Crypto News Today: Litecoin Price Surges as Bitcoin Holds Steady Above $97K

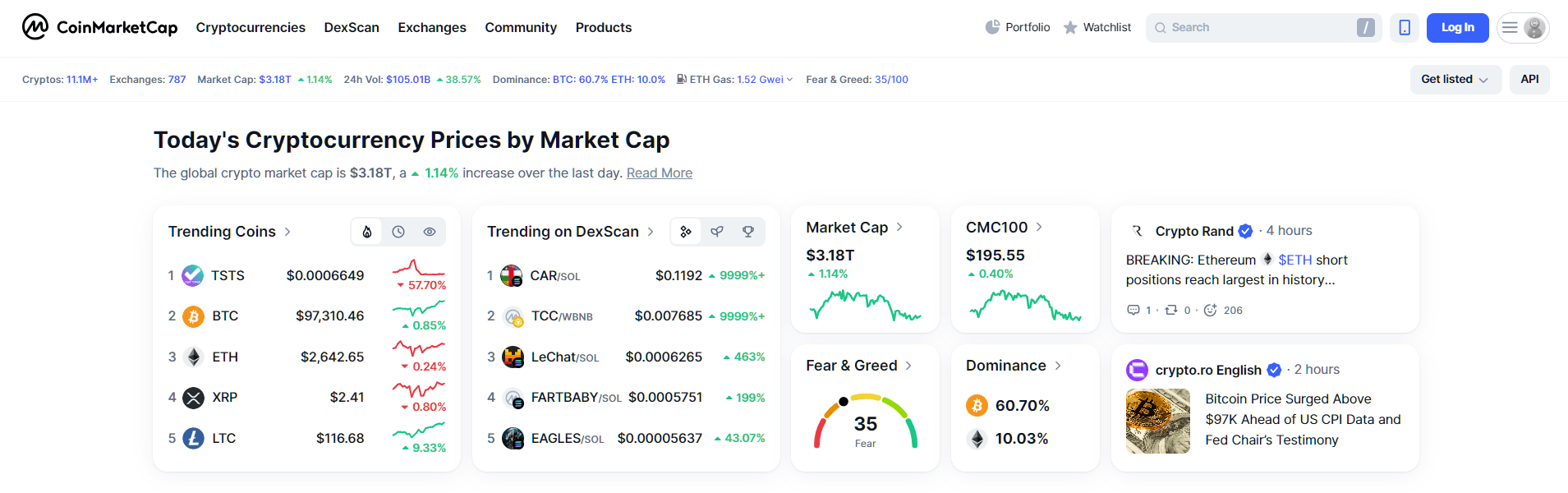

The cryptocurrency market is exhibiting resilience , with Bitcoin maintaining its position above the $97,000 threshold and Litecoin experiencing a notable surge. As of February 10, 2025, the global crypto market capitalization stands at approximately $3.18 trillion, reflecting a slight 1.14% increase over the past 24 hours.

