Mexico and Canada Bought Time—But Can Crypto Handle More Trade War Uncertainty?

Key Takeaways

- Mexico and Canada agree to pause tariffs for a month, temporarily easing market fears.

- The trade war pause helped Bitcoin reclaim $100,000 after a weekend crash wiped out $400 billion.

- Despite Trump’s backing, altcoins remain weak as investors hesitate amid ongoing uncertainty.

The international trade war that triggered one of the largest liquidation events in crypto— wiping out $400 billion —was momentarily put on hold after Mexico and Canada agreed to pause tariffs for a month.

Bitcoin reacted swiftly, bouncing back above $100,000 after hitting a daily low of $91,000. However, the broader market remains hesitant, with altcoins struggling to reclaim pre-crash levels.

With only a temporary pause in tariffs, the question remains: Is this merely a breather before another wave of volatility?

-

Business Donald Trump’s Presidency Fuels Economic Uncertainty Warning: Trade, Tariffs and Tax Cuts Will Shape 2025

-

AI President Trump’s AI Executive Orders: Fewer Rules, More Influence From Silicon Valley

-

Crypto FTX Sentences Reduced, But SBF Stuck—Now His Parents Are Asking Donald Trump for a Pardon

A One-Month Pause: Relief or Delayed Pain?

President Donald Trump announced that he had successfully negotiated with Mexico and Canada to hold off on retaliatory tariffs for 30 days. The move temporarily steadied financial markets, including crypto, after days of turmoil.

However, analysts warn that the pause does little to resolve underlying concerns. If negotiations fail, Trump could introduce even harsher tariffs, triggering another wave of market uncertainty.

Furthermore, while the U.S. has secured a temporary halt from Mexico and Canada, other major economies—including China and the European Union —could still retaliate. Any escalation from these trading partners could send shockwaves through global markets, including crypto.

Crypto investors initially saw Trump’s presidency as a tailwind for the industry, given his vocal support for digital assets. However, while his administration has taken steps to advance pro-crypto policies, the ongoing tariff war has introduced a level of uncertainty that the market may not have fully priced in.

Bitcoin Bounces Back, but Altcoins Lag

Bitcoin’s recovery to $100,000 signals renewed confidence, but the broader market tells a different story. Altcoins—many of which suffered losses of 30% to 40% during Sunday’s sell-off—have yet to stage a full comeback.

Ethereum , the second-largest cryptocurrency, fell below $2,400 at the market’s nadir. Even with Bitcoin’s rebound, ETH has only climbed to $2,648, still far from its pre-crash levels.

