Ripple CEO Brad Garlinghouse’s Potential Role in Trump’s Crypto Advisory Council – Impact on XRP and Market Outlook

Ripple CEO Brad Garlinghouse to Join Trump’s Crypto Advisory Council?

In a major development for the cryptocurrency sector, Ripple CEO Brad Garlinghouse is reportedly in talks to join former U.S. President Donald Trump’s Crypto Advisory Council . The council, established through an executive order, aims to provide insights and regulatory guidance for the digital asset industry in the United States.

This move could be a game-changer for Ripple, which has been at the center of a long-standing legal battle with the U.S. Securities and Exchange Commission (SEC) . If confirmed, Garlinghouse’s participation may pave the way for crypto-friendly policies, potentially leading to clearer regulatory frameworks and fostering a more pro-crypto environment in the U.S.

What This Means for Ripple and XRP

Garlinghouse’s potential appointment could strengthen Ripple’s influence in regulatory discussions, giving the company an edge in shaping future crypto policies. This development comes at a crucial time, as Ripple continues to fight its ongoing lawsuit with the SEC.

XRP Price Implications

Several analysts believe that Garlinghouse’s involvement in the advisory council could directly influence XRP’s price performance . According to market experts:

- If Garlinghouse secures a position on the Crypto Advisory Council, XRP could surge to $5.50 due to increased institutional confidence.

- The possibility of XRP’s full regulatory clearance under a pro-crypto U.S. government could fuel a rally towards the $7 mark by mid-2025.

- However, some analysts urge cautious optimism, citing the market’s volatility and the uncertainty surrounding upcoming SEC rulings.

XRP’s Recent Market Performance

Despite ongoing legal battles, XRP has shown resilience , with a recent surge above $3, fueled by investor optimism. The cryptocurrency has witnessed strong trading volumes and has positioned itself among the top-performing altcoins in recent months.

Experts predict that with a favorable legal outcome for Ripple and a more crypto-friendly U.S. government, XRP could break previous all-time highs and establish itself as a dominant player in the blockchain payments sector.

The Road Ahead: Will XRP Skyrocket in 2025?

The intersection of Ripple’s legal battles, Trump’s potential return to office, and regulatory clarity will be key drivers for XRP’s market trajectory. If Garlinghouse secures his seat on the council, it could signal a major shift in the U.S. crypto regulatory landscape.

While price predictions remain speculative, the growing anticipation surrounding Ripple’s future makes XRP one of the most-watched cryptocurrencies for 2025 .

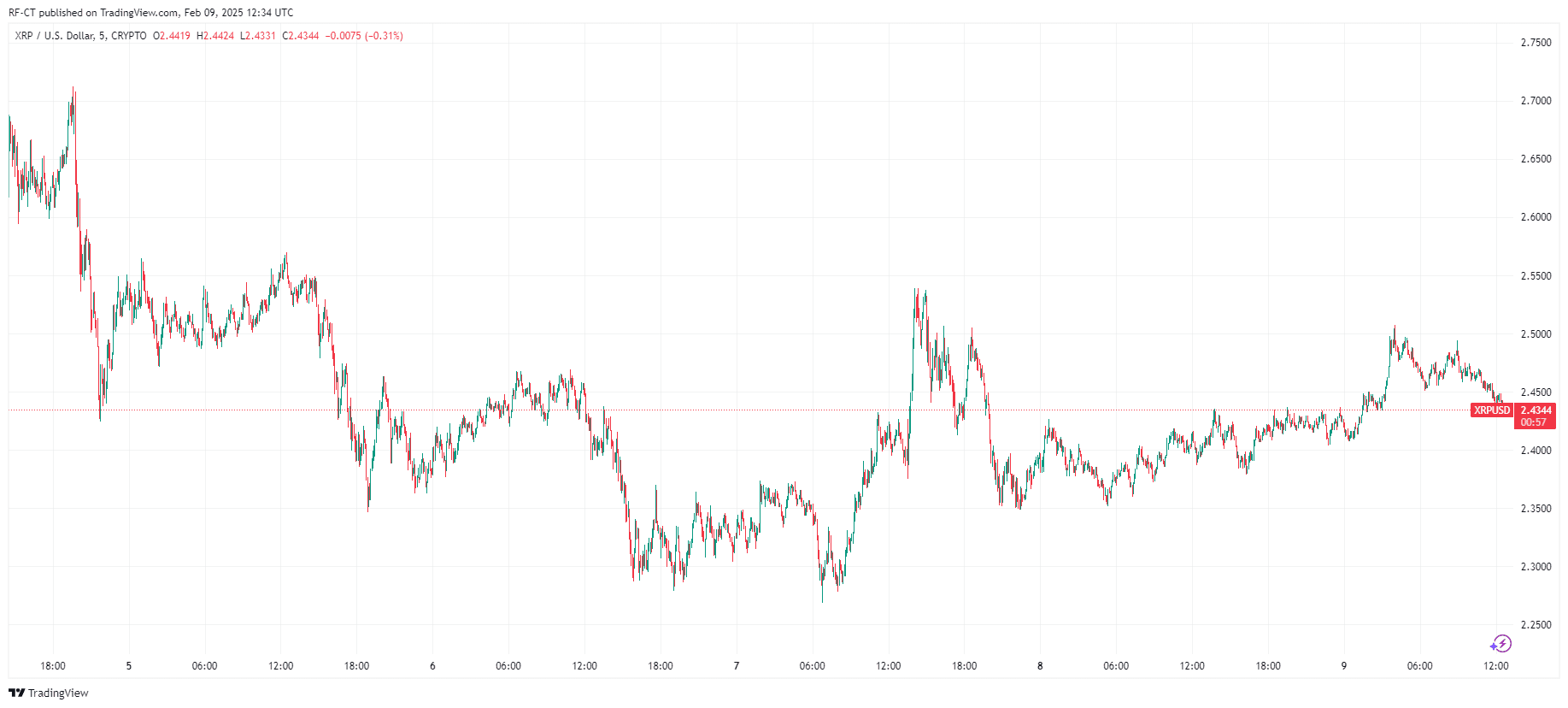

By TradingView - XRPUSD_2025-02-09 (5D)

By TradingView - XRPUSD_2025-02-09 (5D)

Brad Garlinghouse’s potential involvement in the Trump administration’s crypto policy-making could have far-reaching consequences for both Ripple and XRP . With expectations of regulatory clarity and potential price surges, the coming months could be critical for Ripple investors and the broader crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!