By CoinMarketCap - Trending Coins on 2025-02-10

By CoinMarketCap - Trending Coins on 2025-02-10

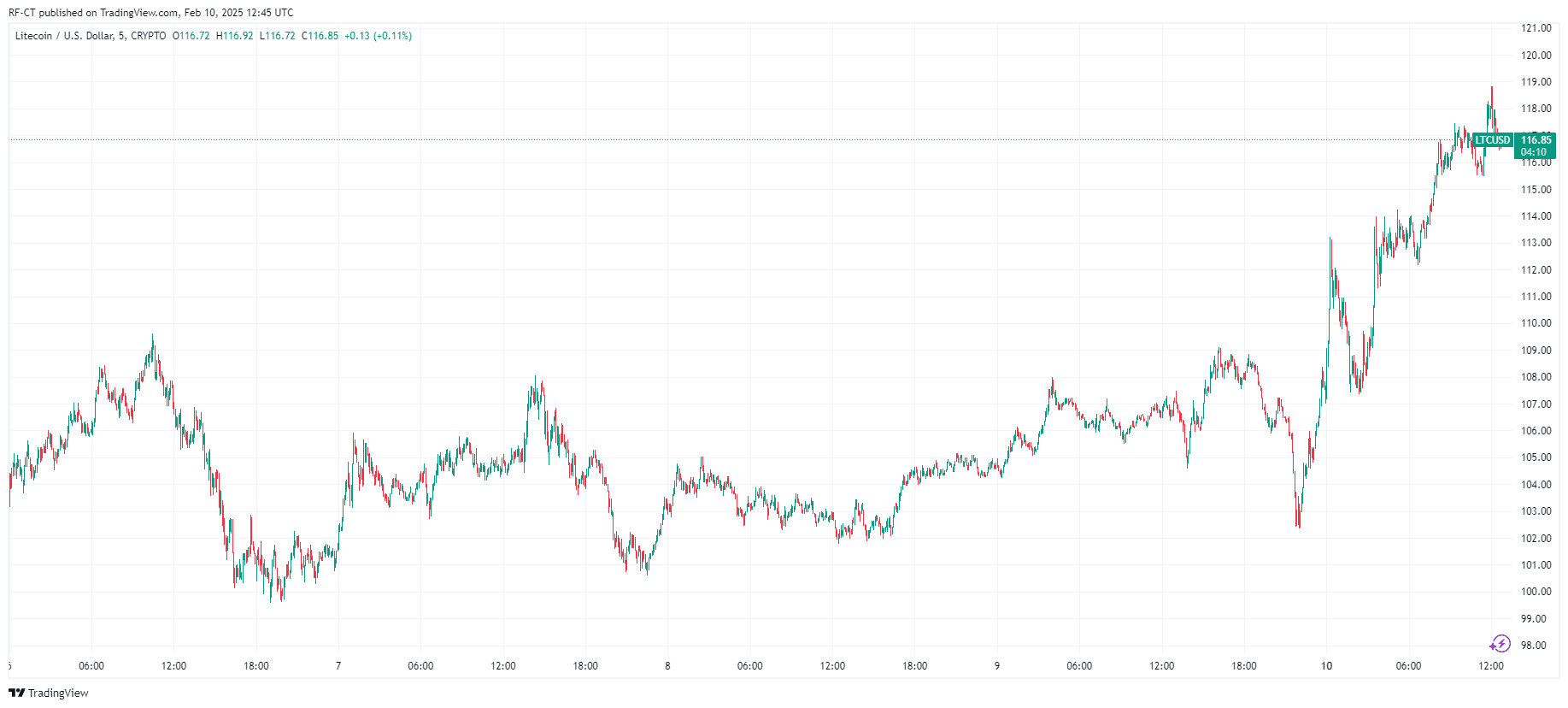

Litecoin Emerges as Top Performer

Litecoin (LTC) has outperformed major cryptocurrencies, recording a significant 9.52% increase to trade at $116.80. Analysts attribute this surge to growing optimism surrounding the potential approval of a spot Litecoin ETF by the U.S. Securities and Exchange Commission (SEC). The likelihood of such an approval has risen to 81%, with many traders anticipating a launch later this year.

By TradingView - LTCUSD_2025-02-10 (5D)

By TradingView - LTCUSD_2025-02-10 (5D)

