Data: In January, the trading volume of stablecoins on the chain decreased by 10.5%, and the trading volume of legal CEX spot decreased by 18.2%.

Bitget2025/02/04 06:06

On February 4th, according to a post by The Block Chief Research Officer @lars0x, several indicators of the cryptocurrency market reached historic highs in January 2025. The adjusted total on-chain trading volume decreased by 10.5% to $600 billion (BTC: -4.4%, ETH: -23%). The adjusted on-chain trading volume of stablecoins decreased by 6.3% to $1.32 trillion, and the supply of publishers increased by 3.1% to reach a new high of $175.20 billion, with USDT accounting for 78% and USDC accounting for 19.6%.

BTC miners' income fell 2.8% to $1.40 billion in January, while ETH stakers' income fell 9.7% to $309 million. A total of 33,906 ETH was destroyed in January, equivalent to $113.20 million. Since the implementation of EIP-1559 in early August 2021, a total of 4.56 million ETH has been destroyed, equivalent to $12.90 billion. Monthly NFT market trading volume on Ethereum fell 41.3% to $519.20 million.

Legal CEX spot trading volume fell 18.2% to $1.65 trillion in January, and the monthly net flow of all BTC spot ETFs was + $4.90 billion. Bitcoin futures non-position squaring contracts increased by 6%, and Ethereum futures non-position squaring contracts increased by 1% to reach new highs. BTC monthly futures trading volume fell by 5.9% to $1.84 trillion. CME Bitcoin futures non-position squaring contracts increased by 3% to a new high of $18.20 billion (daily average trading volume increased by 1.3% to $10.27 billion, reaching a new high). ETH futures monthly trading volume fell by 20.7% to $817 billion. Bitcoin options non-position squaring contracts increased by 61%; Ethereum options non-position squaring contracts increased by 30%. BTC monthly options trading volume increased by 12% to $89 billion, while ETH monthly options trading volume decreased by 16.2% to $19.40 billion.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

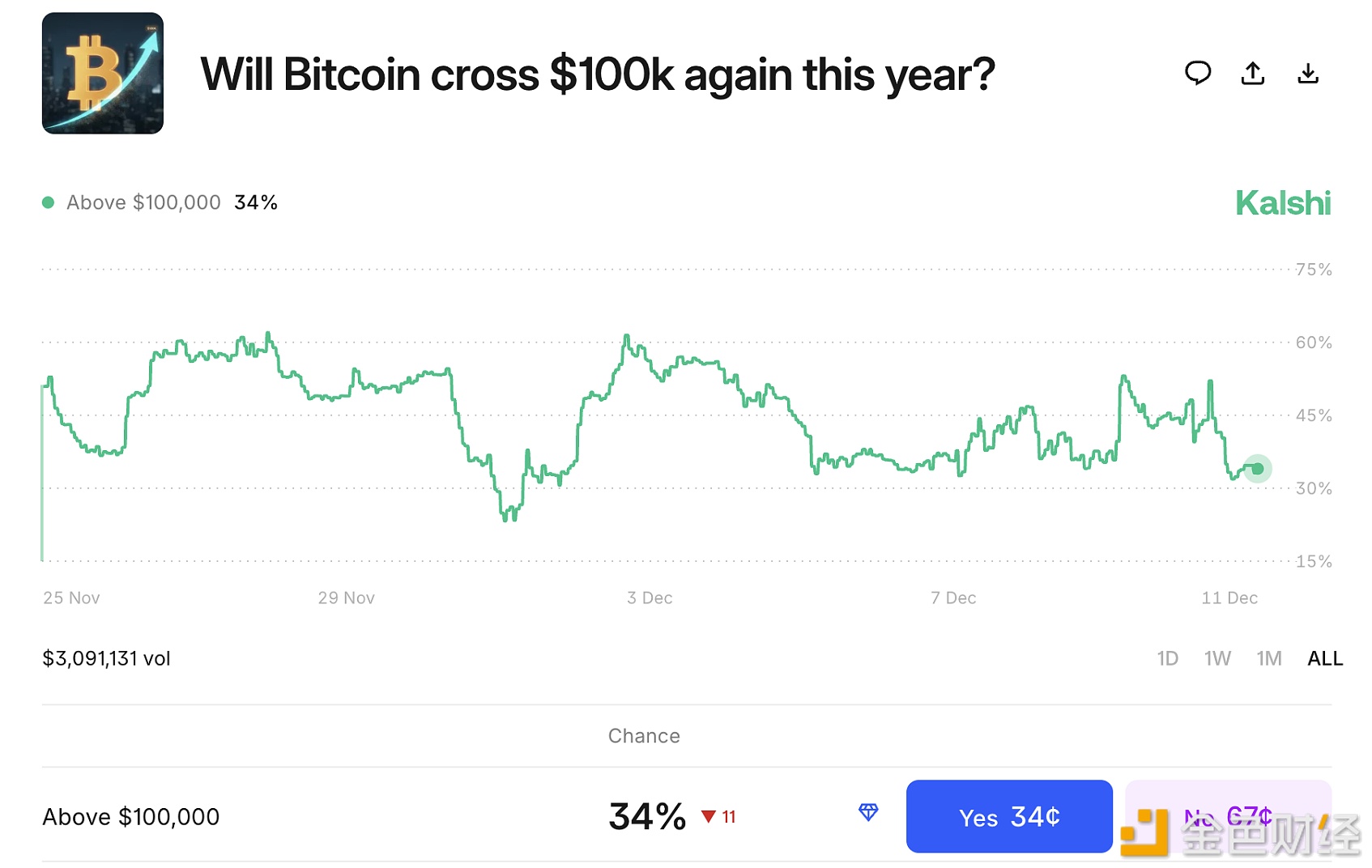

Prediction markets bet that bitcoin will not reach $100,000 by the end of the year

金色财经•2025/12/11 18:04

Data: 90,300 SOL transferred from an anonymous address, routed through intermediaries and flowed into Wintermute

Chaincatcher•2025/12/11 16:56

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$89,957.77

-2.62%

Ethereum

ETH

$3,181.93

-5.53%

Tether USDt

USDT

$1

-0.01%

XRP

XRP

$2

-3.25%

BNB

BNB

$869.88

-2.91%

USDC

USDC

$0.9999

-0.00%

Solana

SOL

$132.44

-3.20%

TRON

TRX

$0.2807

+1.31%

Dogecoin

DOGE

$0.1372

-6.06%

Cardano

ADA

$0.4116

-11.03%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now