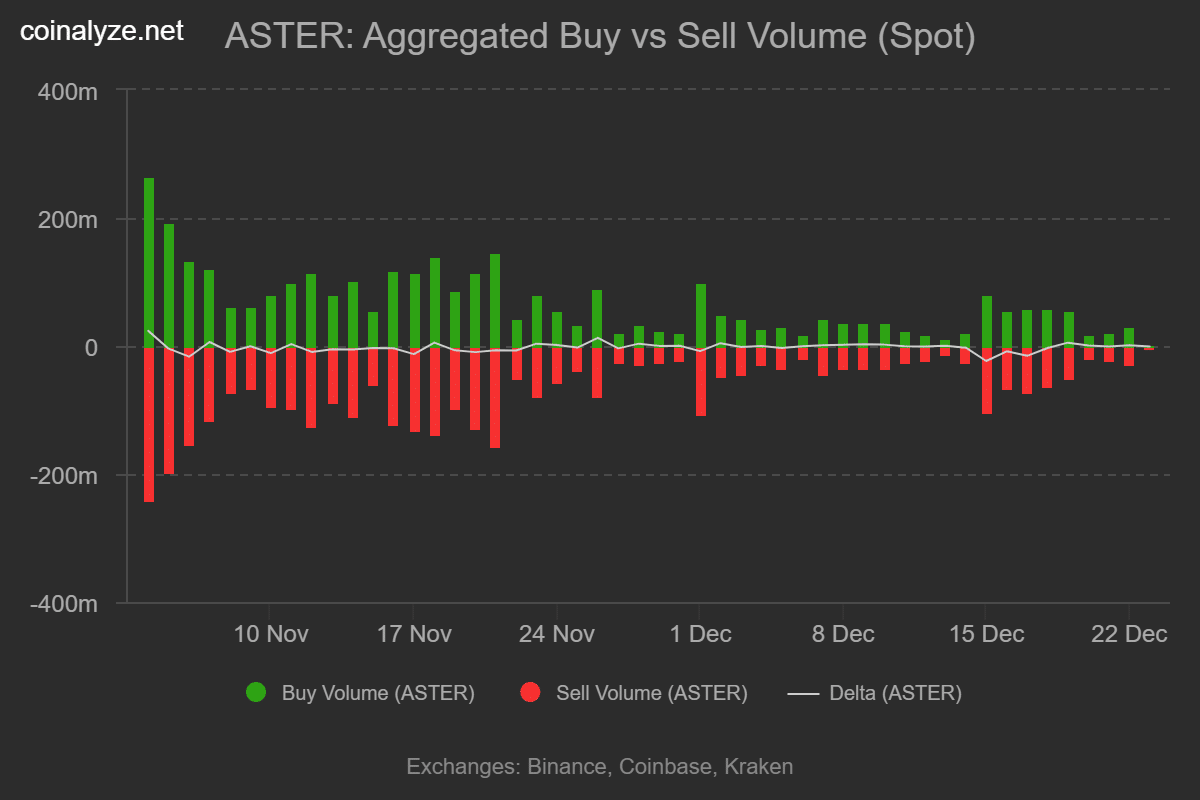

Despite these challenges, the network has maintained swap volume, processing $270 million in the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Stalls Below $90K as Traders Eye $86K Support, Says Michaël van de Poppe

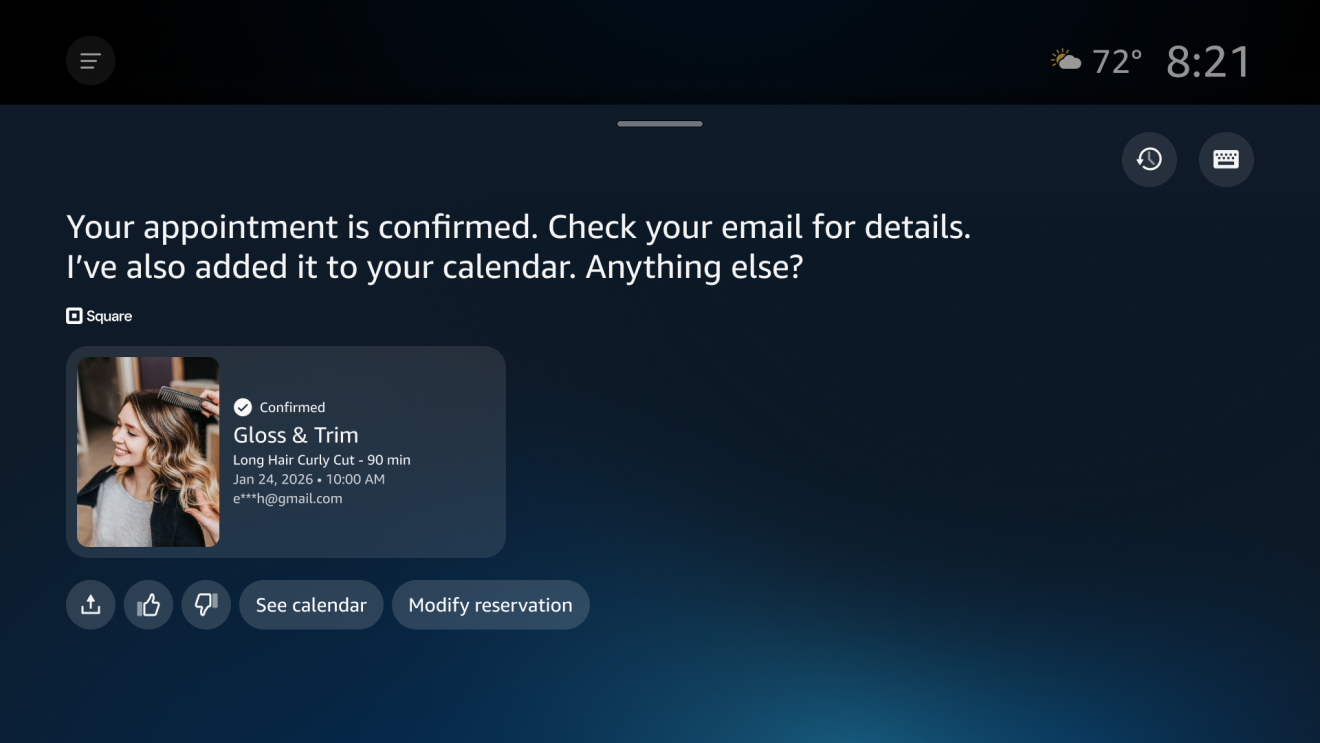

Amazon’s AI assistant Alexa+ now works with Angi, Expedia, Square, and Yelp

Aster DEX buys back $140M in tokens, yet prices stall – Why?

ETF data shows Bitcoin dominance held firm in 2025 as Ethereum gradually gained share