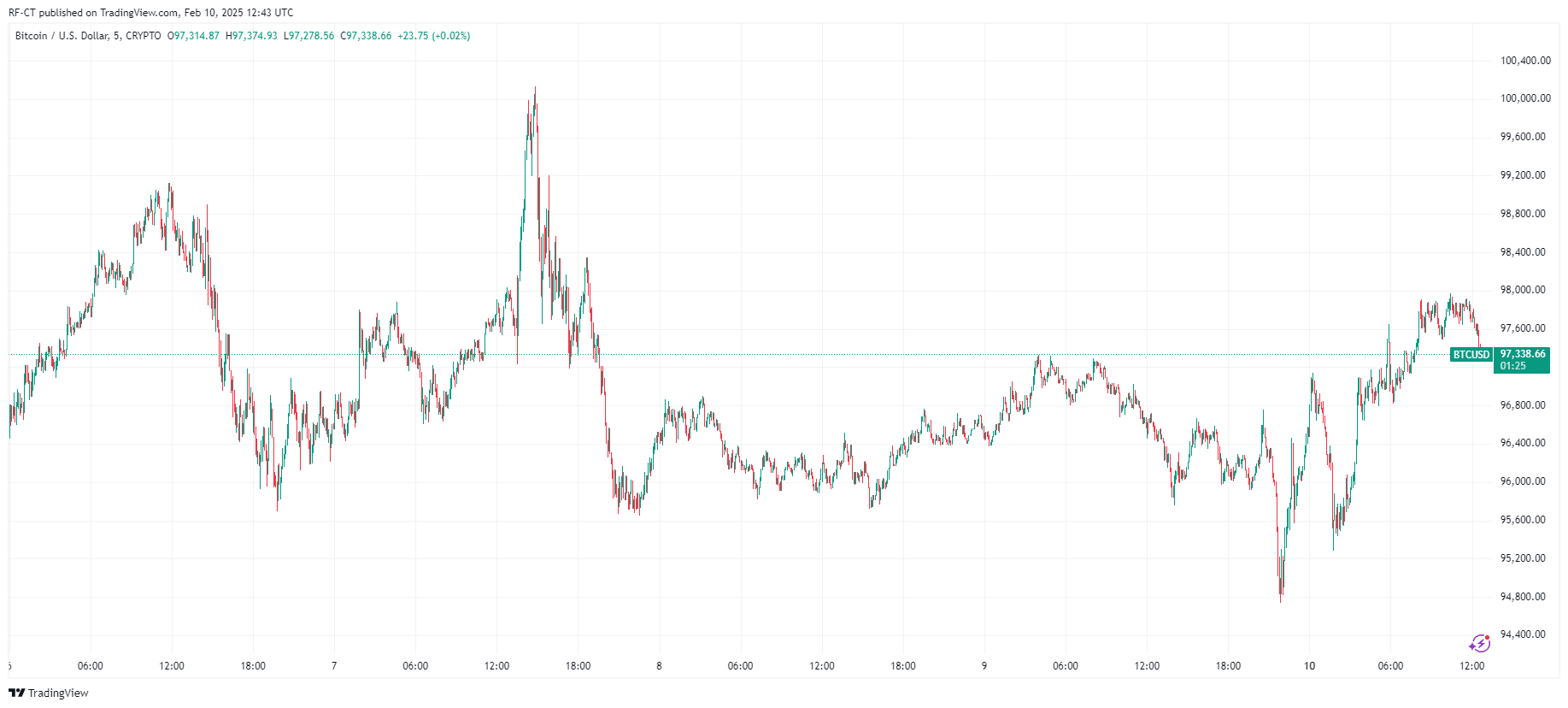

Bitcoin Defends Key Support Level

Bitcoin (BTC) has demonstrated stability, trading at around $97,336 marking a modest 1.01% gain in the last 24 hours. The leading cryptocurrency briefly dipped below $95,000 but quickly rebounded, reaching highs of $98,000, yet still below $100,000. This resilience underscores Bitcoin's strong support at the $95,000 level, a critical threshold for maintaining its bullish outlook.

By TradingView - BTCUSD_2025-02-10 (5D)

By TradingView - BTCUSD_2025-02-10 (5D)

