Bitcoin holds $95K support despite heavy selling pressure

From cointelegraph by Zoltan Vardai

Bitcoin is steadily trading above the key $95,000 psychological support despite one of the largest intraday selling events since 2022.

Bitcoin’s price staged a significant reversal after it briefly bottomed at an over one-week low of $94,726 on Feb. 9, Cointelegraph Markets Pro data shows.

BTC/USD, 1-month chart. Source: Cointelegraph

BTC/USD, 1-month chart. Source: Cointelegraph

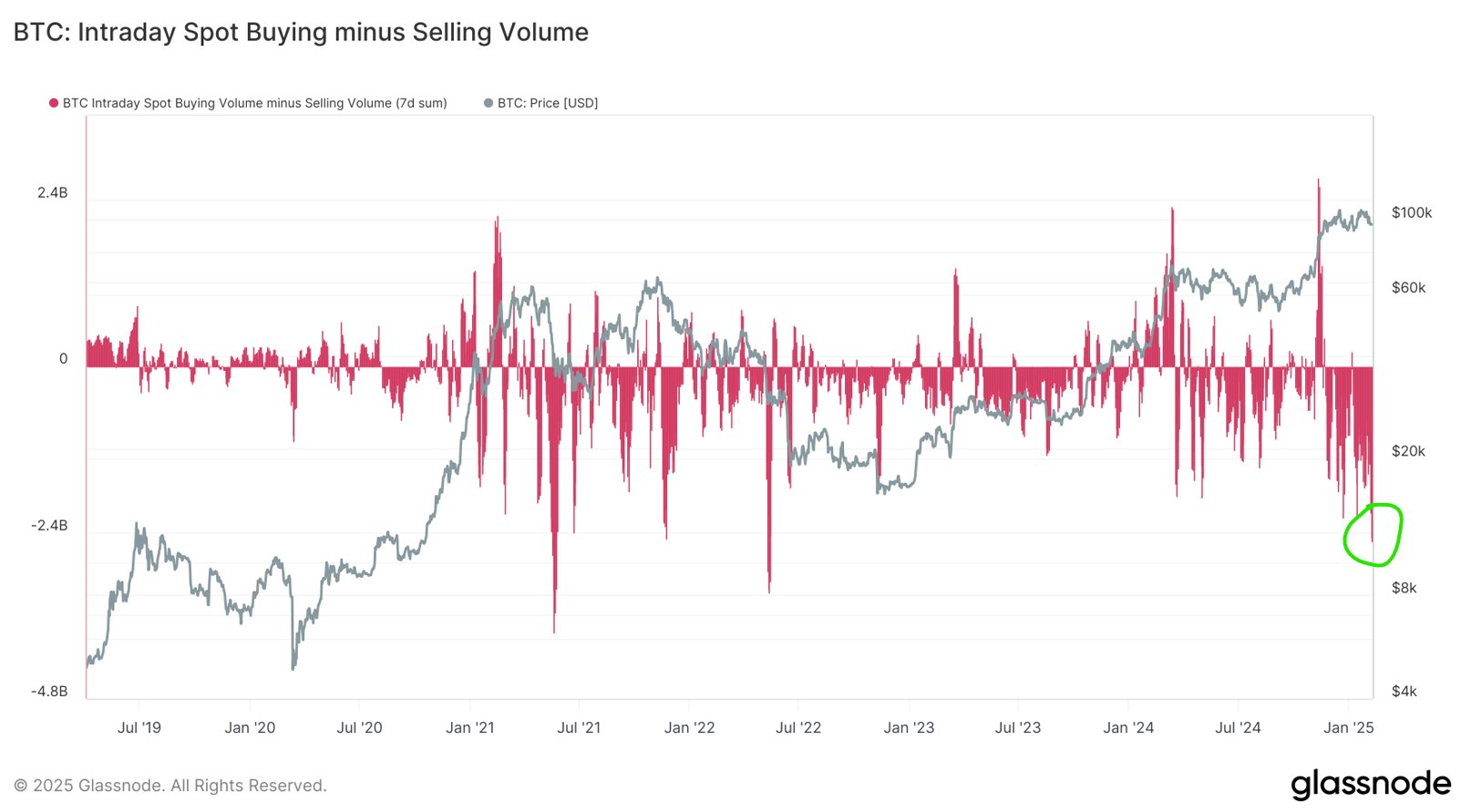

Bitcoin proved significant price resilience, considering that it witnessed the largest daily selling pressure since the collapse of Three Arrows Capital (3AC), according to André Dragosch, head of research at Bitwise Europe.

