BTC options market volatility, block trade caused concern, today 26,000 options expire

西格玛学长2025/02/07 05:10

Today, a large BTC options transaction broke out on the Deribit platform. A user paid a premium of $3.493 million to purchase bullish options worth $120,000 at the end of June, and sold bullish options worth $120,000 at the end of March, with a total trading volume of 600 BTC. This transaction is not only a heavyweight operation in the market, but also shows investors' strong expectations for the BTC price in the coming months, especially their confidence in bullish options expiring in June, implying that the market may experience significant fluctuations.

At the same time, 26,000 BTC options will expire today with a Put/Call ratio of 0.58 and a maximum pain point of $99,500, with a nominal value of $2.54 billion. This data highlights the market's nervousness and may cause drastic price fluctuations. In addition, there are also 203,000 options expiring on the ETH side with a Put/Call ratio of 0.46 and a maximum pain point of $2950, with a nominal value of $560 million. The expiration of these options will profoundly affect market dynamics, and investors need to closely monitor possible market fluctuations and subsequent trading opportunities.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

American Federation of Teachers: Senate cryptocurrency bill will endanger pensions and the overall economy

Chaincatcher•2025/12/10 14:59

U.S. stock market opens with the Dow Jones flat

金色财经•2025/12/10 14:49

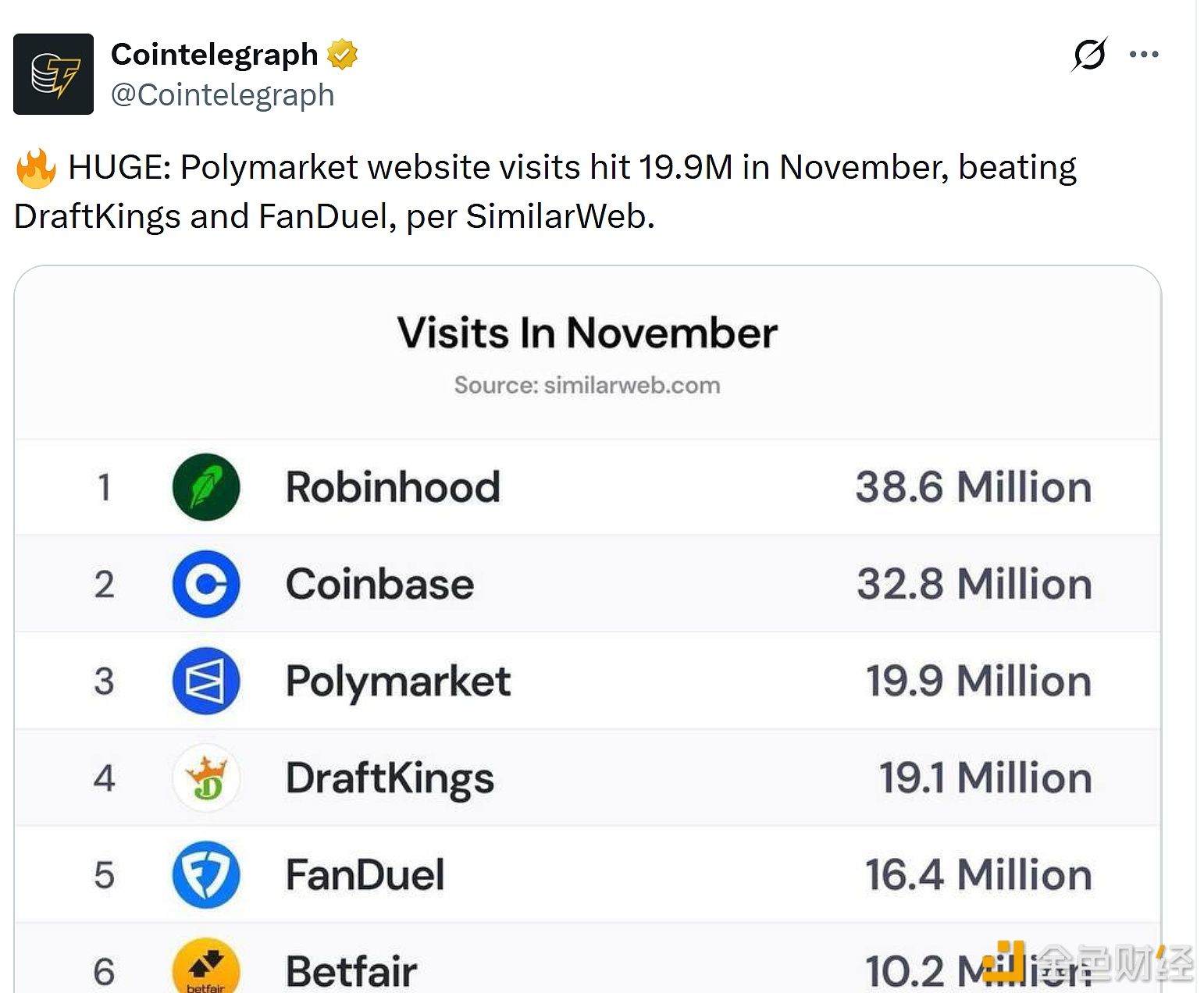

Polymarket website received 19.9 million visits in November

金色财经•2025/12/10 14:40

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$91,787.48

+1.71%

Ethereum

ETH

$3,315.53

+6.50%

Tether USDt

USDT

$1

+0.02%

XRP

XRP

$2.06

+0.43%

BNB

BNB

$889.46

+0.52%

USDC

USDC

$1

+0.01%

Solana

SOL

$137

+3.59%

TRON

TRX

$0.2779

-0.94%

Dogecoin

DOGE

$0.1453

+3.20%

Cardano

ADA

$0.4629

+2.56%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now