Litecoin Bucks Market Trend, Gains 10% as Whales Increase Holdings

From beincrypto by Abiodun Oladokun

Layer-1 coin Litecoin has emerged as the market’s top gainer over the past 24 hours, bucking the prevailing downtrend seen in the broader cryptocurrency market.

The 10% rally comes amid a notable increase in whale accumulation, with large investors gradually building their positions over the past week. With a growing bullish bias, LTC appears poised to extend its current gains.

Litecoin Whales Increase Holdings

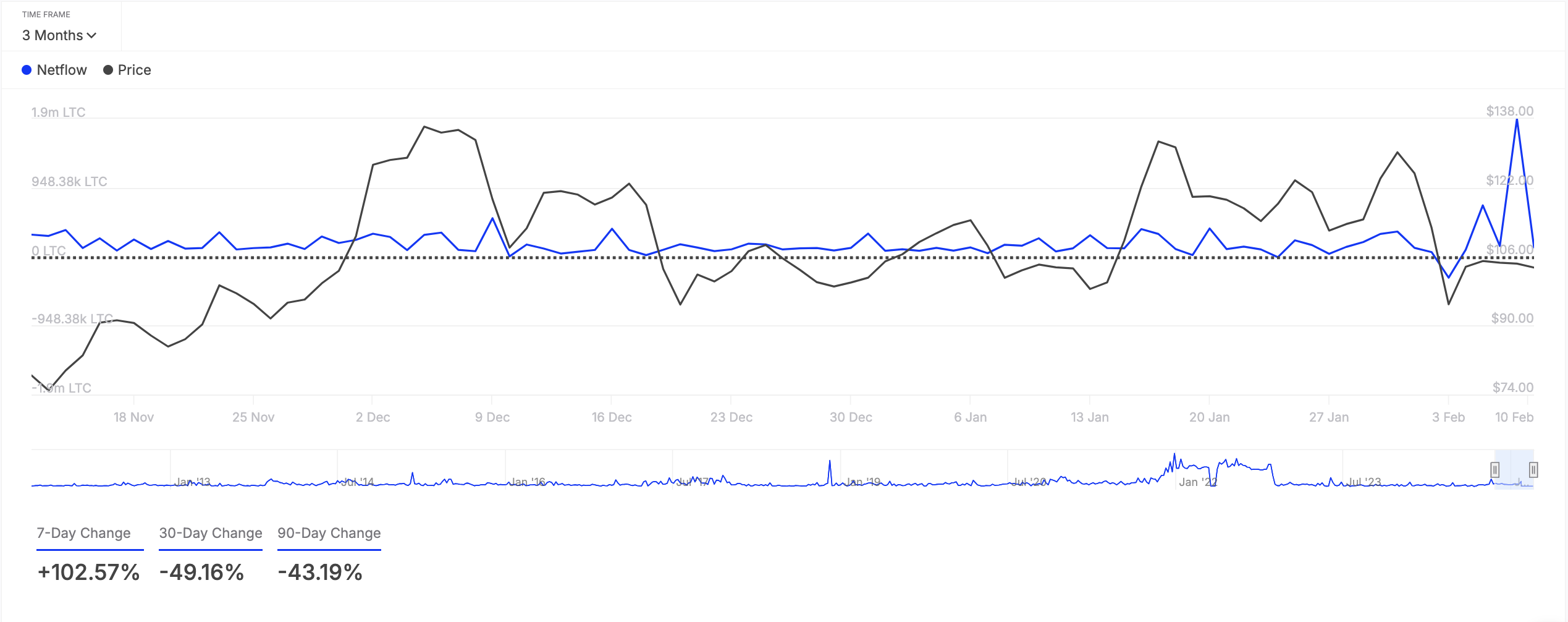

On-chain data reveals that LTC has seen a triple-digit surge in its large holders’ netflow over the past week. According to IntoTheBlock, this has climbed by 103% during that period.

Litecoin Large Holders Netflow. Source: IntoTheBlock

Litecoin Large Holders Netflow. Source: IntoTheBlock

Large holders refer to whale addresses that hold over 0.1% of an asset’s circulating supply. Their netflow measures the difference between the coins these investors buy and the amount they sell over a specific period.

When an asset experiences a spike in large holder netflow, its whale addresses are increasing their holdings. This is a bullish signal, typically driving upward price momentum as these big investors bet on the asset’s future growth.

Retail investors often follow this trend, seeing the increased whale activity as a sign of confidence. As whales accumulate, the rising demand could push LTC’s price higher, creating a positive feedback loop in the market.