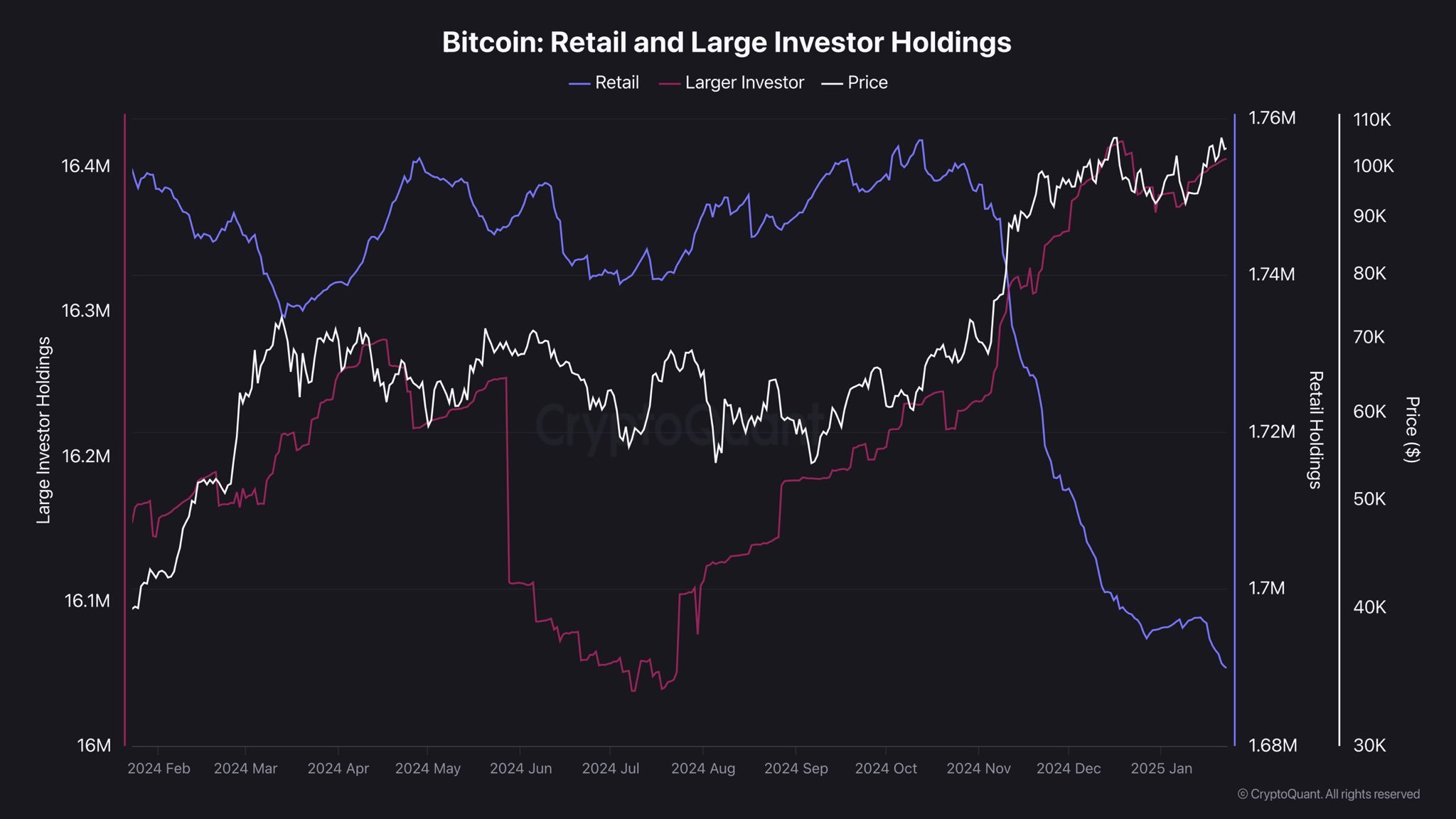

Additionally, following Monday’s market crash, on-chain data revealed a significant shift in market participants.

Retail investor holdings dropped to their lowest level in years. Meanwhile, institutional accumulation surged, with large-wallet entities increasing their Bitcoin holdings at one of the fastest rates on record.

Source: CryptoQuant.

Source: CryptoQuant.

This dynamic suggests that while retail traders panicked during the sell-off, institutions treated the dip as a buying opportunity. The divergence underscores Bitcoin’s growing role as a macro asset—one that sophisticated investors view as a hedge in times of geopolitical uncertainty, while retail sentiment remains more reactive to short-term volatility.

Bitcoin’s Role in an Uncertain Trade Environment

As investors scrambled for stability, Bitcoin dominance spiked to 64%, its highest level in years, before settling at 62% at the time of writing. The shift underscores a clear trend: The market is favoring BTC as a safe-haven asset while riskier altcoins continue to bleed.

Historically, crypto cycles have been dictated by factors like regulation, ETF approvals, and Federal Reserve policy. However, Trump’s second term is introducing a new force—trade policy—as a key driver of market sentiment.

If trade tensions escalate after the one-month tariff pause, institutions may continue rotating into Bitcoin as a hedge, reinforcing its narrative as “digital gold.” Meanwhile, retail investors—still shaken by the recent crash—could remain sidelined, leading to further divergence between Bitcoin and the broader altcoin market.

Trade War Uncertainty: What’s Next for Crypto?

Looking ahead, the market’s next moves depend on how global trade tensions evolve. A full-scale trade war could lead to

- More capital flight into Bitcoin – If uncertainty persists, Bitcoin may attract more investment as a perceived safe haven, much like gold.

- Further altcoin weakness – Without fresh liquidity, altcoins could continue to lag behind BTC.

- Increased volatility – If other nations retaliate with their own tariffs, another round of panic selling could follow.

Trump’s crypto-friendly policies remain in play, but trade tensions could overshadow any regulatory progress. For now, the market is bracing for more turbulence, knowing that the next White House decision could once again dictate the crypto market’s direction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Announcement on Bitget listing NFLXUSDT, FUTUUSDT, JDUSDT, RDDTUSDT, QQQUSDT STOCK Index perpetual futures

Bitget Trading Club Championship (Phase 15)—Trade spot and futures to share 120,000 BGB, up to 2200 BGB per user!

CandyBomb x COMMON: Trade futures to share 1,111,111 COMMON!