Key Points

- Bitcoin surged above $97,000, following an earlier dip to $94,000 levels.

- This is an important macroeconomic week, with potential upcoming rate cut expectations.

At the beginning of an important macroeconomic week that will bring the US Fed Chair’s Jerome Powell testimony on policy direction, Bitcoin rebounded above $97,000 from an earlier dip to $94,000 level.

Bitcoin Trades Above $97,000

At the moment of writing this article, BTC is trading above $97,000, up by over 1% in the last 24 hours. Earlier today, the coin recorded a drop in price at $94,855, but quickly bounced back to current price levels.

BTC price in USD todayBitcoin is seeing intense volatility at the beginning of an important macroeconomic week, during which the US Fed Chair, Jerome Powell will also deliver a significant speech.

Important Upcoming Economic Events This Week

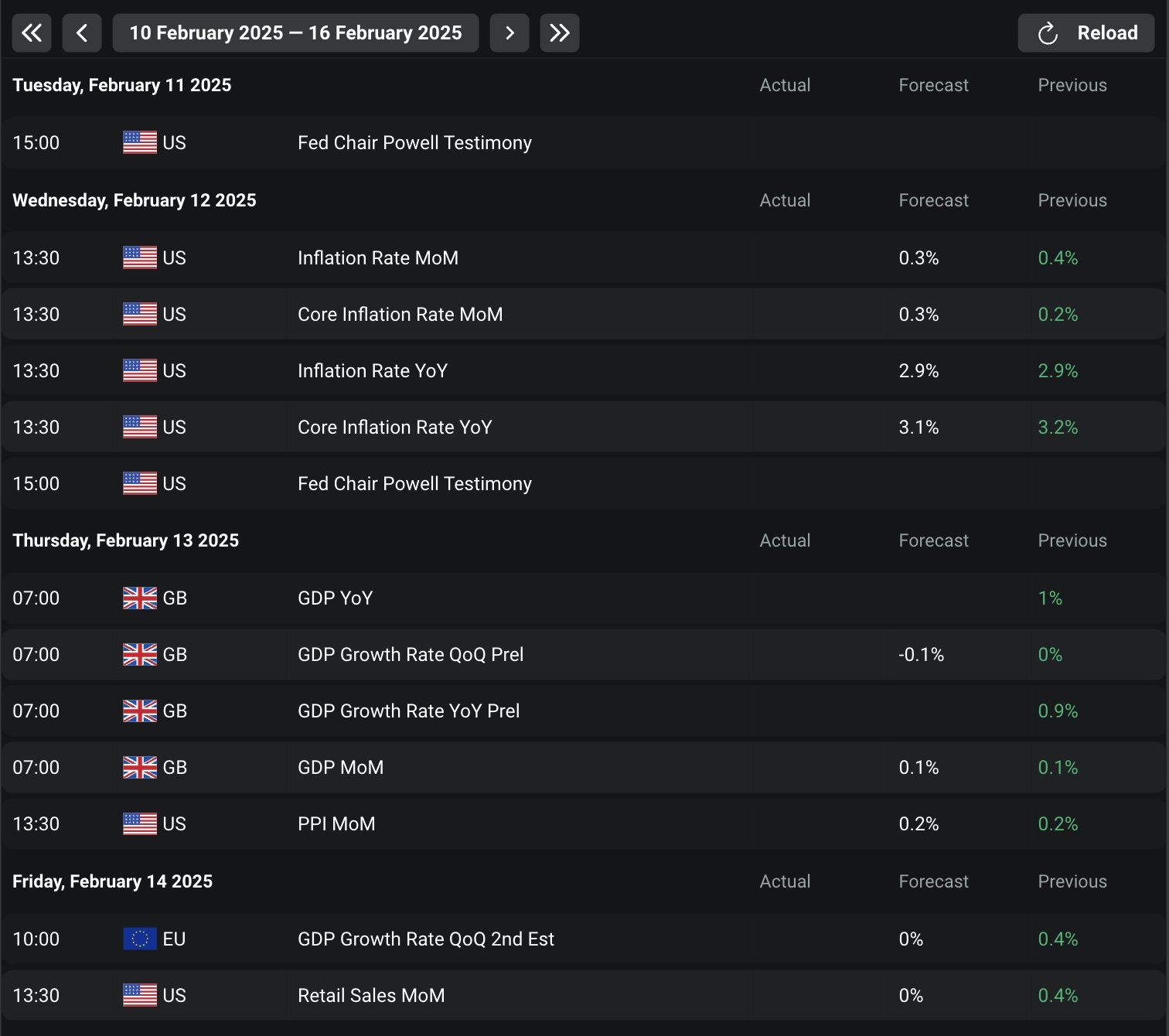

Deribit highlighted the most important events this week that could potentially affect BTC’s price.

Jerome Powell’s Testimony

During February 11-12, the US Fed Chair, Jerome Powell, will deliver an important testimony, revealing insights on the Fed policy direction.

The Federal Reserve held its benchmark rate at 4.25%-4.5% during its most recent meeting that took place on January 29. This move mirrored the need for sustained progress on inflation before considering more interest rate cuts in the US. The upcoming FOMC meeting is scheduled for March 19.

Official notes revealed that several Fed officials have warned that tariff-driven price pressures could keep the Fed’s policy tighter for a longer time than the market expects.

Powell’s testimony will be a key catalyst for Bitcoin and the crypto market’s trajectory, together with the upcoming CPI reports in the US.

US CPI Data

On February 12, the CPI numbers for January will be released, hinting at upcoming potential rate cut expectations. A stronger-than-expected CPI or PPI report could reinforce the Fed’s cautious stance, but any signs of lowering inflation would fuel expectations of potential upcoming rate cuts.

Historical data has shown that interest rate cuts have pushed Bitcoin prices higher.

UK and EU GDP

On February 13 and 14, the UK and EU will release GDP data, mirroring an economic health check for the regions.

Deribit via X

Deribit via X

Meanwhile, Bitcoin remains surrounded by optimism stemming from upcoming SBRs in the US with more states already making moves towards establishing Strategic BTC Reserves. Europe is also seeing bullish BTC-related moves with the Czech Republic leading the way .