- Analysts project a 39% VET surge to $0.04655 by mid-February if market conditions improve temporarily.

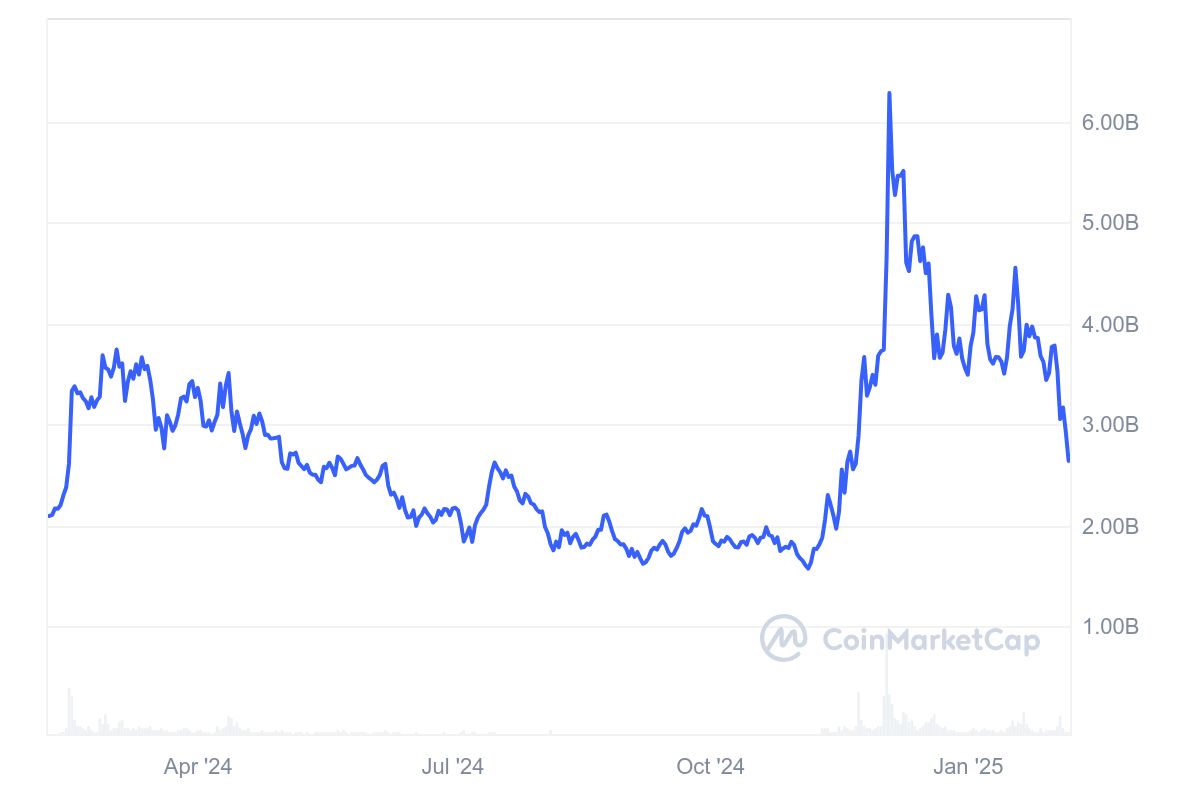

- VET’s market cap dropped 6% to $2.69B; daily volume fell 20% to $63.79M amid low trading activity

The crypto market faced broad declines this week, with VeChain (VET) among the hardest-hit assets. ETHNews data shows VET dropped 31% over seven days, underperforming most cryptocurrencies.

Source: Tradingview

Source: Tradingview

At press time, the token traded at $0.03324, down 6.24% in 24 hours. Its current price sits 87% below its 2021 peak of $0.2782, reflecting prolonged struggles to regain historical highs.

Over the past three weeks, VET’s price moved within a narrow band, fluctuating between key levels without clear directional momentum. This sideways trading followed a steady erosion of value since early January.

Source: Coinmarketcap

Source: Coinmarketcap

Market capitalization mirrored the decline, falling 6% to $2.69 billion. Daily trading volume contracted 20%, settling at $63.79 million — a sign of reduced investor activity amid uncertainty.

Analytics platform CoinCodex projects a potential reversal

Forecasts suggest VET could climb 37% to $0.0459 by mid-February, with a possible peak near $0.04655. Such a move would mark a 39% gain from current levels. While the prediction hinges on broader market recovery, it offers cautious optimism for holders. The token’s technical indicators, however, remain mixed, lacking definitive signals of sustained upward pressure.

The anticipated rebound contrasts with VET’s long-term challenges. Reclaiming its all-time high would require a 740% surge — a scenario analysts deem improbable without major ecosystem developments or market-wide bullish catalysts. Short-term gains, if realized, may provide partial relief for investors weathering recent losses.

VeChain’s performance mirrors volatility in blockchain-focused assets, which often react sharply to macroeconomic trends and sector-specific news. Its blockchain , designed for supply chain management, has yet to announce upgrades or partnerships that could drive renewed demand.

As the crypto market seeks stability, VET’s trajectory will test whether technical forecasts can override bearish sentiment. For now, traders await clarity on whether mid-February’s projected uptick materializes — or becomes another false dawn in a turbulent market cycle.