The research lead wrote in a Feb. 10 X post :

“We have just reached the highest amount of selling pressure on Bitcoin spot exchanges since the collapse of 3AC in June 2022. Yet, the price is still close to $100,000.”

Bitcoin’s price resilience may signal “seller exhaustion,” added the researcher.

BTC: Intraday spot buying minus selling volume. Source: André Dragosch

BTC: Intraday spot buying minus selling volume. Source: André Dragosch

The collapse of 3AC, a Singapore-based crypto hedge fund that once managed over $10 billion worth of assets, sent shockwaves through the cryptocurrency market in 2022.

3AC exchanged roughly $500 million worth of Bitcoin with the Luna Foundation Guard or the equivalent fiat amount in LUNC just weeks before Terra imploded .

The series of liquidations for 3AC had a catastrophic impact on crypto lenders such as BlockFi, Voyager and Celsius. Many of the crypto lenders had to eventually file for bankruptcy themselves due to exposure to 3AC.

Related: Austin University to launch $5M Bitcoin fund with 5-year HODL strategy: Report

Bitcoin momentum hinges on $93,000 support due to $1.7 billion in liquidations

Bitcoin investor sentiment remains pressured by global trade war concerns following new import tariffs announced by the United States and China.

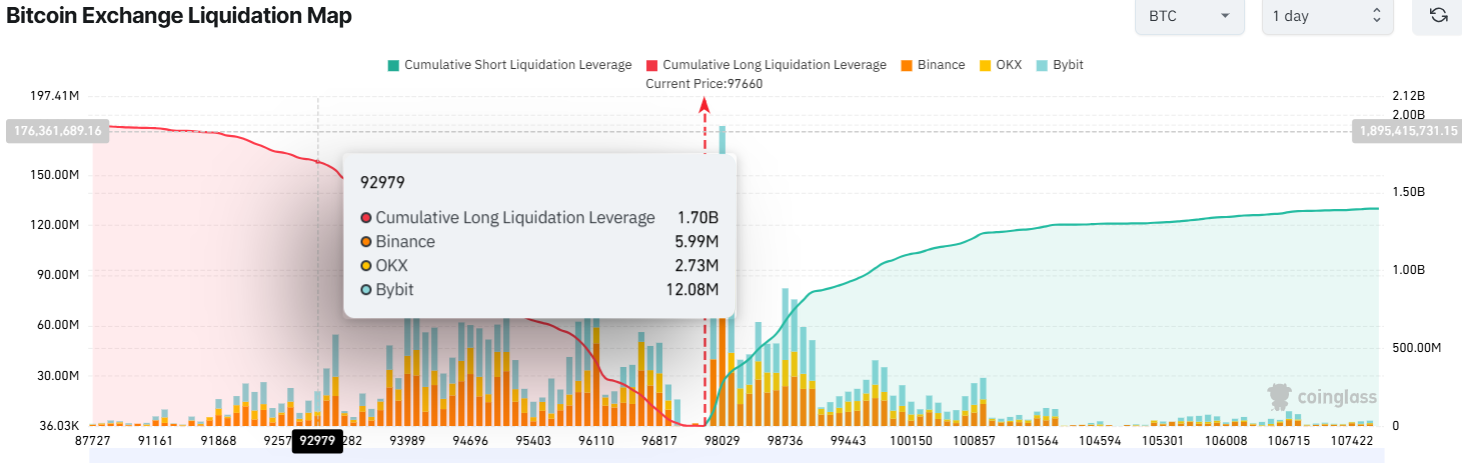

While Bitcoin temporarily fell below $95,000, a correction below the key $93,000 support may cause significant downside volatility due to the growing crypto market leverage.

Bitcoin exchange liquidation map. Source: CoinGlass

Bitcoin exchange liquidation map. Source: CoinGlass

A potential Bitcoin correction below $93,000 would liquidate over $1.7 billion worth of cumulative leveraged long positions across all exchanges, CoinGlass data shows.

Related: Kentucky joins growing list of US states to introduce Bitcoin reserve bill

A correction below the $93,000 support level may trigger a further decline to $91,500, Ryan Lee, chief analyst at Bitget Research, told Cointelegraph.

Escalating trade war tensions could increase economic certainty, which may push Bitcoin below $90,000 in the short term, despite Bitcoin’s status as a hedge against traditional finance volatility.

Meanwhile, market participants await President Donald Trump’s upcoming discussions with Chinese President Xi Jinping, which are aimed at resolving trade tensions and avoiding a full-scale trade war.

Trump was scheduled to meet President Jinping on Feb. 11, but reports citing unnamed US officials suggest that the meeting would be delayed, according to a Feb. 4 WSJ report .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!