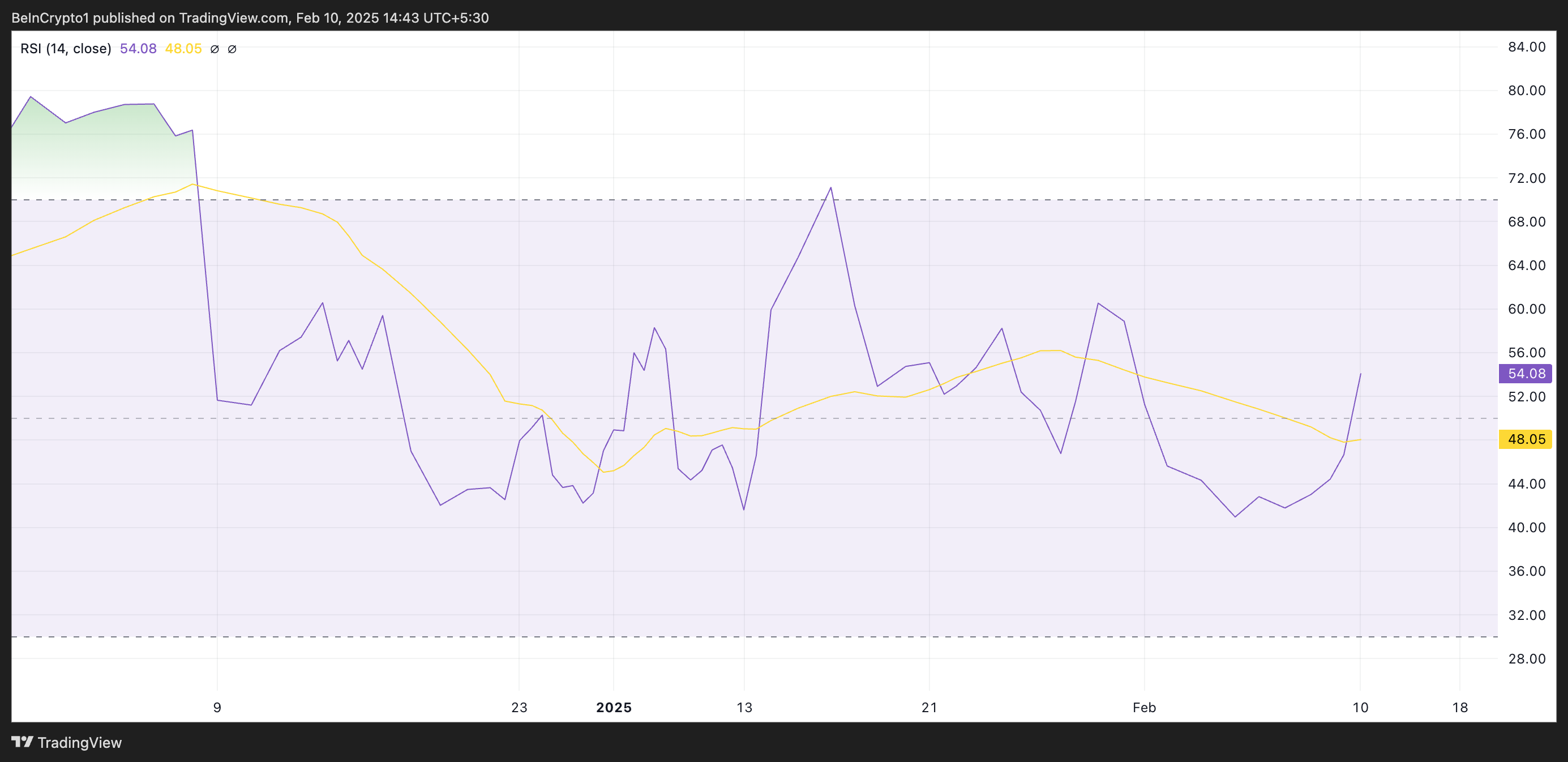

Further, the coin’s Relative Strength Index ( RSI ), assessed on the daily chart, confirms the surge in demand. At press time, LTC’s RSI is at 54.08 and is on an upward trend.

Litecoin RSI. Source: TradingView

Litecoin RSI. Source: TradingView

This momentum indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. Conversely, values under 30 suggest that the asset is oversold and may witness a rebound.

At 54.08 and climbing, LTC’s RSI suggests a moderate bullish momentum. It indicates growing buying pressure with the potential for further upward movement if the trend continues.

LTC Price Prediction: Could $124 Be Next?

LTC’s Elder-Ray Index has posted a positive value for the first time in eight days, highlighting the bullish shift in market trends. At press time, it is at 4.26.

An asset’s Elder-Ray Index measures the relationship between its buying and selling pressure in a market. When the index is positive, it indicates that bullish momentum is dominant, suggesting that buyers are in control and the asset’s price is likely to continue increasing.

If this holds, LTC’s value could rocket above $120 to trade at $124.03.

Litecoin Price Analysis. Source: TradingView

Litecoin Price Analysis. Source: TradingView

However, if profit-taking resurfaces, LTC’s price could shed current gains and drop to $109.81.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anthropology and Innovation: Leveraging Cultural Understanding to Propel Technological and Business Advancement

- Anthropology bridges human-technology gaps by decoding cultural patterns in AI, business, and education. - Ethnographic methods enhance product design (e.g., Intel , Adidas) and reduce AI implementation risks via cultural alignment. - Anthropology-driven corporate training boosts ROI 2-3x in cross-cultural communication and diversity initiatives. - Venture capital increasingly uses "predictive anthropology" to forecast markets, though "impact washing" risks persist. - Cross-disciplinary integration of an

AI-Powered Token Fluctuations: Insights Gained from the ChainOpera AI Token Downturn

- ChainOpera AI's COAI token collapsed 90% in late 2025 due to hyper-centralized supply, governance flaws, and regulatory ambiguity. - The crash triggered market instability, exposing vulnerabilities in AI-driven crypto ecosystems reliant on speculative hype rather than intrinsic value. - Anthropological insights and interdisciplinary models like CAVM are proposed to improve governance and valuation frameworks for decentralized AI projects. - Structural safeguards including diversified token supply, hybrid

MMT Token's Latest Price Jump: Temporary Hype or Genuine Breakthrough?

- MMT token surged 1,330% post-Binance listing in late 2025 but fell 37.37% over 30 days amid crypto market weakness. - Market analysis highlights oversold RSI-7 (19.23) and weak buying interest, while Bitcoin dominance rose to 58.13%. - MMT launched buybacks and a perpetual futures DEX to stabilize value, but top 100 holders control 20.4% of circulating supply. - Experts note speculative GME-like retail frenzy alongside DeFi utility, predicting 2025 price range of $0.4342-$0.8212.

Stripe and Paradigm’s Payments-Focused Blockchain Tempo Launches Public Testnet