71% of institutional traders have ‘no plans’ for crypto: JPMorgan survey

From cointelegraph by Martin Young

From cointelegraph by Martin Young

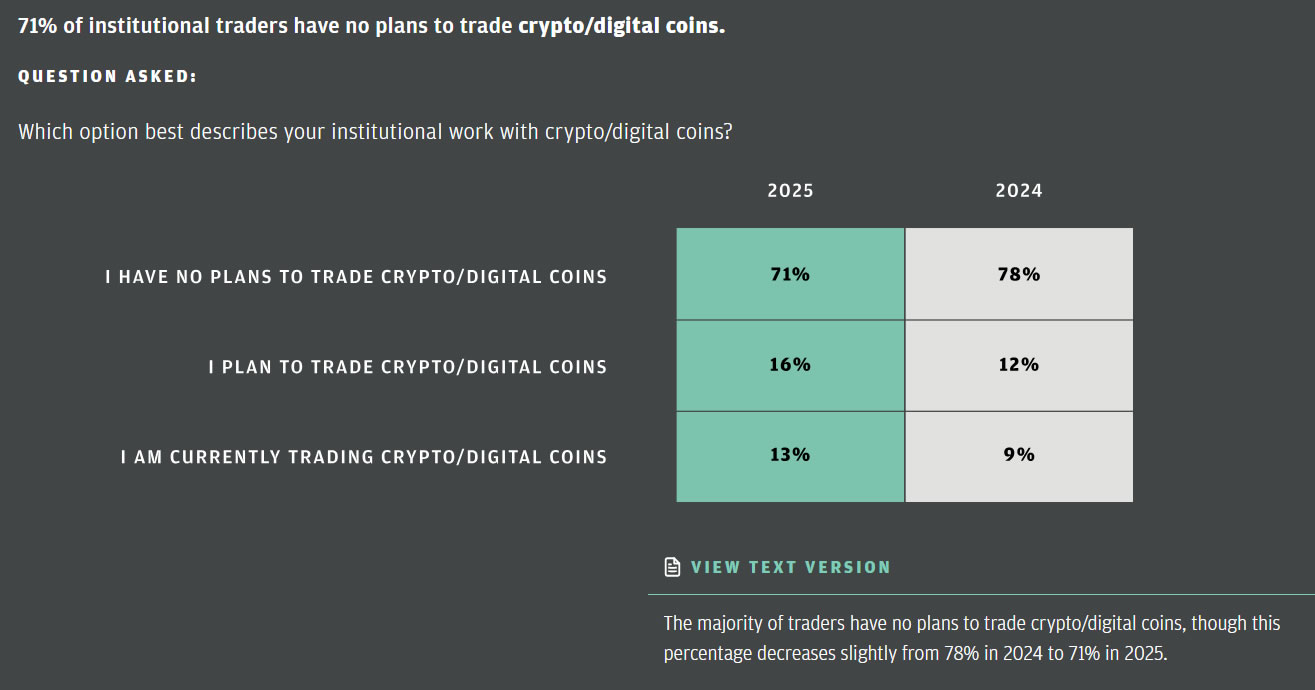

More than 70% of respondents to a JPMorgan e-trading survey for institutional traders said that they were not planning to trade crypto this year.

“The majority of traders have no plans to trade crypto or digital coins,” according to the Wall Street giant’s January survey of institutional traders.

The results show that the percentage decreased from 78% in 2024 to 71% in 2025.

The survey also found that 16% planned to trade crypto this year, and 13% said they were already doing so. Both figures were higher than in 2024.

However, 100% of respondents in the annual trading poll said they planned to increase online or e-trading activity, especially for less liquid assets.

Source: JPMorgan

The seeming lack of interest in crypto trading comes despite an improving regulatory environment for digital assets in the United States following a shakeup at the major financial agencies under the Trump administration.

“Recent headlines suggest that the new administration supports the market and recent changes have lowered the barriers for traditional banking community members to enter this space,” Eddie Wen, JPMorgan’s global head of digital markets, told Bloomberg.

Meanwhile, respondents signaled that inflation and tariffs will have the biggest impact on markets in 2025, followed by escalating geopolitical tension. Additionally, 41% of those surveyed said market volatility was the biggest trading challenge, up from 28% last year.

“It does not surprise me that 51% of the participants thought that tariffs and inflation will be two of the central risks or two of the central spots for the market to focus on,” said Gergana Thiel, global co-head of Macro Sales at JPMorgan.

The annual survey of 4,200 JPMorgan clients participating from 60 locations around the world ran from Jan. 9 to 23.

Signals that the US government is pivoting in support of the crypto industry were strengthened as the SEC scaled back its crypto enforcement unit this week.

Meanwhile, Donald Trump signed an executive order directing the government to create a sovereign wealth fund.

The fund would be part-managed by Treasury Secretary Scott Bessent and Secretary of Commerce Howard Lutnick, who are both pro-crypto. Senator Cynthia Lummis has hinted that the fund might be used to buy Bitcoin.

Also this week, White House “crypto czar” David Sacks said the US wants to bring stablecoins onshore to “extend the dollar’s dominance internationally and extend it online digitally.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!