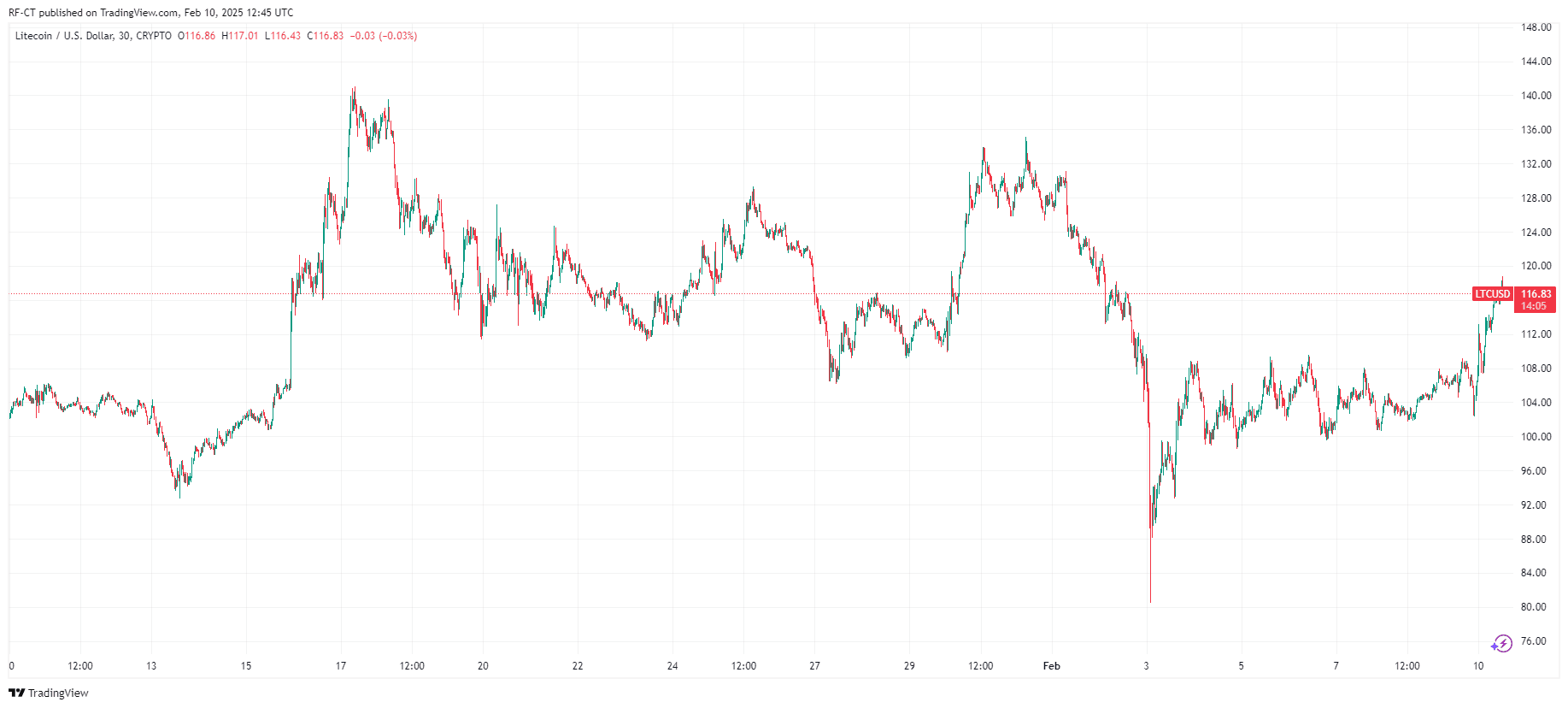

Market Outlook and Key Considerations

The overall cryptocurrency market remains stable, with the total market capitalization holding steady at $3.18 trillion. Bitcoin's ability to maintain its position above the $97,000 support level is crucial for sustaining its bullish momentum. Meanwhile, Litecoin's impressive performance highlights its potential as a promising asset in the current market landscape.

By TradingView - LTCUSD_2025-02-10 (1M)

By TradingView - LTCUSD_2025-02-10 (1M)

In summary, the cryptocurrency market is displaying signs of resilience, with Bitcoin defending key support levels and Litecoin leading in gains. Investors are advised to monitor these developments closely, as they may signal further opportunities in the evolving crypto landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

As the crypto market recovers in 2025, Digital Asset Treasury (DAT) firms and protocol token buybacks are drawing increasing attention. DAT refers to public companies accumulating crypto assets as part of their treasury. This model enhances shareholder returns through yield and price appreciation, while avoiding the direct risks of holding crypto. Similar to an ETF but more active, DAT structures can generate additional income via staking or lending, driving NAV growth. Protocol token buybacks, such as those seen with HYPE, LINK, and ENA, use protocol revenues to automatically repurchase and burn tokens. This reduces circulating supply and creates a deflationary effect. Key drivers for upside include institutional capital inflows and potential Fed rate cuts, which would stimulate risk assets. Combined with buyback mechanisms that reinforce value capture, these assets are well-positioned to lead in the next market rebound.