Stock exchange group SIX now supports crypto as collateral for triparty

From ledgerinsights by Ledger Insights

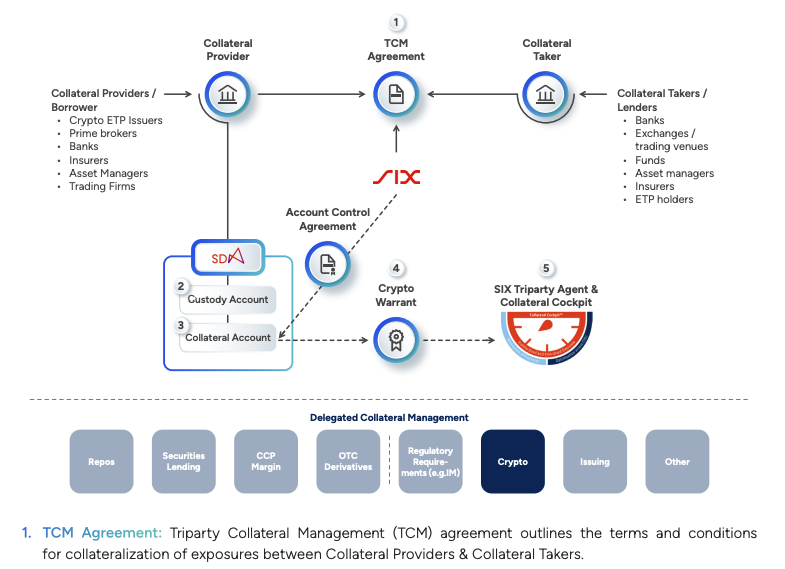

Today Swiss stock exchange group SIX launched its Digital Collateral Service which supports the use of crypto as collateral alongside conventional assets. SIX operates one of Europe’s largest triparty agents, which provide an outsourced collateral management solution for financial institutions.

This is a major step forward for the institutional adoption of crypto, as triparty agents are core to institutional collateral management activities. Hence, institutions don’t have to use a separate platform for crypto collateral management. It also provides enhanced protection in cases of default.

However, the service will primarily be used for crypto related transactions – by ETP issuers, institutional traders and crypto exchanges. Given the volatility of crypto prices, we wondered whether the solution allows crypto to be used for all kinds of traditional trades. It does not.

While SIX mentions the potential to post both bonds and bitcoin as collateral for a single position, crypto cannot be used as collateral on SIX exchanges or for repo transactions. Hence, if an institution has to post collateral for securities lending, it cannot use crypto. The aim is to provide a conventional collateral solution for OTC and bilateral trades of crypto.

Triparty combined with SDX custody

SIX also operates the SIX Digital Exchange (SDX) which provides an exchange for digital securities as well as a crypto custody solution and other crypto services. Hence, the Digital Collateral Service combines SDX’s custody solution with the triparty agent service.

“The role of cryptocurrencies in collateral management will become increasingly important,” said David Newns, Head of SDX. “Our new and fully integrated solution empowers product issuers, traders, brokers, and market makers to optimize their collateral usage, whether it’s crypto or traditional securities, with built-in risk management safeguards. This allows financial institutions to embrace crypto collateral on a larger scale.”

Initially the assets supported are Bitcoin, Ethereum, Avalanche, Cardano, Solana, Ripple and the USDC stablecoin, but the selection will be expanded based on client demand.

We asked how long it took to get regulatory approval – three months.This is just the latest of several world firsts for SIX and SDX . It was the first to launch a secondary market for digital securities. The first to integrate the digital securities depository with the conventional central securities depository (CSD) allowing firms that aren’t DLT savvy firms to trade digital securities. The first to support a digital security used for central bank repo. And one of SDX’s biggest claims to fame is it is the first platform to host a (pilot) wholesale CBDC for settlement.

Meanwhile, earlier this week the US Commodities Futures Trading Commission (CFTC) announced plans for a tokenized collateral pilot , including the use of stablecoins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!