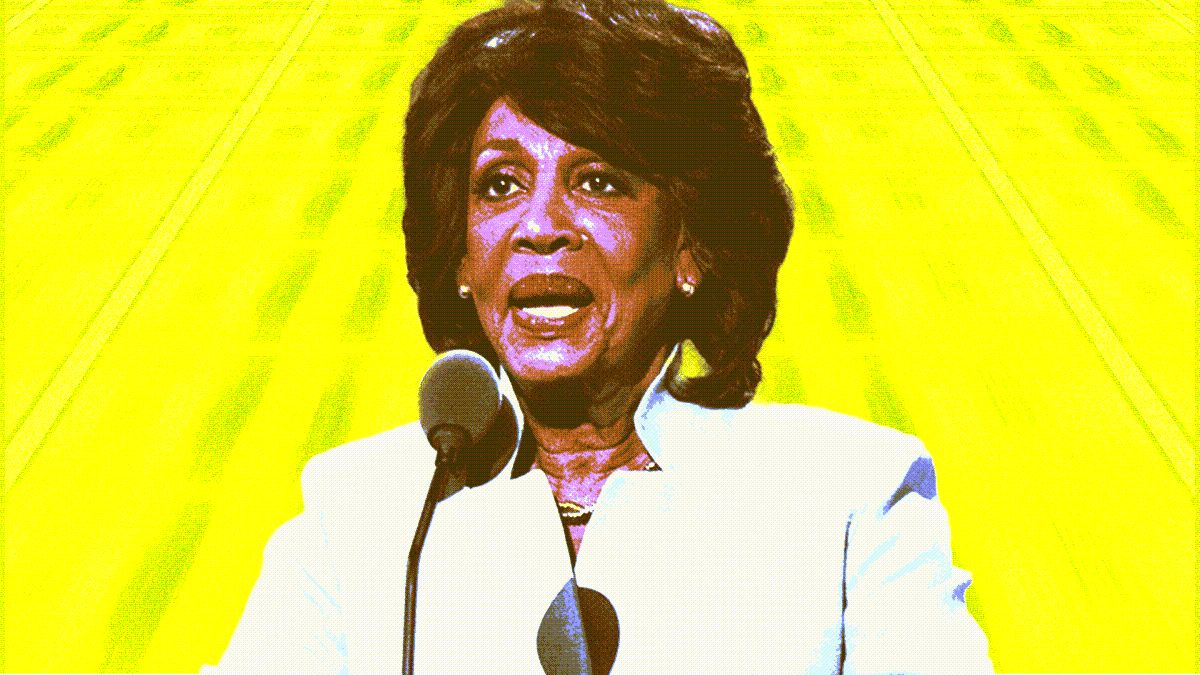

Top Democrat Rep. Maxine Waters releases draft proposal to regulate stablecoins: Punchbowl News

Quick Take The discussion draft includes language around federal regulators for stablecoins including the Comptroller of the Currency, the Federal Reserve and the Federal Deposit Insurance Corporation. On the other side of the aisle, last week Republicans House Financial Services Committee Chair French Hill alongside Rep. Bryan Steil released draft legislation to regulate stablecoins.

Top Democrat of the House Financial Services Committee Maxine Waters released a discussion draft on Monday to regulate stablecoins, according to a copy obtained by Punchbowl News.

The discussion draft includes language around federal regulators for stablecoins, including the Comptroller of the Currency, the Federal Reserve and the Federal Deposit Insurance Corporation, and also state regulators. Stablecoin issuers that are registered also would have reporting requirements and would be required to have reserves back "on an at least one-to-one basis," according to the draft legislation.

Waters' office did not respond to a request for comment.

Waters has worked with now former House Financial Services Committee Chair Patrick McHenry, R-N.C., to create a regulatory framework for stablecoins since 2022. A bill passed out of the Republican-led committee last year. At the time, Waters called the bill "deeply problematic" due to a provision that allows state regulators to approve stablecoin issuances without Federal Reserve input.

Waters' draft is based on discussions with McHenry, Punchbowl News' Brendan Pedersen reported .

Waters, the California Democrat previously chair of the House Financial Services Committee, had called for a "grand bargain on stablecoins" before the end of 2024, signaling optimism that a deal could be reached, but that didn't come to fruition.

On the other side of the aisle, last week, Republican House Financial Services Committee Chair French Hill, alongside Rep. Bryan Steil, released draft legislation to regulate stablecoins.

That Republican-led draft also builds on work done over the past few years, though it has a few differences. For example, it gives the Office of the Comptroller of the Currency the authority to "approve and supervise federally qualified nonbank payment stablecoin issuers " instead of including a federal path through the Federal Reserve for "payment stablecoin issuers."

Work is also underway in the Senate following the introduction of a bill to regulate stablecoins by Sen. Bill Hagerty, R-Tenn., called the "Guiding and Establishing National Innovation for US Stablecoins.

Hagerty's bill was introduced just ahead of a press conference on Feb. 4, where lawmakers announced they would be forming a working group to write rules for crypto and stablecoins. That working group included members from the House Financial Services Committee, Senate Agriculture Committee, House Agriculture Committee and the Senate Banking Committee.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

When Hackers Become State Actors and AI: A Security Self-Assessment Checklist for Crypto Projects in 2026

Wall Street interprets the Federal Reserve decision as more dovish than expected

The market originally expected a "hawkish rate cut" from the Federal Reserve, but in reality, there were no additional dissenters, no higher dot plot, and the anticipated tough stance from Powell did not materialize.

The Federal Reserve cuts rates again but divisions deepen, next year's path may become more conservative

Although this rate cut was as expected, there was an unusual split within the Federal Reserve, and it hinted at a possible prolonged pause in the future. At the same time, the Fed is stabilizing year-end liquidity by purchasing short-term bonds.

Betting on LUNA: $1.8 billion is being wagered on Do Kwon's prison sentence

The surge in LUNA’s price and huge trading volume are not a result of fundamental recovery, but rather the market betting with real money on how long Do Kwon will be sentenced on the eve of his sentencing.